✈️ New Chapter 11 Bankruptcy Filing - LATAM Airlines Group S.A. ($LTM) ✈️

LATAM Airlines Group S.A.

May 26, 2020

COVID-19 is starting to notch a long list of corporate victims. Chapter 11 bankruptcy filings have NOT been in short supply the last two months. Yet while many of the debtors may cite COVID-19 as a factor leading to the bankruptcy filings, in the super-majority of cases it was merely a contributing factor. The icing on the cake, if you will. From our vantage point, prior to the last week, there had only been (arguably) four pure-play COVID-19 chapter 11 bankruptcy filings:

Ravn Air Group Inc. — COVID-19 effectively shut down Alaska and CARES Act funds were unavailable to stave off a filing.

Alpha Entertainment LLC (XFL) — COVID-19 cold-stopped all sports mid-season.

GGI Holdings LLC (Gold’s Gym) — COVID-19 shuts down gyms nationwide.

Avianca Holdings SA — COVID-19 and mandated government shutdowns hindered all travel and flight bookings went negative.

Those were just the appetizer. This week things got VERY, VERY, REAL. The Hertz Corporation ($HTZ) became one of the largest chapter 11 bankruptcy filings EVER because COVID-19 put a stop to air travel — the thing that HTZ is most dependent upon in its business. This caused used-car values to fall through the floor and, in turn, effectively blow up the company’s securitization structure. And then LATAM Airlines Group S.A. ($LTM) became the second large latin american airline to file. This should not have been a surprise to anyone.

On May 13 in “✈️ Airlines, Airlines, Airlines ✈️ ,” we wrote about (i) the airline bailout debate engulfing folks in the US, (ii) the Avianca bankruptcy filing, (iii) Virgin Australia’s voluntary administration filing in Australia (after the Aussie government refused to partake in a bailout), (iv) Norway’s attempts to deal with Norwegian Air Shuttle SA’s ($NWARF) troubles, and (v) Boeing Corporation ($BA) CEO Dave Calhoun’s flippant remarks that “it’s probable that a major [US] carrier will go out of business” — yet another example of people confusing the concepts “filing for chapter 11 bankruptcy” with “going out of business and disappearing from the face of the earth.” For the avoidance of doubt, no, they are not necessarily the same thing (outside of retail anyway). In what was not exactly our boldest call, we noted that there would be more COVID-19-spawned action to come — particularly, in the near-term, in Latin America:

Which leaves Latin America’s other air carriers in a bad spot, including Latam Airlines Group SA (the finance unit of which has debt bid in the 30s and 40s), Gol Linhas Aereas Inteligentes SA ($GOL)(the finance unit of which has debt bid in the low 40s), and Aerovías de México SA de CV (Aeromexico)(which has debt bid in the 30s). Will one of these be one of the next airlines in bankruptcy court?

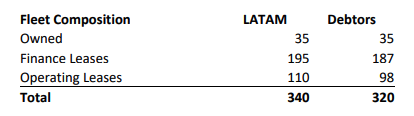

Early in the morning on May 26th, LATAM Airlines Group SA (“LATAM Parent, and with 28 direct or indirect subsidiary debtors, the “Debtors”) filed for bankruptcy in the Southern District of New York. It is the fourteenth-largest airline in the world (measured by passengers carried) and Latin America’s leading airline; it services 145 different destinations in 26 countries. Including 20 aircraft leased to non-debtor third-parties, the company has a total fleet of 340 aircraft.

Source: First Day Declaration. Docket #3.

On the strength of this fleet, in 2019, the company did $10.1b in revenue with over $1b of operating cash flow after investments (for the third straight year) and $195.6mm of net income. While the majority of said revenue comes from passenger services, the company also supplements revenues with cargo-related services to 151 destinations in 29 countries (11% of revenue but growing quickly). With four consecutive years of net profits, the company was, as far as airline companies go, doing very well — particularly in Brazil (38% revenue), Chile (16%) and the United States (10%).

Contributing to the positive performance trend is the fact that the company has apparently been executing its business plan quite well. It has rejiggered its cost structure; established new routes; reduced fleet commitments; and upgraded operational execution and customer experience (including the implementation of a frequent flyer program).* Improved operational performance gave the company flexibility in other parts of the business. Notably, the company decreased leverage by $2b — dropping its leverage ratio from 5.8x to 4x. It also reduced its capital fleet commitments by $6.3b from 2015 to 2019. Everything was going in the right direction.

But then COVID-19 caused a 95% reduction in LATAM’s passenger service. All of the business plan execution in the world couldn’t have prepared the Debtors for such a meaningful drop off. To state the obvious, this created an immediate liquidity strain on the business and instantly called the Debtors’ capital structure into question. To address the liquidity situation, the Debtors drew down the entirety of their secured revolving credit facility giving them $707mm total cash on hand (plus another $621 held by non-debtor affiliates). Here is the rest of the Debtors’ largely unsecured capital structure:

The rubber is going to meet the runway with a lot of the aircraft leases. The finance leases are all entered into by special purpose vehicles (“SPVs”) which then lease the planes to LATAM Parent which then subleases the aircraft to other opcos including certain of the Debtors. The SPVs finance the acquisition of aircrafts through various banks, pledging the owned aircraft as collateral. The principal amount outstanding under the various SPV financings is $3.3b.

Meanwhile, the operating leases are entered into with third-party lessors like AerCap Holdings N.V., Aircastle Holding Corporation Limited and Avolon Aerospace Leasing Ltd. The Debtors have negotiated rent deferrals with these parties but, generally, they pay $44mm/month in rent and, all in, have $2.9b in aircraft-related lease liabilities.

Similarly, certain aircraft purchase agreements are likely to be grounded. The company has agreements to purchase 44 aircraft from Airbus S.E. and 7 aircraft from Boeing.

The Debtors seem primed to leverage certain bankruptcy tools here. First and foremost is right-sizing the fleet, which means a lot of the aforementioned agreements will be (or are likely to be) on the chopping block. Indeed, the Debtors have already filed a motion seeking to reject around 19 of them.

Two significant shareholders have agreed to fund $900mm of super-priority DIP financing which will be part of a larger $2.15b DIP Facility (PETITION Note: reminder that Avianca has not sought approval of a DIP credit facility…yet). Given that many Latin American countries have suspended air travel for months (i.e., Argentina through September, Colombia through August) and the US recently announced it would deny entry to non-citizens from Brazil, the Debtors will need this financing to complement the cash already on hand to stay afloat.

Like Hertz and Avianca, it looks like this one will linger in bankruptcy court for awhile as all of the various parties in interest try to figure out what a business plan looks like in a post-COVID world.

*Notably, the company brags that it was able to “…increase available seat kilometers (or ASKs, used to measure an airline’s carrying capacity) by approximately 11%…” which, in turn, contributed to an increase in passengers carried from 68mm to 74mm per year and increased its operational margin from 5% to 7%. This is confirmation of what we already knew: to juice revenues airlines have been engaging in sardine-packing experiment, squeezing as many passengers into a flight as possible. And it worked! Query, however, what will happen to ASKs in a post-COVID-19 world. 🤔

Jurisdiction: S.D. of New York (Judge Garrity Jr.)

Capital Structure: see above

Professionals:

Legal: Cleary Gottlieb Steen & Hamilton LLP (Richard Cooper, Lisa Schweitzer, Luke Barefoot, Thomas Kessler, David Schwartz) & Togut Segal & Segal LLP (Albert Togut, Kyle Ortiz)

Financial Advisor: FTI Consulting Inc.

Investment Banker: PJT Partners LP

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Large equityholders: Cueto Group, Delta Air Lines Inc. ($DAL), Chilean Pension Funds,

Large Equityholder: Qatar Airways investments UK Ltd.

Legal: Alston & Bird LLP (Gerard Catalanello, James Vincequerra)

Official Committee of Unsecured Creditors

Legal: Dechert LLP (Benjamin Rose)

Conflicts Legal: Klestadt Winters Jureller Southard & Stevens LLP