🥾New Chapter 11 Bankruptcy Filing - Stage Stores Inc. ($SSI) 🥾

Stage Stores Inc.

April 10, 2020

Houston-based Stage Stores Inc. ($SSI) marks the second department store chain to file for chapter 11 bankruptcy in Texas this week, following on the heals of Neiman Marcus. With John Varvatos and J.Crew also filing this week, the retail sector is clearly starting to buckle. All of these names — with maybe the exception of Varvatos — were potentially headed towards chapter 11 pre-COVID. As were J.C. Penney Corp. ($JCP) and GNC Holdings Inc. ($GNC), both of which may be debtors by the end of this week. Sh*t is getting real for retail.

We first wrote about Stage Stores in November ‘18, highlighting dismal department store performance but a seemingly successful experiment converting 8 department stores to off-price. At the time, its off-price business had a 9.9% comp sales increase. Moreover, the company partnered with ThredUp, embracing the secondhand apparel trend. While we have no way of knowing whether this drove any revenue, it, in combination with the conversions, showed that management was thinking outside the box to reverse disturbing retail trends.

By March ‘19, the company was on record with plans to close between 40-60 department stores. In August ‘19, it became public knowledge that Berkeley Research Group was working with the company. The company reported Q2 ‘19 results that — the hiring of a restructuring advisor with a lot of experience with liquidating retailers, aside — actually showed some promise. We wrote:

Thursday was a big day for the company. One one hand, some big mouths leaked to The Wall Street Journal that the company retained Berkeley Research Group to advise on department store operations. That’s certainly not a great sign though it may be a positive that the company is seeking assistance sooner rather than later. On the other hand, the company reported Q2 ‘19 results that were, to some degree, somewhat surprising to the upside. Net sales declined merely $1mm YOY and comp sales were 1.8%, a rare increase that stems the barrage of consecutive quarters of negative turns. Off-price conversions powered 1.5% of the increase. The company reported positive trends in comps, transaction count, average transaction value, private label credit card growth, and SG&A. On the flip side, COGs increased meaningfully, adjusted EBITDA declined $2.1mm YOY and interest expense is on the rise. The company has $324mm of debt. Cash stands at $25mm with $66mm in ABL availability. The company’s net loss was $24mm compared to $17mm last year.

Some of the reported loss is attributable to offensive moves. The company’s inventory increased 5% as the company seeks to avoid peak shipping expense and get out ahead of tariff risk (PETITION Note: see a theme emerging here, folks?). There are also costs associated with location closures: the company will shed 46 more stores.

What’s next? Well, the company raised EBITDA guidance for fiscal ‘19: management is clearly confident that the off-price conversion will continue to drive improvements. No analysts were on the earnings call to challenge the company. Restructuring advisors will surely want to pay attention to see whether management’s optimism is well-placed.

As we wrote in February ‘20, subsequent results showed that “management’s optimism was, in fact, misplaced.” Now, three months later, the company is in court.

We should take a second to note that this is a potential sale case. The first day papers, therefore, are meant to paint a picture that will draw interest from potential buyers. And so it’s all about the successful conversion of stores. Indeed, the company asserts that its transformation WAS, in fact, taking hold as it moved beyond the initial small batch of store conversions to a more wholesale approach to off-price. By September 2019, 82 store transitions had been completed. And, to date, 233 department stores have been converted to the Gordmans off-price model (PETITION Note: the company acquired Gordmans out of bankruptcy. The company also deigns to suggest that the stock price increase from under a dollar in January ‘19 to $9.50 in early ‘20 is indicative of the market’s support of the off-price conversion and the potential for success post-conversion — as if stock prices mean sh*t in this interest rate environment.). The company now has 289 off-price stores in total (including the Gordmans acquisition) and 437 department stores.

Enter COVID-19 here. No operations = no liquidity. The company’s conversion plan stopped in its tracks. Like every other retailer in the US, the company stopped paying rent and furloughed thousands of employees. “Combined with zero revenue and uncertainty associated with consumer demand in the coming months, Stage Stores, like so many others, is in the middle of a perfect storm.”

The company’s plan in bankruptcy appears to be to leave open any and all optionality. One one hand, it will liquidate inventory, wind-down operations and close stores. On the other hand, it will pursue a sale process, managing inventory in such a way “…to increase the likelihood of a going-concern transaction and, to the extent one materializes … pivot to cease store closings at any stores needed to implement the going-concern transaction.” To aid this plan, the company will seek court latitude as it relates to post-petition rent. These savings, coupled with cash collateral, will avail the company of liquidity needed to finance this dual-path approach (PETITION Note: the company suggests that, if needed, the company will explore a DIP credit facility at a later time).

We should note that Wells Fargo Bank NA ($WFC) is the company’s lender and has permitted the use of over $10mm for cash collateral. We previously wrote:

Wells Fargo Bank NA ($WFC) is the company’s administrative agent and primary lender under the company’s asset-based credit facility. Prior to Destination Maternity’s ($DEST) chapter 11 filing, Wells Fargo tightened the screws, instituting reserves against credit availability to de-risk its position. It stands to reason that it is doing the same thing here given the company’s sub-optimal performance and failure to meet projections. Said another way, WFC has had it with retail. Unlike oil and gas lending, there are no pressures here to play ball in the name of “relationship banking” when, at the end of the day, so many of these “relationships” are getting wiped from the earth.

Looks like they’re at least providing a little bit of leash here to give the company at least some chance of locating a White Knight that will provide value above and beyond liquidation value (however you calculate that these days)* and keep this thing alive. Which is to say that none of this is likely to give much solace to the staggering $173mm worth of unsecured trade debt here. 😬

Not that the unsecureds should be the only concerned parties here. With first day relief totaling over $2mm, employee wage obligations running potentially as high as $8mm, and high-priced professionals, this thing could very well be administratively insolvent from the get-go.

*Perhaps news coming out of T.J. Maxx (TJX) will help spark interest from a buyer. There are also some potentially valuable NOLs here.

Jurisdiction: S.D. of Texas (Judge Jones)

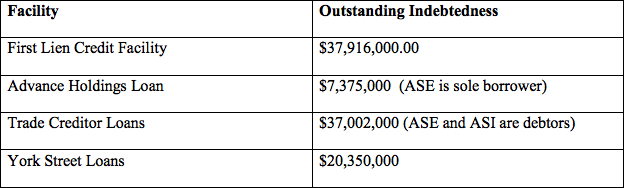

Capital Structure: $178.6mm RCF (Wells Fargo Bank NA), $47.4mm Term Loan (Wells Fargo Bank, Pathlight Capital LLC)

Professionals:

Legal: Kirkland & Ellis LLP (Joshua Sussberg, Neil Herman, Joshua Altman, Kevin McClelland, Jeremy Fielding) & Jackson Walker LLP (Matthew Cavenaugh, Jennifer Wertz, Kristhy Peguero, Veronica Polnick)

CRO: Elaine Crowley

Financial Advisor: Berkeley Research Group LLC (Stephen Coulombe)

Investment Banker: PJ Solomon LP (Mark Hootnick)

Real Estate Advisor: A&G Realty Partners

Liquidation Consultant: Gordon Brothers Retail Partners LLC

Claims Agent: KCC (*click on the link above for free docket access)

Other Parties in Interest:

RCF Agent: Wells Fargo Bank NA

Legal: Riemer & Braunstein LLP (Jaime Koff, Brendan Recupero, Paul Bekkar, Steven Fox) & Winstead PC (Sean Davis, Matthew Bourda)

Term Agent: Wells Fargo Bank NA

Legal: Choate Hall & Stewart LLP (Kevin Simard, Mark Silva) & Winstead PC (Sean Davis, Matthew Bourda)

Large equityholder: Axar Capital Management LP