🧀 New Chapter 11 Bankruptcy Filing - CEC Entertainment Inc. 🧀

CEC Entertainment Inc.

June 24, 2020

For our rundown, please go here.

Jurisdiction: S.D. of Texas (Judge Isgur)

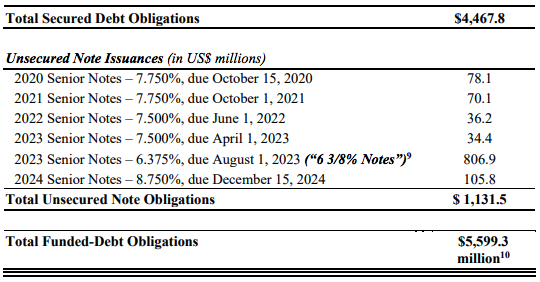

Capital Structure: $1.089b funded debt ($760mm TL, $108 RCF, $6mm LOC, $215.7mm notes)

Professionals:

Legal: Weil Gotshal & Manges LLP (Matthew Barr, Alfredo Perez, Andrew Citron, Rachael Foust, Scott Bowling)

Board of Directors: David McKillips, Andrew Jhawar, Naveen Shahani, Allen Weiss, Peter Brown, Paul Aronzon

Financial Advisor: FTI Consulting Inc. (Chad Coben)

Investment Banker: PJT Partners LP (Jamie O’Connell)

Real Estate Advisor: Hilco Real Estate LLC

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

PE Sponsor: Queso Holdings Inc./AP VIII CEC Holdings, L.P. (Apollo)

Legal: Paul Weiss Rifkind Wharton & Garrison LLP

First Lien Credit Agreement Agent: Credit Suisse AG, Cayman Islands Branch

Legal: Davis Polk & Wardwell LLP (Eli Vonnegut) & Rapp & Krock PC (Henry Flores, Kenneth Krock)

Ad Hoc Group of First Lien Lenders: American Money Management Corp, Arbour Lane Capital Management, Arena Capital Advisors LLC, Ares Management LLC, Bank of Montreal, BlueMountain Capital Management, Carlson Capital LP, Catalur Capital Management LP, Citibank NA, Credit Suisse AG, Deutsche Bank New York, Fidelity Management & Research Co., Fortress Investment Group LLC, GS Capital Partners LP, Hill Path Capital, Indaba Capital Fund LP, ICG Debt Advisors, Jefferies Financ LLC, J.H. Lane Partners Master Fund LP, Monarch Alternative Capital LP, MSD Capital LP, MSD Partners LP, Octagon Credit Investors LLC, Par Four Investment Management LLC, RFG-Clover LLC, Second Lien LLC, UBS AG, Wazee Street Capital Management, Western Asset Management Company LLC, WhiteStar Asset Management, ZAIS Group LLC

Legal: Akin Gump Strauss Hauer & Feld LLP (Ira Dizengoff, Philip Dublin, Jason Rubin, Marty Brimmage Jr., Lacy Lawrence)

Indenture Trustee: Wilmington Trust NA

Legal: Reed Smith LLP (Kurt Gwynne, Jason Angelo)

Ad Hoc Group of ‘22 8% Senior Noteholders (Longfellow Investment Management Co. LLC, Prudential Financial Inc., Resource Credit Income Fund, Westchester Capital Management)

Legal: King & Spalding LLP (Matthew Warren, Lindsey Henrikson, Michael Rupe)

Financial Advisor: Ducera Partners LLC

Official Committee of Unsecured Creditors: Wilmington Trust NA, The Coca-Cola Company, National Retail Properties, Performance Food Group, Washington Prime Group, NCR Corporation, Index Promotions

Legal: Kelley Drye & Warren LLP (Eric Wilson, Jason Adams, Lauren Schlussel & Womble Bond Dickinson LLP (Matthew Ward)

7/17/20 Dkt. 352.