🚜New Chapter 11 Bankruptcy Filing - Tea Olive I LLC (d/b/a Stock+Field)🚜

Tea Olive I LLC (d/b/a Stock+Field)

The #retailapocalypse is indiscriminate. Sometimes it likes to take down big prey like J.C. Penney or J. Crew but other times it just wants to snag some low hanging fruit via the path of least resistance. That means that a number of retailers those of us in our bubbles in major coastal cities have maybe never heard of will find their way into a bankruptcy court. And a bankruptcy court outside of Delaware or Texas no less.

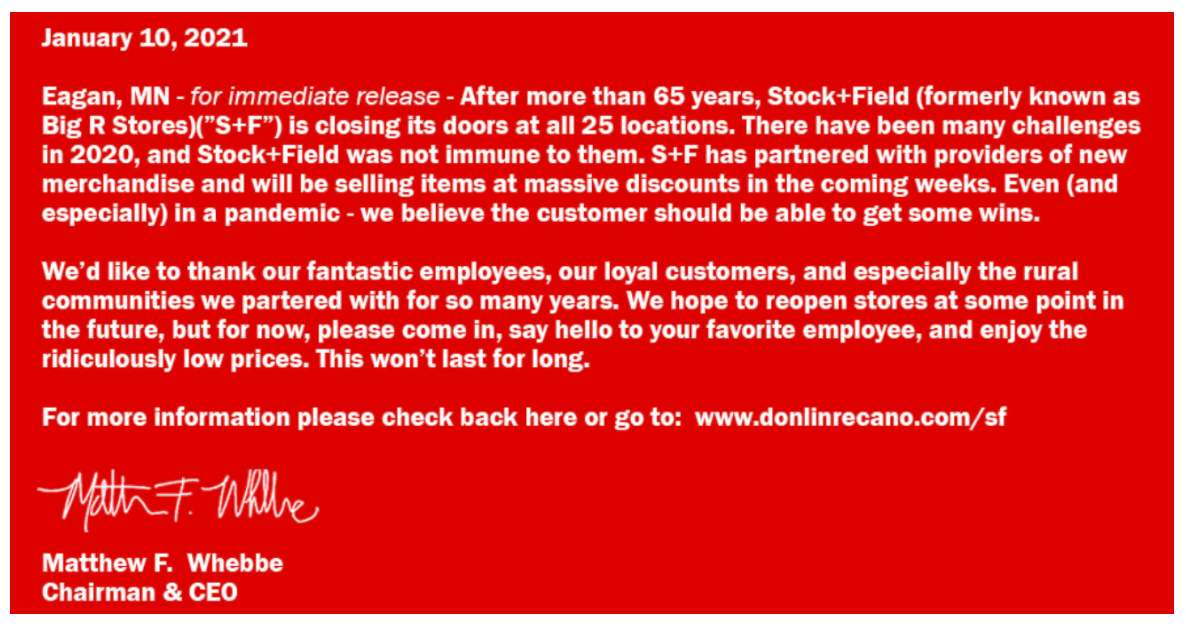

Like Tea Olive I LLC (d/b/a Stock+Field) for instance. The Minnesota-based “farm, home and outdoor retailer” operates 25 stores across the mid-West. It only sells “a small amount of products…online.” While that’s obviously pretty lame, this place seems like a smorgasbord of fun: in one fell swoop you can go in and pick up, among other things, some dog food, a kayak, some beekeeping equipment, some lawn fertilizer, workwear and apparel, a grill, paint, a new HVAC unit, auto parts, food, toys and firearms! A Christmas bonanza, this place must be! Earl Jr. can get himself a little toy gun while Big Earl can get himself a grenade launcher and AR-15. Everybody wins!

Well, not everybody. Unfortunately, the place is liquidating, a sad post-holidays result for the 1,000 full and part-time employees that work there.

In 2018, the debtor did $176mm of revenue and adjusted EBITDA of $5.1mm. In 2019, to differentiate itself from other unrelated “Big R” entities in the US, the debtor changed its name from “Big R Stores” to “Stock+Field” expecting some short-term drops in performance but expecting those drops to be mere blips on the road to a stronger future. And, in fact, the company did suffer a small drop in performance: it did $173.9mm in revenue and $1.6mm in adjusted EBITDA. 2020 was supposed to be the year.

Spoiler alert: it wasn’t. Not for literally anybody on the planet (well, other than maybe Elon Musk, Joseph Biden, fans of Brexit…ah…you get the idea…there are exceptions to literally everything). Per the company:

In the beginning of 2020, the Debtor continued its rebranding efforts and expected the business to grow throughout the year. However, the Covid-19 pandemic unexpectedly upset all expectations for 2020. All of the Debtor’s 25 stores were open under strict capacity and operating hour restrictions due to the pandemic. Additionally, the pandemic itself has altered the shopping behaviors of the Debtor’s consumers, with some customers not feeling comfortable entering physical stores to shop. While the Debtor sells some products online, the majority of its products are sold solely in stores.

😬Apparently they didn’t get the omni-channel memo. For fiscal year 2020, therefore, the debtor estimates $141.5mm in revenue and -$2.2mm in adjusted EBITDA. Consequently, the company hired restructuring professionals to pursue a financing options and/or a sale. But had no luck. The company then hired Tiger Capital Group to pursue liquidation. Get ready for…

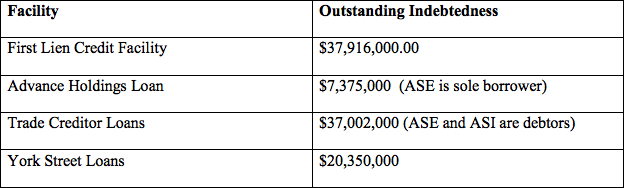

The debtor owes $29.7mm to its senior secured lender, CIT Northbridge Credit LLC pursuant to a credit agreement entered into in early March 2020. Query how seriously the various parties were taking COVID-19 given the timing. Still, the debtor estimates its inventory value to be $45.6mm and it also has $734k of A/R and prepaid assets against $26.5mm in trade debt (inclusive of approximately $1mm in 503(b)(9) claims).* The size of general unsecured creditor recoveries — certain to be less than 100% — will definitely depend on whether there are shoppers out there who are willing to risk contracting COVID-19 simply to hit the bid on that alleged $45.6mm in inventory value.

One question that also arises with retail cases is what happens with gift cards? It appears the debtor intends to honor outstanding gift cards until February 8, 2021. Hurry out, y’all, and get yourself some new toys and firearms just in time for the Civil War.

*For the uninitiated, the Bankruptcy Code provides that suppliers of goods delivered to a debtor in the ordinary course of business in the 20 days prior to a petition date be allowed as administrative expenses.

PETITION is a digital media company that provides curated content, analysis and commentary about distressed investing, bankruptcy and restructuring. We discuss disruption from the vantage point of the disrupted. For “all-access” to our content, lease visit us here.

Date: January 10, 2020

Jurisdiction: D. of Minnesota (Judge Fisher)

Capital Structure: $29.7mm funded secured debt (Second Avenue Capital Partners LLC)

Company Professionals:

Legal: Fredrikson & Byron PA (Clinton Cutler, James Brand, Steven Kinsella, Samuel Andre)

Restructuring Advisor: Clear Thinking Group (Michael Wesley)

Liquidator: Tiger Capital Group LLC

Investment Banker: Steeplechase Advisors LLC (James Cullen, Dan O’Rourke, David Burke, Nate Anderson, Eddie Doherty, Amy Rose)

Claims Agent: Donlin Recano (Click here for free docket access)

Other Parties in Interest:

Secured Loan Agent: Second Avenue Capital Partners LLC

Secured Lender: CIT Northbridge Credit LLC

Legal: Riemer & Braunstein LLP (Steven Fox)