New Chapter 11 Bankruptcy Filing - Advanced Sports Enterprises Inc.

Advanced Sports Enterprises Inc.

November 16, 2018

Another day, another retailer in bankruptcy court.

Advanced Sports Enterprises Inc. and several affiliated companies filed for bankruptcy on Friday in the District of North Carolina. The debtors are designers, manufacturers and wholesale sellers of bicycles and related equipment. The debtors utilize both online (www.performancebike.com) and brick-and-mortar channels (104 retail stores across 20 states) to sell their bikes.

The debtors blame their capital structure and the seasonal nature of their business for their fall into bankruptcy. Due to lack of liquidity, it sounds as if the debtors engaged in an operational restructuring that included stretching payables to suppliers and creditors. As you might imagine, once payments are delayed, suppliers and creditors get kind of pissed off and start imposing more aggressive payment terms. In other words, they’re not too keen on being creditors. When that happens, a company pushing the envelope is caught in a vicious cycle. Indeed, here, the debtors say that they are on pace to run out of money in January 2019.

So, the debtors intend to market their business to an array of potential purchasers: private equity funds, family offices, strategic parties, and liquidators. While that process plays out, they will close 40 stores. They seek approval of a $45mm DIP credit facility from their prepetition senior secured lender, Wells Fargo Bank NA, to fund the cases.

Jurisdiction: D. of North Carolina

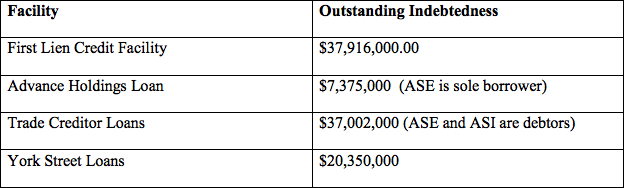

Capital Structure: $37.9mm first lien credit facility (Wells Fargo NA). $7.375mm term loan (Advanced Holdings Co., Ltd.). Otherwise, see below.

Company Professionals:

Legal: Flaster/Greenberg P.C. (William Burnett, Richard Dressel, Harry Giacometti, Douglas Stanger, Damien Nicholas Tancredi) & (local) Northern Blue LLP (John Northen, Vicki Parrott, John Paul H. Cournoyer)

Financial Advisor: Clear Thinking Group LLC (Joseph Marchese)

Investment Banker: D.A. Davidson & Co. (Michael Smith)

Liquidator: Gordon Brothers Retail Partners LLC

Real Estate Consultant: A&G Realty Partners LLC

Claims Agent: KCC LLC (*click on company name above for free docket access)

Other Parties in Interest:

Senior Secured Lender: Wells Fargo Bank NA

Legal: Riemer & Braunstein LLP (Donald Rothman, Steven Fox) & (local) Williams Mullen (Holmes Harden)

Unsecured Creditors Committee: none appointed due to lack of creditors.

Source: First Day Declaration.