New Chapter 11 Bankruptcy Filing - J.C. Penney Company Inc. ($JCP)

J.C. Penney Company Inc.

May 15, 2020

Let’s be clear about something right off the bat. Encino Man, Captain America and Austin Powers could all suddenly surface from being entombed in ice for decades and even THEY wouldn’t be surprised that Texas-based J.C. Penney Company Inc. (and 17 affiliates, the “debtors”) filed for chapter 11 bankruptcy.

There are a couple of ways to look at this one.

First, there’s the debtors’ way. Not one to squander a solid opportunity, the debtors dive under “COVID Cover”:

“Before the pandemic, the Company had a substantial liquidity cushion, was improving its operations, and was proactively engaging with creditors to deleverage its capital structure and extend its debt maturities to build a healthier balance sheet. Unfortunately, that progress was wiped out with the onset of COVID-19. And now, the Company is unable to maintain its upward trajectory through its “Plan for Renewal.” Moreover, following the temporary shutdown of its 846 brick-and-mortar stores, the Company is unable to responsibly pay the upcoming debt service on its over-burdened capital structure.”

The debtors note that since Jill Soltau became CEO on October 2, 2018, the debtors have been off to the races with their “Plan for Renewal” strategy. This strategy was focused on getting back to JCP’s fundamentals. It emphasized (a) offering compelling merchandise, (b) delivering an engaging experience, (c) driving traffic online and to stores (including providing buy online, pickup in store or curbside pickup — the latest in retail technology that literally everyone is doing), (d) fueling growth, and (e) developing a results-minded culture. The debtors are quick to point out that all of this smoky verbiage is leading to “meaningful progress” — something they define as “…having just achieved comparable store sales improvement in six of eight merchandise divisions in the second half of 2019 over the first half, and successfully meeting or exceeding guidance on all key financial objectives for the 2019 fiscal year.” The debtors further highlight:

The five financial objectives were: (a) Comparable stores sales were expected to be down between 7-8% (stores sales were down 7.7%); (b) adjusted comparable store sales, which excludes the impact of the Company’s exit from major appliances and in-store furniture categories were expected to be down in a range of 5-6% (adjusted comparable store sales down 5.6%); (c) cost of goods sold, as a rate of net sales was expected to decrease 150-200 basis points (decreased approximately 210 basis points over prior year, which resulted in improved gross margin); (d) adjusted EBITDA was $583 million (a 2.6% improvement over prior year); and (e) free cash flow for fiscal year 2019 was $145 million, beating the target of positive.

Not exactly the highest bar in certain respects but, sure, progress nonetheless we suppose. The debtors point out, on multiple occasions, that prior to COVID-19, its “…projections showed sufficient liquidity to maintain operations without any restructuring transaction.” Maintain being the operative word. Everyone knows the company is in the midst of a slow death.

To prolong life, the focus has been on and remains on high-margin goods (which explains the company getting out of low-margin furniture and appliances and a renewed focus on private label), reducing inventory, and developing a new look for JCP’s stores which, interestingly, appears to focus on the “experiential” element that everyone has ballyhooed over the last several years which is now, in a COVID world, somewhat tenuous.

Which gets us to the way the market has looked at this. The numbers paint an ugly picture. Total revenues went from $12.87b in fiscal year ‘18 to $12b in ‘19. Gross margin also declined from 36% to 34%. In the LTM as of 2/1/20 (pre-COVID), revenue was looking like $11.1b. Curious. But, yeah, sure COGs decreased as has SG&A. People still aren’t walking through the doors and buying sh*t though. A fact reflected by the stock price which has done nothing aside from slowly slide downward since new management onboarded:

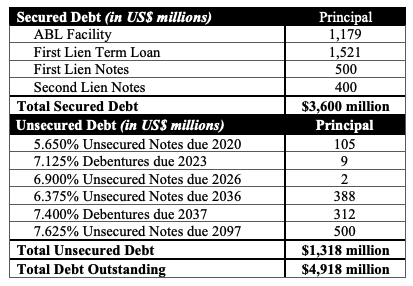

All of this performance has also obviously called into question the debtors’ ability to grow into its capital structure:

Here’s a more detailed look at the breakdown of unsecured funded debt:

And yet, prior to COVID, the debt stack has more or less held up. Here is the chart for JCP’s ‘23 5.875% $500mm senior secured first lien notes from the date of new management’s start to today:

Here is the chart for JCP’s ‘25 8.624% $400mm second lien notes from the date of new management’s start to today:

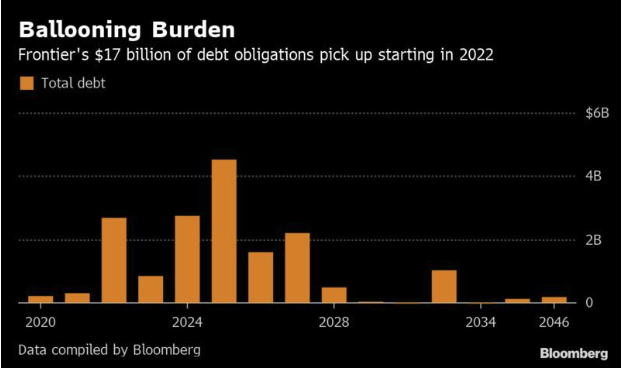

And here is our absolute favorite: JCP’s ‘97 7.625% $500mm senior unsecured notes:

The fact that these notes were in the 20s mere months ago is mind-boggling.

We talk a lot about how bankruptcy filings are a way to tell a story. And, here, the debtors, while not trying to hide their stretched balance sheet nor the pains of brick-and-mortar department stores with a 846-store footprint, are certainly trying to spin a positive story about management and the new strategic direction — all while highlighting that there are pockets of value here. For instance, of those 846 stores, 387 of them are owned, including 110 operating on ground leases. The private brand portfolio — acquired over decades — represents 46% of total merchandise sales. The debtors also own six of their 11 distribution centers and warehouses.

With that in mind, prior to COVID, management and their advisors were trying to be proactive about the balance sheet — primarily the term loans and first lien secured notes maturing in 2023. In Q3 ‘19, the debtors engaged with their first lien noteholders, term lenders and second lien noteholders on proposals that would, among other things, address those maturities, promote liquidity, and reduce interest expense. According to the debtors, they came close. A distressed investor was poised to purchase more than $750mm of the term loans and, in connection with a new $360mm FILO facility, launch the first step of a broader process that would have kicked maturities out a few years. In exchange, the debtors would lien up unencumbered collateral (real estate). Enter COVID. The deal went up in smoke.

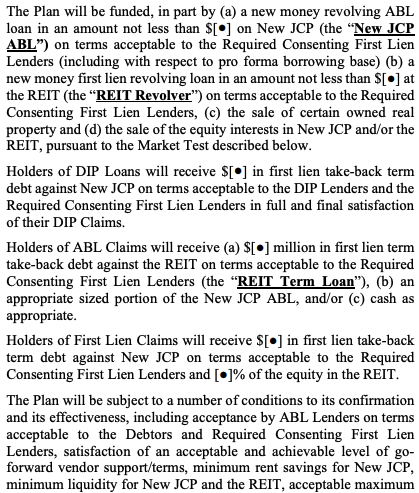

There’s a new “deal” in its stead. A restructuring support agreement filed along with the bankruptcy papers contemplates a new post-reorg operating company (“New JCP”) and a new REIT which will issue new common stock and new interests, respectively. Beyond that, not much is clear from the filing: the term sheet has a ton of blanks in it:

There’s clearly a lot of work to do here. There’s also the “Market Test” element which entails, among other things, running new financing processes, pursuing potential sale/leaseback transactions, and pursuing a sale of the all or part of the debtors’ assets. If the debtors don’t have a business plan by July 14 and binding commitments for third-party financing by August 15, the debtors are required to immediately cease pursuing a plan and must instead pursue a 363 of all of their assets. Said another way, if the economy continues to decline, consumer spending doesn’t recover, and credit markets tighten up, there’s a very good chance that JCP could liquidate. Remember: retail sales sunk to a record low in April. Is that peak pain? Or will things get worse as the unemployment rate takes root? Will people shop at JC Penney if they even shop at all? There are numerous challenges here.

The debtors will use cash collateral for now and later seek approval of a $900mm DIP credit facility of which $450mm will be new money (L+11.75% continues the trend of expensive retail DIPs). It matures in 180 days, giving the debtors 6 months to get this all done.

*****

A few more notes as there are definitely clear winners and losers here.

Let’s start with the losers:

The Malls. It’s one thing when one department store files for bankruptcy and sheds stores. It’s an entirely different story when several of them go bankrupt at the same time and shed stores. This is going to be a bloodbath. Already, the debtors have a motion on file seeking to reject 20 leases.

Nike Inc. ($NKE) & Adidas ($ADDYY). Perhaps they’re covered by 503(b)(9) status or maybe they can slickster their way into critical vendor status (all for which the debtors seek $15.1mm on an interim basis and $49.6mm on a final basis). Regardless, showing up among the top creditors in both the Stage Stores Inc. bankruptcy and now the J.C. Penney bankruptcy makes for a horrible week.

The Geniuses Who Invested in JCP Debt that Matures in 2097. As CNBC’s Michael Santoli noted, “This JC Penney issue fell only 77 years short of maturing money-good.”

Bill Ackman & Ron Johnson. This.

And here are the winners:

The New York Times. Imperfect as it may be, their digitalization efforts allow us all to read and marvel about the life of James Cash Penney, a name that so befitting of a Quentin Tarantino movie that you can easily imagine JC chillin with Jack Dalton on some crazy Hollywood adventure. We read it with sadness as he boasts of the Golden Rule and profit-sharing. Profits alone would be nice, let alone sharing.

Kirkland & Ellis LLP. Seriously. These guys are smoking it and have just OWNED retail. In the past eight days alone the firm has filed Stage Stores Inc., Neiman Marcus Group LTD LLC and now JCP. It’s a department store hat trick. Zoom out from retail and add in Ultra Petroleum Corp. and Intelsat SA and these folks are lucky they’re working from home. They can’t afford to waste any billable minutes on a commute at this point.

Management. They’re getting what they paid for AND, consequently, they’re getting paid. No doubt Kirkland marched in there months ago and pitched/promised management that they’d secure lucrative pay packages for them if hired and … BOOM! $7.5mm to four members of management!

Jurisdiction: S.D. of Texas (Judge Jones)

Capital Structure: See above.

Professionals:

Legal: Kirkland & Ellis LLP (Joshua Sussberg, Christopher Marcus, Aparna Yenamandra, Rebecca Blake Chaikin, Allyson Smith Weinhouse, Jake William Gordon) & Jackson Walker LLP (Matthew Cavenaugh, Jennifer Wertz, Kristhy Peguero, Veronica Polnick)

OpCo (JC Penney Corporation Inc.) Independent Directors: Alan Carr, Steven Panagos

Legal: Katten Muchin Rosenman LLP (Steven Reisman)

PropCo (JCP Real Estate Holdings LLC & JC Penney Properties LLC) Independent Directors: William Transier, Heather Summerfield

Legal: Quinn Emanuel Urquhart & Sullivan LLP

Financial Advisor: AlixPartners LLP (James Mesterharm, Deb Reiger-Paganis)

Investment Banker: Lazard Freres & Co. LLC (David Kurtz, Christian Tempke, Michael Weitz)

Store Closing Consultant: Gordon Brothers Retail Partners LLC

Real Estate Consultants: B. Riley Real Estate LLC & Cushman & Wakefield US Inc.

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

DIP Agent: GLAS USA LLC

Legal: Arnold & Porter Kaye Scholer

RCF Agent: Wells Fargo Bank NA

Legal: Otterbourg PC & Bracewell LLP (William Wood)

Financial Advisor: M-III Partners (Mo Meghli)

TL Agent: JPMorgan Chase Bank NA

Indenture Trustee: Wilmington Trust NA

Ad Hoc Group of Certain Term Loan Lenders & First Lien Noteholders & DIP Lenders (H/2 Capital Partners, Ares Capital Management, Silver Point Capital, KKR, Whitebox Advisors, Sculptor Capital Management, Brigade Capital Management, Apollo, Owl Creek Asset Management LP, Sixth Street Partners)

Legal: Milbank LLP (Dennis Dunne, Andrew Leblanc, Thomas Kreller, Brian Kinney) & Porter Hedges LLP

Financial Advisor: Houlihan Lokey (Saul Burian)

Second Lien Noteholders (GoldenTree Asset Management, Carlson, Contrarian Capital Management LLC, Littlejohn & Co.)

Legal: Stroock & Stroock & Lavan LLP (Kris Hansen) & Haynes and Boone LLP (Kelli Norfleet, Charles Beckham)

Financial Advisor: Evercore Group LLC (Roopesh Shah)

Large equityholder: BlackRock Inc. (13.85%)