👖New Chapter 11 Bankruptcy Filing - True Religion Apparel Inc.👖

True Religion Apparel Inc.

4/14/20

TMI: we’ve had a hard enough time getting Johnny to even wear pants at all over the last few weeks let alone put on jeans. That one Zoom call where he spilled coffee on himself and jumped out of his chair emblazoned an image in our minds that we’ll need some real therapy to get over. We had to take out an enterprise Headspace account as a result. But enough about us.

To the topic at hand: True Religion Apparel Inc. Here’s the good news: True Religion and its four affiliates (the “debtors”) legged it out long enough to avoid PETITION’s dreaded Two-Year Rule violation. Any retailer that can stave off a chapter 22 bankruptcy filing for as long as True Religion did (30 months) has, in fact, achieved a “successful” restructuring in our book. That said, the brand is nevertheless back in bankruptcy court. If that logic strikes you as perverse well, yes, we admit it: the bar for bankrupted retailers is, in fact, that low.

Interestingly and somewhat counter-intuitively, there has been a dearth of retail restructuring activity during the COVID-19 strike. We went through some explanation for that here and the theme was subsequently picked up and expanded upon by the MSM: there were countless articles about how busy restructuring professionals are and yet very few filings (though there has been a lot of activity this week). Why? It’s hard for retailers to conduct GOB sales when stores aren’t open. DIP financing is harder to come by. Buyers are few and far between. Everyone is having trouble underwriting deals when it’s so difficult to gauge if and when things will return to “normal.”

True Religion couldn’t afford to wait. It has 87 retail stores. They’re closed. It’s wholesale business — dependent, of course, on other open brick-and-mortar shops — is also closed. This was an immediate 80% hit to revenue.* The company — which had posted a $50mm net loss for the TTM ended 2/1/20 (read: it was already pretty effed) — suddenly found itself facing an accelerated liquidity crisis. Stretching payables, stretching rent, furloughing employees. All of those measures were VERY short-term band-aids. A bankruptcy filing became absolutely necessary to gain access to much needed liquidity. This filing is about a DIP credit facility folks. Without it, they’d be looking at Chapter 7 liquidation. Per the debtors:

The Debtors must have access to the DIP Facilities to continue to pay essential expenses—including employee benefits, trust fund taxes and other critical operating expenditures—while they use the breathing spell provided by the Bankruptcy Code to wait out the effects of the COVID-19 pandemic and attempt to pursue a value-maximizing transaction for all stakeholders.

Critical operating expenditures? Yup, e-commerce maintenance and fulfillment, wholesale and restructuring expenses baby. The plan is to “mothball” the business and hope for a tiered reopening of stores “at the conclusion fo the COVID-19 pandemic.” In the meantime, the debtors intend to pull a Modell’s/Pier 1 and get relief from having to pay rent. This as pure of a “breathing spell” as you can get.

Back to the financing. The debtors have approximately $139mm of funded debt split between a $28.5mm asset-backed term loan (inclusive of LOCs) and a $110.5mm first lien term loan. The debtors also had access to a $28.5mm revolver subject to a “borrowing base,” as usual, but that facility wasn’t tapped. We’re guessing Crystal Financial ratcheted up reserves and didn’t leave much opportunity for drawing that money outside of a filing.

In March 2020 the debtors sought, in earnest, new financing, talking to their existing lenders and third-party lenders. They also considered the possibility of tapping funds via the recently-enacted CARES Act. They note:

In addition to the Debtors’ efforts in the private marketplace, the Debtors and their Restructuring Advisors evaluated the availability of government appropriations through the CARES Act. After careful consideration, the Debtors determined that they were not eligible for government funding, or to the extent that there was a possibility that they would be eligible, they would not be able to wait the time necessary to find out whether a loan would be available under the CARES Act. The Debtors are hopeful that future stimulus packages will target companies such as the Debtors – i.e. mid-market companies with 1000 employees that are currently in chapter 11, but that could utilize government financing when emerging from chapter 11.

New third-party financing didn’t come to fruition. Among other reasons, lenders cited “the timing, complexity and overall challenges in the retail industry in light of COVID-19.” It’s hard out there for an underwriter. Ultimately, the debtors settled on financing offered by some of its first lien term lenders.

Now, we don’t normally get too deep into DIP details but given the difficulty financing retailers today, we thought the structure merited discussion. Here’s what the debtors negotiated:

A $29mm senior secured super-priority asset-based revolver (rollup);

A $59.89mm senior secured super-priority delayed-draw term loan credit facility of which $8.4mm is new money, a bit over $3mm is for LOCs, and the rest constitutes a rollup of pre-petition debt.

Major equityholder and pre-petition lender Farmstead Capital Management LLC is a big player in the term loan. The DIP is subject to a “strict” 13-week budget based on a four-month case with an eye towards either a section 363 sale or a reorganization by mid-May. Seems ambitious. For obvious reasons. But Farmstead ain’t suffering no fools. Per the debtors:

…the Debtors’ lenders are unwilling to fund a contentious chapter 11 case and they have made this clear to the Debtors over the course of the negotiations. Any material delay or significant litigation during these cases will result in the Debtors’ default of its covenants and send the Debtors spiraling into a fire-sale liquidation.

Given that Farmstead is taking half of its DIP fee paid-in-kind, they may be looking to own this sucker on the backend via a credit bid. Hats off to those guys.

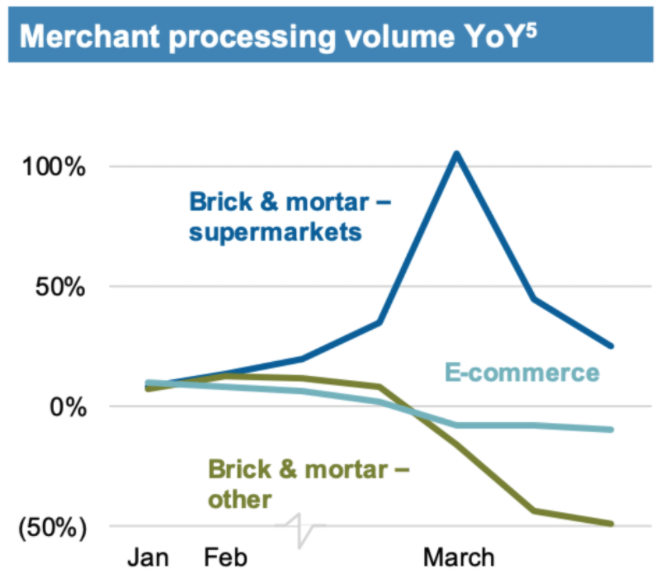

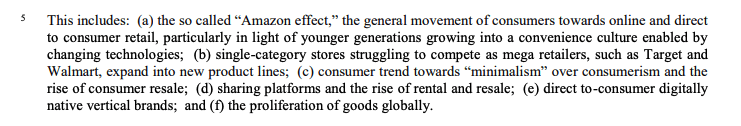

*The papers are not entirely clear but they appear to indicate that e-commerce “accounts for less than 26% of sales” out of $209mm or ~$54mm. Given layoffs across the country, we have to think that e-commerce fell off a cliff in February and March too. Said another way, there’s no way it could’ve generated enough revenue to keep the business afloat. Also, JP Morgan ($JPM) included the following chart in its earnings deck this week:

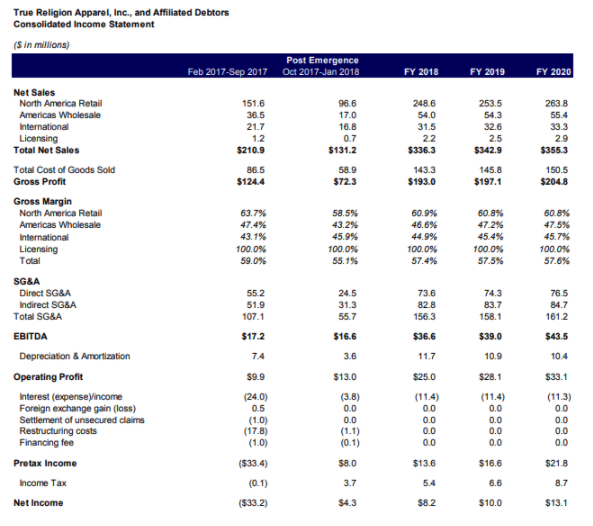

**We’d be remiss if we didn’t note the financial performance here. Again, the debtors highlighted a $50mm net loss in the fiscal year that just closed on February 1, 2020. Here are the financial projections that True Religion filed as part of its disclosure statement during its first chapter 11 filing:

That’s a savage miss.

Jurisdiction: D. of Delaware (Judge Sontchi)

Capital Structure: $28.5mm Asset-Backed Term Loan (Crystal Financial LLC), $110.5mm First Lien TL (Delaware Trust Company)

Professionals:

Legal: Cole Schotz PC (Justin Alberto, Seth Van Aalten, Michael Trentin, Kate Stickles, Patrick Reilley, Taylre Janak) & Akin Gump Strauss Hauer & Feld LLP (Arik Preis, Kevin Eide)

Board of Directors: Eugene Davis, Lisa Gavales, Stephen Perrella, Robert McHugh

Financial Advisor: Province Inc. (Michael Atkinson)

Real Estate Advisor: RCS Real Estate Advisors

Claims Agent: Stretto (*click on the link above for free docket access)

Other Parties in Interest:

Pre-petition ABL & DIP ABL Agent: Crystal Financial LLC

Legal: Choate Hall & Stewart LLP (John Ventola, Jonathan Marshall) & Womble Bond Dickinson US LLP (Matthew Ward, Morgan Patterson)

Pre-petition TL & DIP TL Lenders

Legal: Proskauer Rose LLP (Brian Rosen, Lucy Kweskin) & Young Conaway Stargatt & Taylor LLP (Jaime Luton Chapman)

Major equityholders: Farmstead Capital Management LLC, Waddell & Reed, Towerbrook Capital Partners, Apex Credit Partners LLC, Credit Suisse, Goldman Sachs Asset Management