⛽️ New Chapter 11 Bankruptcy Filing - Templar Energy LLC ⛽️

Templar Energy LLC

May 31, 2020

Templar Energy LLC (and six affiliates, the “debtors”), an Oklahoma City-based independent oil and gas exploration and production company that operates primarily in the Greater Anadarko Basin of Western Oklahoma and the Texas Panhandle, filed a prepackaged plan of liquidation early Monday morning — the culmination of a multi-year effort to stave off the inevitable.

A quick flashback. Four years ago oil and gas companies were collapsing into bankruptcy left and right. After oil and gas prices fell hard, the oil and gas tide rolled out and left a lot of investors stranded naked on the beach. Most funds were of the view that this was just a hiccup. One fund after another raised billions after billions of dollars thinking that energy was “where it’s at.” We now know how off-kilter that thesis was.

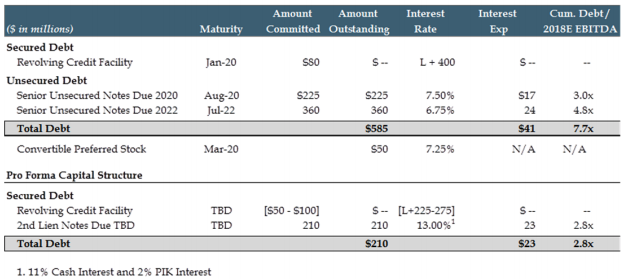

Some companies back then were luckier than others. Thanks in large part to its relatively simple and highly concentrated capital structure and a clear demarcation of value based on prevailing commodity prices of the time, in September 2016, Templar Energy was able to consummate an out-of-court restructuring that extinguished $1.45b of second lien debt. Repeat: $1.45 BILLION of second lien debt — a tremendous amount of value destruction a mere four years after the company’s formation. Of course, as with all things there are nuances here. “Value destruction” is a relative phrase that applies to the par holders of the debt when originally issued. Certain second lien lenders who participated in the out-of-court restructuring may very well have purchased the paper for cents on the dollar once the par guys had to pull the ripcord. Destruction there, therefore, is a function of price. There’s no way to know (from publicly available information) whether any of the original holders of second lien paper came out ahead upon receiving $133mm in cash and 45% of the equity in exchange for their second lien paper. It’s certainly possible that some did.

It’s also highly probable that some didn’t. Take Ares Management LLC, Bain Capital and Paulson & Co. Inc. for instance; they each participated in a rights offering for participating preferred equity in the company in exchange for $220mm dumped into this turd (plus $145mm placed by legacy equity holders). Given that the RBL IS NOW IMPAIRED here, clearly that equity check hasn’t borne fruit. It was also used to pay the aforementioned $133mm of cash recovery so … suffice it to say … this does not seem like one that the aforementioned funds will be referencing in future LP-oriented marketing materials.

Emanating out of that ‘16 transaction is the debtors’ current $600mm RBL. This time around, it is the fulcrum security. The debtors note, “Critically the claims under the RBL Facility are deeply impaired.” And the RBL lenders have no intention of owning the assets — predominantly leases with various oil and gas mineral owners covering non-exclusive working interests in approximately 2,165 oil and gas wells over approximately 273,400 continuous acres of property. Let’s be clear here: first lien lenders generally aren’t in the business of horizontal drilling and hydraulic fracking. Of course, right now, the debtors aren’t really in the business of horizontal drilling and hydraulic fracking. At least technically speaking. Given where oil and gas prices are — thanks Putin/MBS on the supply side, COVID-19 on the demand side — the debtors aren’t even conducting any drilling. Typically they operate anywhere up to 13 rigs at a time. All of which is to say that the lenders’ position explains why this is a sale + plan of liquidation case rather than a second debt-for-equity play.*

To aid the debtors’ attempts to continue pre-petition sale efforts post-petition, certain of the RBL Lenders have committed to a $37.5mm DIP (with a 0.5-to-1 $12.5mm rollup). Pursuant to a restructuring support agreement, the RBL lenders have agreed to receive their pro rata share of any net sale proceeds and all remaining cash held by the debtors’ estates as of the plan effective date minus (i) cash needed to repay the DIP, (ii) wind down funds, and (iii) monies placed into a professional fee escrow. Royalty owners, materialman and mechanics’ lienholders will be paid in full. General unsecured claimants and equity will get wiped.

*We should note — to hammer home the point — that one of the events that hammered the debtors’ liquidity position was the RBL lenders’ April 1, 2019 redetermination down of the RBL borrowing base to $415mm. This regularly scheduled redetermination analysis created an immediate $22mm “deficiency payment” liability for the debtors as it had $437mm borrowed at the time. The debtors stopped making those payments in November 2019. They’ve been in a state of forbearance with the RBL lenders ever since.

$37.5mm DIP with $12.5 rollup

Jurisdiction: D. of Delaware (Judge )

Capital Structure:

Professionals:

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Paul Basta, Robert Britton, Sarah Harnett, Teresa Li) & Young Conaway Stargatt & Taylor LLP (Pauline Morgan, Jaime Luton Chapman, Tara Pakrouh)

Financial Advisor: Alvarez & Marsal LLC

Investment Banker: Guggenheim Securities LLC (Morgan Suckow)

Claims Agent: KCC (*click on the link above for free docket access)

Other Parties in Interest:

DIP Agent ($37.5mm): Bank of America NA

Consenting RBL Lenders

Legal: Morgan Lewis & Bockius LLP (Amy Kyle, Andrew Gallo) & Richards Layton & Finger PA

Financial Advisor: RPA Advisors LLC

Large Class A equityholders: Ares Management LLC, Paulson & Co. Inc., Bain Capital, Lord Abbett, Archview Investment, Bank of America, Seix Advisors, Bardin Hill/Halcyon Loan Invest Management, Oppenheimer Funds