April 22, 2020

This is a fun one.

Speedcast International Limited, a publicly-traded Australian company headquartered in Houston and 32 affiliates (the “debtors”) filed rare freefall bankruptcy cases in the Southern District of Texas earlier this week. In a week where another 4.4mm people filed for unemployment, one thing seems abundantly clear: the Texas’ bankruptcy courts are going to need help. While Delaware has also been extremely busy, both the Northern District and Southern District of Texas are seeing rock solid bankruptcy flow these days. If the judges got volume bonuses, they’d be rolling in it.

Who’s the big loser? Well, with all of these bankruptcy hearings conducted telephonically, we reckon it’s the city of Houston. In normal times, there’d be a steady stream of suits flushing through the local economy there: staying at the hotels, eating at the restaurants, drinking at the bars. Brutal. But we digress. 🤔

One thing the restructuring industry gives us is an open window into how one domino can topple over others. For instance, the energy and cruise industries are clearly effed currently and so it stands to reason that service providers to those industries would also feel pain. This is where Speedcast comes in: it is a provider of information technology services and (largely satellite-dependent) communications solutions (i.e., cybersecurity, content solutions, data and voice apps, IoT, network systems) to customers in the cruise, energy, government and commercial maritime businesses. They plug a hole: they offer telecom services to users in remote parts around the world, “primarily where there is limited or no terrestrial network.” Picture some evildoer in some decked out yacht-lair somewhere plotting to take over the world Austin Powers-style. He is probably leveraging Speedcast for IT solutions (PETITION Note: we’re just painting a picture folks; we’re not suggesting that the company merely deals with shady-a$$ mofos. Don’t @ us.). The business is truly international in scope.

Putting aside yacht-loving villains, Speedcast has high profile clients. Carnival Corp. ($CCL), for instance, contracted with Speedcast in December 2018 — long before any of Carnival’s customers contracted with the coronavirus. Cruisers streaming reports about their horrific cruise-going experiences likely used Speedcast product to get the word out. 😬 This was a growing business segment. Revenue increased by $36.5mm from fiscal year 2018 to 2019.

Likewise, the debtors’ energy business had also been growing. The debtors provide “high-bandwidth remote communication services to all segments of the global energy industry, including companies involved in drilling and exploration, floating production storage, offloading, offshore service, general service, engineering, and construction.” Revenue there increased from $158.3mm in FY18 to $164.5mm. We’re pretty sure we know which direction that number is heading in FY20.

Similarly, the debtors’ other business segments — Enterprise & Emerging Markets and Government — demonstrated growth between ‘18 and ‘19. All in, this is a $722.3mm revenue business. Unfortunately, it also had net losses of $459.8mm in FY19. So, yeah. There’s that. The debtors’ rapid expansion over the years apparently didn’t lead to immediate synergistic realization and the debtors suffered from margin compression, revenue declines from specific business lines, and other ails that affected performance and liquidity.

While there have been operational issues for some time now, those were just jabs. COVID-19 and the attendant global shutdown body slammed the company. The debtors note:

Further, the lasting and distressed market conditions in the maritime and oil and gas industries, and the recent and dramatic impact of the COVID-19 pandemic, have impacted all players in the global marketplace. The Company has been particularly hard hit by these adverse market conditions. The outsized impact on the Company’s Maritime Business and Energy Business customers has manifested in a dramatic reduction in cash receipts. This macroeconomic downturn, along with the above-mentioned headwinds that contributed to the lower than expected FY19 financial results, made clear that the Company would not satisfy the Net Leverage Covenant under the Credit Agreement.

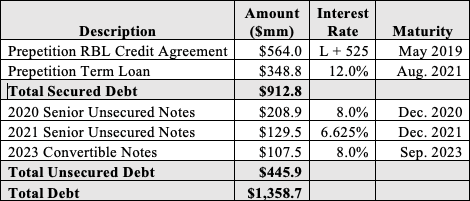

Right. The debt. $689.1mm of it, to be exact (exclusive of financing arrangements) — of which approximately $590mm is a term loan. With a capital structure this simple, one would think that this is a case that is ripe for a prearranged deal memorialized via a pre-petition restructuring support agreement. But no. There isn’t one here. Why not?

The term lenders argue that the debtors engaged them too late in the game. Therefore, there wasn’t enough time to conduct due diligence on the business, they say. Surely quarantine ain’t helping matters on that front. Nor is the fact that the company is international in nature.

And so this is a traditional freefall balance sheet and operational restructuring — something you don’t really see much of anymore. This case looks headed towards either a sale — which we’re guessing is the term lenders preferred outcome (par plus accrued baby!) — or a plan that would equitize the term lenders and put the go-forward financing needs of the debtors on the shoulders of the term lenders. A plan would preserve the debtors’ net operating losses which, as noted above, could be meaningful.

The debtors and the ad hoc lenders did nail down a commitment for a multiple-draw super-priority senior secured term loan DIP which includes a $90mm new money portion ($35mm on an interim basis) and a $90mm roll-up ($35mm on an interim basis). Judge Isgur took some exception to the interim roll-up portion of the proposed facility but the debtors and the lenders were hand-in-hand saying that — particularly under the circumstances today — the interim roll-up was necessary and appropriate because the lenders need a “big incentive” to lend and “the lenders’ capital providers are getting squeezed themselves.” 🤔 (PETITION Note: The DIP market sounds vicious — though some of that, here, is attributable to the nature of the assets. Delta Airlines can place senior secured notes right now at around 7% because, well … duh … planes!). Judge Isgur did caution however that he wants no part of professionals throwing this interim roll-up in his face as precedent in an upcoming case (Um, we’ll see how that plays out…this financing environment ain’t exactly reversing overnight). While the ad hoc lenders are clearly in pole position for the DIP commitment, they’re syndicating the loan now (which would obviously affect the roll-up too). The DIP will push the professionals towards a path forward over the next couple of weeks and the hope is for a result to be consummated within six months.

Interestingly, the largest single unsecured creditor is an entity that suffers from its own issues and has reportedly hired bankruptcy professionals for advice: Intelsat SA is owed $44mm. In late March, Intelsat terminated their contract with the debtors in a pretty savage leverage play. We talk about leverage a lot in PETITION. There’s balance sheet leverage and then there is situational leverage. Intelsat flexed its muscles and exercised the latter. In exchange it got critical vendor designation, acknowledgement of the full amount of their pre-petition claim and mutual releases. Significantly, the debtors stressed the importance of the relationship, noting that the IT services were needed more than ever as vessels sail adjusted routes due to COVID (read: boats are circling around because governments won’t let passengers disembark).

We should know within a few weeks what a deal may look like here.

Jurisdiction: S.D. of Texas (Judge Isgur)

Capital Structure: $87.7mm RCF, $591.4mm Term Loan, $10.6mm LOC

Professionals:

Legal: Weil Gotshal & Manges LLP (Gary Holtzer, Alfredo Perez, David Griffiths, Brenda Funk, Martha Martir, Kelly DiBlasi, Stephanie Morrison, Paul Genender, Amanda Pennington Prugh, Jake Rutherford) & Herbert Smith Freehills LLP

Independent Director: Stephe Wilks, Grant Scott Ferguson, Michael Martin Malone, Peter Jackson, Carol Flaton, David Mack)

Financial Advisor/CRO: FTI Consulting Inc. (Michael Healy)

Investment Banker: Moelis & Company Co. (Paul Rathborne, Adam Waldman)

Claims Agent: KCC (*click on the link above for free docket access)

Other Parties in Interest:

Ad Hoc Group of Secured Lenders

Davis Polk & Wardwell LLP (Damian Schaible, David Schiff, Jonah Peppiatt, Jarret Erickson) & Rapp & Krock PC (Henry Flores, Kenneth Krock)

Financial Advisor: Greenhill & Co. Inc.

DIP Agent: Credit Suisse AG

Skadden Arps Slate Meagher & Flom LLP (Steven Messina, George Howard, Albert Hogan III, David Wagener)

Large Creditor: Intelsat SA

Large Creditor: Inmarsat Global Limited

Official Committee of Unsecured Creditors

Legal: Hogan Lovells US LLP (S. Lee Whitesell, John Beck, David Simonds, Ron Silverman, Michael Hefter) & Husch Blackwell LLP (Randall Rios, Timothy Million)