September 15, 2019

Houston-based Sheridan Holding Company II LLC and 8 affiliated debtors filed a chapter 11 bankruptcy case in the Southern District of Texas with a nearly-fully-consensual prepackaged plan of reorganization. The plan, once effective, would eliminate approximately $900mm(!) of pre-petition debt. The case is supported by a $100mm DIP credit facility (50% new money).

Why so much debt? While this is an oil and gas story much like scores of other companies we’ve seen march through the bankruptcy court doors, the business model, here, is a bit different than usual. Sheridan II is a “fund”; it invests in a portfolio of working interests in mature onshore producing properties in Texas, New Mexico and Wyoming. Like Matt Damon in “Promised Land,” the debtors scour God’s country in search of properties, acquires working interests in those properties, and then seeks to deploy their special sauce (“application of cost-effective reinvestments, operational improvements, and enhanced recovery programs to the acquired assets”) to eke out product and, ultimately, sell that sh*t at a profit. This, as you might suspect, requires a bunch of capital (and equity from LPs like Warburg Pincus).* Hence the $1.1b of debt on balance sheet. All of this is well (pun intended) and good, provided the commodity environment cooperates. Which, we all know all too well, has not been the case in recent years. Peace out equity. Peace out sub debt.

Interestingly, some of that debt was placed not too long ago. Confronted with the oil and gas downturn, the debtors took the initiative to avoid bankruptcy; they cut off distributions to LPs, took measures to decrease debt, cut opex, capex and SG&A, and engaged in a hedging program. In 2017, the debtors raised $455mm of the subordinated term loan (with PIK interest galore), while also clawing back 50% of distributions previously made to LPs to the tune of $64mm. Everyone needed to have skin in the game. Alas, these measures were insufficient.

Per this plan, that skin is seared. The revolving lenders and term lenders will receive 95% of the common stock in the reorganized entity with the subordinated term lenders getting the remaining 5%. YIKES. The debtors estimate that the subordinated term lenders will recover 2.6% of the amount of their claims under the proposed plan. 2.6% of $514mm = EPIC VALUE DESTRUCTION. Sweeeeeeeeet. Of course, the limited partners are wistfully looking at that 2.6%. Everything is relative.

*****

Some additional notes about this case:

The hope to have confirmation in 30 days.

The plan includes the ability to “toggle” to a sale pursuant to a plan if a buyer for the assets emerges. These “toggle” plans continue to be all of the rage these days.

The debtors note that this was a “hard fought” negotiation. We’ve lost count of how many times professionals pat themselves on the backs by noting that they arrived at a deal, resolving the issues of various constituencies with conflicting interests and positions. First, enough already: this isn’t exactly Fallujah. You’re a bunch of mostly white males (the CEO of the company notwithstanding), sitting around a luxury conference table in a high rise in Manhattan or Houston. Let’s keep some perspective here, people. Second, THIS IS WHAT YOU GET PAID $1000+/hour to do. If you CAN’T get to a deal, then that really says something, particularly in a situation like this where the capital structure isn’t all-too-complex.

The bulk of the debtors’ assets were purchased from SandRidge Energy in 2013. This is like bankruptcy hot potato.

Independent directors are really becoming a cottage industry. We have to say, if you’re an independent director across dozens of companies, it probably makes sense to keep Quinn Emanuel on retainer. That way, you’re less likely to see them on the opposite side of the table (and when you do, you may at least temper certain bulldog tendencies). Just saying.

Finally, the debtors’ bankruptcy papers provide real insights into what’s happening in the oil and gas industry today — particularly in the Permian Basin. The debtors’ assets mostly rest in the Permian, the purported crown jewel of oil and gas exploration and production. Except, as previously discussed in PETITION, production of oil out of the Permian ain’t worth as much if, say, you can’t move it anywhere. Transportation constraints, while relaxing somewhat, continue to persist. Per the company:

“Prices realized by the Debtors for crude oil produced and sold in the Permian Basin have been further depressed since 2018 due to “price differentials”—the difference in price received for sales of oil in the Permian Basin as compared to sales at the Cushing, Oklahoma sales hub or sales of sour crude oil. The differentials are largely attributable to take-away capacity constraints caused by increases in supply exceeding available transportation infrastructure. During 2018, Permian Basin crude oil at times sold at discounts relative to sales at the Cushing, Oklahoma hub of $16 per barrel or more. Price differentials have narrowed as additional take-away capacity has come online, but crude oil still sells in the Permian Basin at a discount relative to Cushing prices.”

So, there’s that teeny weeny problemo.

If you think that’s bad, bear in mind what’s happening with natural gas:

“Similarly, the Henry Hub natural gas spot market price fell from a peak of $5.39 per million British thermal units (“MMBtu”) in January 2014 to $1.73 per MMBtu by March 2016, and remains at approximately $2.62 per MMBtu as of the Petition Date. In 2019, natural gas prices at the Waha hub in West Texas have at times been negative, meaning that the Debtors have at times either had to shut in production or pay purchasers to take the Debtors’ natural gas.”

It’s the natural gas equivalent of negative interest rates. 😜🙈

*All in, this fund raised $1.8b of equity. The Sheridan Group, the manager of the debtors, has raised $4.6b across three funds, completing nine major acquisitions for an aggregate purchase price of $5.7b. Only Sheridan II, however, is a debtor (as of now?).

Jurisdiction: S.D. of Texas (Judge Isgur)

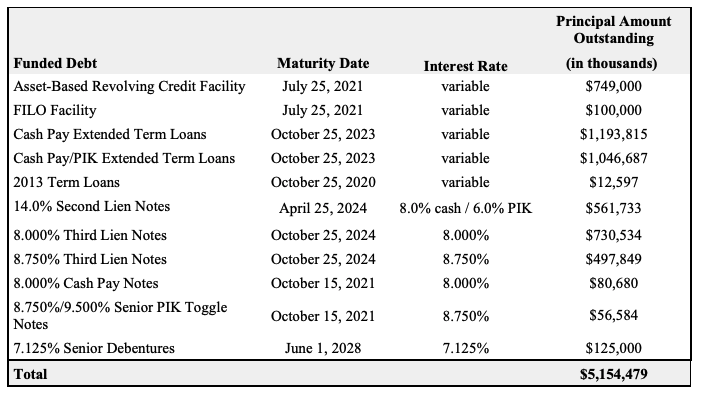

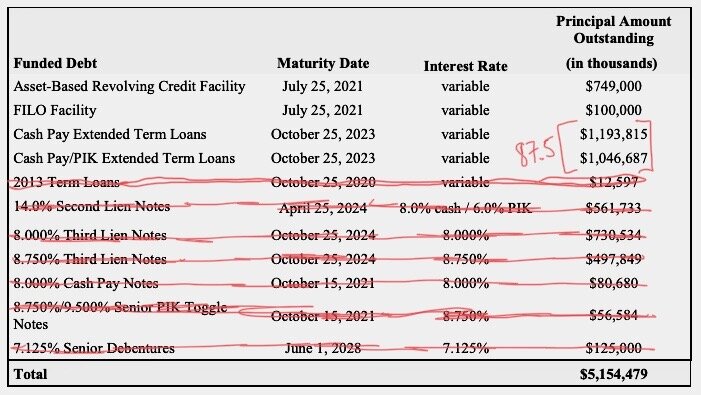

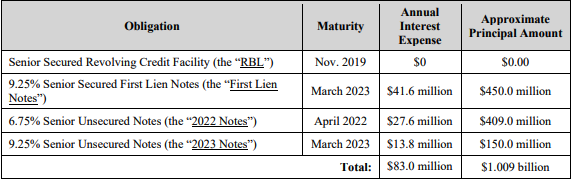

Capital Structure: $66 RCF (Bank of America NA), $543.1mm Term Loan (Bank of America NA), $514mm ‘22 13.5%/17% PIK Subordinated Term Loans (Wilmington Trust NA) — see below.

Professionals:

Legal: Kirkland & Ellis LLP (Joshua Sussberg, Steven Serajeddini, Spencer Winters, Stephen Hackney, Rachael Marie Bazinski, Jaimie Fedell, Casey James McGushin) & Jackson Walker LLP (Elizabeth Freeman, Matthew Cavenaugh)

Board of Directors: Alan Carr, Jonathan Foster

Financial Advisor: AlixPartners LLP

Investment Banker: Evercore Group LLC

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Administrative agent and collateral agent under the Sheridan II Term Loan Credit Agreements: Bank of America NA

Legal: Davis Polk & Wardwell LLP (Damian Schaible, Stephen Piraino, Nathaniel Sokol)

Financial Advisor: Houlihan Lokey Capital Inc.

Administrative Agent under the Sheridan II RBL: Bank of America NA

Legal: Vinson & Elkins LLP (William Wallander, Bradley Foxman, Andrew Geppert)

Financial Advisor: Houlihan Lokey Capital Inc.

Ad Hoc Group of Subordinated Term Loans (Pantheon Ventures US LP, HarbourVest Partners LP)

Legal: Weil Gotshal & Manges LLP (Matthew Barr, Gabriel Morgan, Clifford Carlson)

Financial Advisor: PJT Partners LP

Limited Partner: Wilberg Pincus LLC