New Chapter 11 Bankruptcy Filing - Centric Brands Inc. ($CTRC)

Centric Brands Inc.

May 18, 2020

New York-based Centric Brands Inc. ($CTRC)(f/k/a Differential Brands Group Inc., Joe’s Jeans Inc., and Innovo Group Inc.) and 34 affiliates (the “debtors”) filed for chapter 11 bankruptcy earlier this week after COVID-19 ripped through the economy and disrupted retail operations all over the country. You’ve likely never heard of Centric Brands Inc. (unless you happened to have a soft spot for esoteric brand stocks). But there is a very good chance that you’ve purchased one of its licensed products or one of its privately-owned brands. They’re ubiquitous. And they’re ubiquitous because the company’s reach has expanded aggressively over the years.

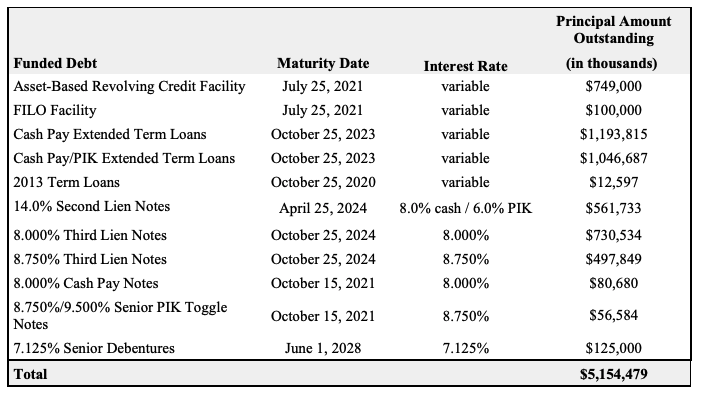

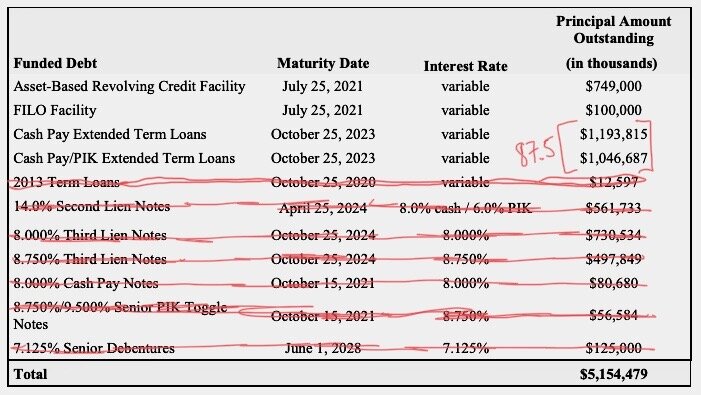

The company started in 1987, acquired Joe’s Jeans in 2007, acquired Hudson Brand in 2013, merged with Robert Graham in 2015, acquired SWIMS in 2016 and then acquired Global Brands Group Holding Limited in 2018 for $1.2b. The majority of the company’s $1.7b of funded debt emanates out of that last transaction. More on this in a moment.

In addition to the aforementioned private brands, the company designs, produces, merchandises, manages and markets approximately 100 brands pursuant to various licenses. These brands include AllSaints, Calvin Klein, Disney, Jessica Simpson, Kenneth Cole, Tommy Hilfiger and many more. The company sells its licensed and private-brands in one of three categories: kids, accessories, and men’s and women’s apparel. The former two grew from ‘18 to ‘19. The latter…well…not so much. All of the company’s product is made in Asia or Mexico.

For distribution, the company sells wholesale to, among others, bigbox retailers like Walmart Inc. ($WMT) and Target Inc. ($TGT), to department stores like Macy’s Inc. ($M), Kohls Corporation ($KSS) and J.C. Penney Corporation ($JCPQ), to off-price retailers like TJX Companies ($TJX) and Ross Stores ($ROST), and on Amazon Inc. ($AMZN). It also has brick-and-mortar stores for its private label brands Robert Graham (33 stores) and SWIMS (one store) as well as certain licensed brands like BCBG (46 stores), Joe’s Jeans (13), and Herve Leger (one). Finally, the company operates partner shop-in-shops for BCBG with big department stores.

Bankruptcy aficionados are familiar with the BCBG brand. BCBG filed for bankruptcy itself back in March 2017. Marquee Brands LLC later acquired the entire portfolio of brands from BCBG Max Azria Global Holdings — including BCBGMAXAZRIA, BCBGeneration and Herve Leger — for $108mm later that year. Marquee’s licensing partner? Global Brands Group Holding Limited, which, as noted above, is now part of Centric Brands. Through license agreements entered into back in July 2017, Centric has the right to manufacture and distribute certain licensed BCBG product; it also has the right to use certain intellectual property for retail and e-commerce sales.

Back in April, BCBG and the company started getting after it. BCBG was pissed because the company owed it $3mm in royalty payments. After the company continued not to pay, BCBG terminated the agreement. Now the parties have a settlement. The company is rejecting the licensing agreements, agreeing to let BCBG setoff $3mm against its pre-petition claim (which is capped at $20mm and pledged in support of the plan), and agreeing to pay ongoing royalties on the goods to be supplied to wholesale partners. Marquee Brands LLC is taking the licenses back and intends to add BCBG to its e-commerce portfolio.*

Soooooo…what happens to those brick-and-mortar locations we mentioned earlier? The debtors filed a motion already seeking to reject nonresidential real property leases effective as of the petition date. The debtors seek approval to reject seven Robert Graham leases, 42 BCBG leases and one Joe’s Jeans lease. Of those rejected leases 25 are in locations managed by Simon Property Group ($SPG). But, sure, the “A” malls are juuuuuuuust fine folks. Nothing to see here.

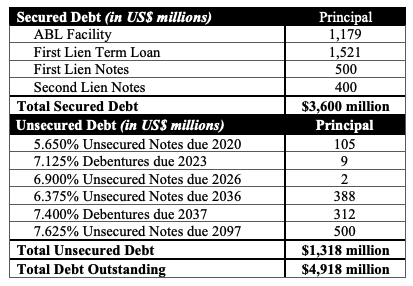

Well, except the capital structure. It’s so large it’s kinda hard to miss. The company has:

$163.9mm RCF,

$20mm ‘20 term loan bridge,

$631.9mm ‘23 first lien term loan (HPS Investment Partners, Ares Capital Corporation)

$719.8mm second lien term loan (GSO Capital Partners LP and Blackstone Tactical Opportunities Fund),

$200.3mm securitization facility, and

$28.7mm unsecured convertible notes plus $10mm modified convertible notes.

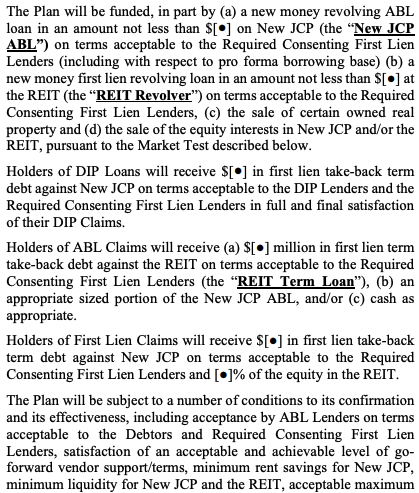

Luckily the holdings are concentrated among the above-noted funds. Accordingly, HPS, Ares and Blackstone will end up lenders in an exit first lien term loan and own the reorganized equity on the backend of this restructuring. HPS and Ares will own 30% of the equity and Blackstone will own 70% (subject to dilution). Your kids’ favorite licensed casualwear powered by private equity!**

*It is unclear what Marquee Brands LLC will do with the BCBG wholesale business. This article suggests they’ll do something and then goes on to emphasize only the e-commerce approach.

**The case will be powered by a $435mm DIP credit facility of which $275mm will be provided by the revolving lenders (and will rollup the pre-petition facility) and roll into an exit facility. The remaining $160mm will be a DIP term loan provided by Blackstone which will role into the exit first lien term loan with the first lien term lenders. The debtors will also extend its existing Securitization Facility.

Jurisdiction: S.D. of New York (Judge )

Capital Structure: $163.9mm RCF, $20mm ‘20 term loan bridge, $631.9mm ‘23 first lien term loan, $719.8mm second lien term loan, $200.3mm securitization facility, $28.7mm unsecured convertible notes, $10mm modified convertible notes

Professionals:

Legal: Ropes & Gray LLP (Gregg Galardi, Christine Pirro Schwarzman, Daniel Egan, Emily Kehoe)

Financial Advisor/CRO: Alvarez & Marsal LLC (Joseph Sciametta)

Investment Banker: PJT Partners LP (James Baird)

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Prepetition First Lien Revolver & DIP Agent ($275mm): ACF Finco I LP

Legal: Morgan Lewis & Bockius LLP (Julia Frost-Davies, Laura McCarthy)

First Lien Lenders: HPS Investment Partners, Ares Capital Corporation

Legal: Latham & Watkins LLP (Richard Levy, James Ktsanes)

Preptition Second Lien TL & DIP TL Agent ($160mm): US Bank NA

Legal: Nixon Peabody LLP (Catherine Ng)

Second Lien Lenders and DIP TL Lenders: GSO Capital Partners LP and Blackstone Tactical Opportunities Fund

Legal: Akin Gump Strauss Hauer & Feld LLP (Ira Dizengoff, Philip Dublin, Brad Kahn)

Receivables Purchase Agreement Agent

Legal: Mayer Brown LLP (Brian Trust)

Major equityholders: Cede & Co., GSO Capital Opportunities Fund III LP, GSO CST III Holdco LP, TCP Denim LLC, Tengram Capital Partners Fund II LP, Ares Capital Corporation