New Chapter 11 Bankruptcy Filing - Neiman Marcus Group LTD LLC

Neiman Marcus Group LTD LLC

May 7, 2020

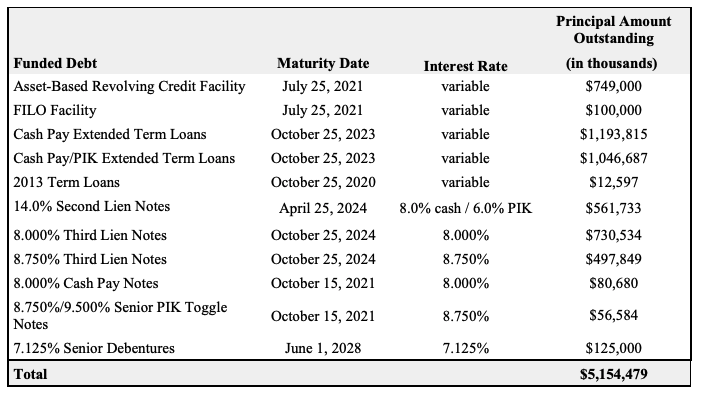

Dallas-based Neiman Marcus Group LTD LLC, Bergdorf Goodman Inc. and 22 other debtors filed for chapter 11 bankruptcy in the Southern District of Texas late this week. If anyone is seeking an explanation as to why that may be outside the obvious pandemic-related narrative, look no farther than this monstrosity:

A quick reality check: that $5b capital structure isn’t attached to an international enterprise with hundreds or thousands of stores. You know, like Forever21. Rather, that horror show backs a 68 store business (43 Neiman Marcus, 2 Bergdorf, 22 Last Call). Ah….gotta love the good ol’ $5b leveraged buyout.

This case is all about “BIG.”

Big capital structure stemming from a big LBO by two big PE funds, Ares Capital Management and CPP Investment Board USRE Inc.

Big brands with big price tags. PETITION Note: top unsecured creditors include Chanel Inc., Gucci America, Dolce and Gabbana USA Inc., Stuart Weitzman Inc., Theory LLC, Christian Louboutin, Yves Saint Laurent America Inc., Burberry USA, and more. There is also a big amount allocated towards critical vendors: $42.5mm. Nobody messes with Gucci, folks. Here’s a live shot of a representative walking out of court confident that they’ll get their money:

Big fees. More on this below.

Big, complicated — and controversial — multi-year re-designation and asset stripping transactions that were part of the debtors’ (and now non-debtors’) elaborate strategy to restructure out-of-court by kicking the can down the road. This is undoubtedly going to stir a big fight in the case. More on this below too.

Big value destruction.

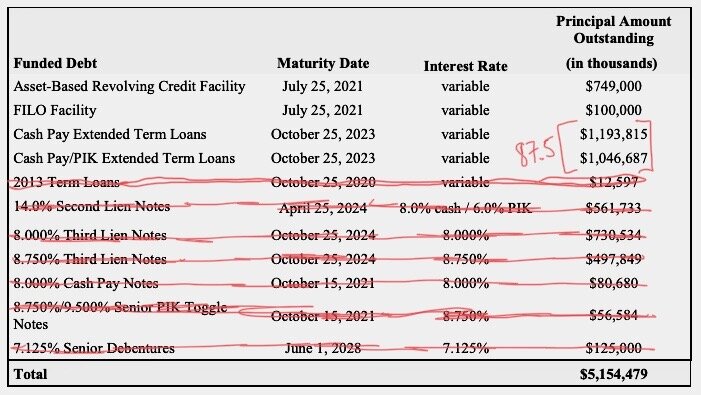

Here is what will happen to the pre-petition capital structure under the proposed term sheet and restructuring support agreement filed along with the chapter 11 papers — a deal that has the support of 78% of the term lenders, 78% of the debentures, 99% of the second lien notes, 70% of the third lien notes, and 100% of the private equity sponsors:

The Asset-Based Revolving Credit Facility and FILO Facility will get out at par. There’ll be a $750mm exit facility. Beyond that? All that red constitutes heaps and heaps of value that’s now essentially an option. It’s a bet that there is a place in the future for brick-and-mortar luxury department stores. Pursuant to the deal, the “Extended Term Loans” will get the lion’s share of equity (87.5%, subject to dilution). The rest of the capital structure will get small slivers of reorganized equity. General unsecured creditors will get “their pro rata share of a cash pool.” The private equity sponsors will get wiped out but for their hoped-for liability releases.

Back to those big fees. The biggest issue for this week was the debtors’ proposed $675mm new money DIP credit facility (that comes in junior to the existing ABL in priority…in other words, no roll-up here). The DIP is essentially 13% paper chock full of fees (including a backstop fee payable in “NewCo equity” at 30% discount to plan value). One disgruntled party, Mudrick Capital Management, a holder of $144mm of the term loan, appears to have beef with Pimco and other DIP backstop parties — saying that the backstop agreement is inappropriate and the DIP fees are outrageous, likening the fee grab to a COVID hoarding mentality — and therefore felt compelled to cross-examine the debtors’ banker as to the reasonableness of it all. If you’ve ever imagined a kid suing other kids for not picking him for their dodgeball team, it would look something like this did.

And so Lazard’s testimony basically boiled down to this:

“Uh, yeah, dude, nobody knows when the economy will fully open up. The company only has $100mm of cash on the petition date. And IT’S NOT OPERATING. That money is enough for maybe 3 weeks of cash burn given that the debtors intend to continue paying rent (unlike most other retailers that have filed for bankruptcy lately). Damn pesky high-end landlords. Anyway, so we’ll burn approximately $300mm between now and when stores are projected to reopen in July/August. No operating cash flow + meaningful cash burn = risky AF lending environment. It’s unprecedented to lend into a situation with a cash burn that, while it pales in comparison to something like Uber, is pretty damn extreme. Look at the J.Crew DIP: it ain’t exactly cheap to lend in this market. There are no unencumbered assets; there certainly isn’t a way to get junior financing. And a priming fight makes no sense here given the impossibility of showing an equity cushion. So stop being an entitled little brat. There’s no obligation on anyone to cut you into the deal. And if you’re going to cry over spilled milk, take up your beef with Pimco and f*ck right off. Alternatively, you can subscribe to your pro rata portion of the DIP and enjoy all of the fees other than the backstop fee.”

The Judge was convinced that the above rationale constituted good business judgment and approved the DIP on an interim basis.

The hearing also foreshadowed another contentious issue in the case: the myTheresa situation. See, the Debtors’ position is the following: “The ‘17 MyTheresa designation as unrestricted subs + the ‘18 distribution of the myTheresa operating companies to non-debtor Neiman Marcus Group Inc. (a/k/a the “asset stripping” transaction) + a ‘19 wholesale amend-and-extend + cost-saving initiatives + comparable same store sales growth for 7 of 10 quarters + “significantly expanded margins” during the holiday period = rocket ship future growth but for the damn pandemic. On the flip side, Marble Ridge Capital LP takes the position that:

…the Debtors’ financial troubles were entirely foreseeable well before recent events. The Company has operated at leverage multiples more than twice its peers since at least 2018 (prior to the fraudulent transfers described herein). And last year’s debt restructuring increased the Company’s already unsustainable annual interest expense by more than $100 million while only reducing the Company’s debt load by $250 million leaving a fraction of adjusted EBITDA for any capital expenditures, principal repayment, taxes or one-time charges. Sadly, the Debtors’ financial distress will come as no surprise to anyone.

This ain’t gonna be pretty. Marble Ridge has already had one suit for fraudulent transfer dismissed with prejudice at the pleading stage. Now there are defamation and other claims AGAINST Marble Ridge outstanding. And subsequent suits in the NY Supreme Court. Have no fear, though, folks. There are independent managers in the mix now to perform an “independent” investigation into these transactions.

The debtors intend to have a plan on file by early June with confirmation in September. Until then, pop your popcorn folks. You can socially distance AND watch these fireworks.

Jurisdiction: S.D. of Texas (Judge Jones)

Capital Structure: See above.

Professionals:

Legal: Kirkland & Ellis LLP (Anup Sathy, Chad Husnick, Matthew Fagen, Austin Klar, Gregory Hesse, Dan Latona, Gavin Campbell, Gary Kavarsky, Mark McKane, Jeffrey Goldfine, Josh Greenblatt, Maya Ben Meir) & Jackson Walker LLP (Matthew Cavenaugh, Jennifer Wertz, Kristhy Peguero, Veronica Polnick)

Independent Managers of NMG LTD LLC: Marc Beilinson, Scott Vogel

Legal: Willkie Farr & Gallagher LLP (Brian Lennon, Todd Cosenza, Jennifer Hardy, Joseph Davis, Alexander Cheney)

Financial Advisor: Alvarez & Marsal LLC (Dennis Stogsdill)

Independent Manager of Mariposa Intermediate Holdings LLC: Anthony Horton

Legal: Katten Muchin Rosenman LLP

Neiman Marcus Inc.

Legal: Latham & Watkins LLP (Jeffrey Bjork)

Financial Advisor/CRO: Berkeley Research Group LLC (Mark Weinstein, Kyle Richter, Marissa Light)

Investment Banker: Lazard Freres & Co. LLC (Tyler Cowan)

Claims Agent: Stretto (*click on the link above for free docket access)

Other Parties in Interest:

Pre-petition ABL Agent: Deutsche Bank AG New York Branch

Legal: White & Case LLP (Scott Greissman, Andrew Zatz, Rashida Adams) & Gray Reed & McGraw LLP (Jason Brookner, Paul Moak, Lydia Webb)

FILO Agent: TPG Specialty Lending Inc.

Schulte Roth & Zabel LLP (Adam Harris, Abbey Walsh, G. Scott Leonard) & Jones Walker LLP (Joseph Bain)

Pre-petition Term Loan Agent: Credit Suisse AG Cayman Islands Branch

Legal: Cravath Swaine & Moore LLP (Paul Zumbro, George Zobitz, Christopher Kelly) & Haynes and Boone LLP (Charles Beckham, Martha Wyrick)

Second Lien Note Agent: Ankura Trust Company LLC

Third Lien Note Agent: Wilmington Trust NA

Unsecured Notes Indenture Trustee: UMB Bank NA

Legal: Kramer Levin Naftalis & Frankel LLP (Douglas Mannal, Rachael Ringer)

2028 Debentures Agent: Wilmington Savings Fund Society FSB

Ad Hoc Term Loan Lender Group (Davidson Kempner Capital Management LP, Pacific Investment Management Company LLC, Sixth Street Partners LLC)

Legal: Wachtell Lipton Rosen & Katz (Joshua Feltman, Emil Kleinhaus) & Vinson & Elkins LLP (Harry Perrin, Kiran Vakamudi, Paul Heath, Matthew Moran, Katherine Drell Grissel)

Financial Advisor: Ducera Partners LLC

Ad Hoc Secured Noteholder Committee

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Andrew Rosenberg, Alice Belisle Eaton, Claudia Tobler, Diane Meyers, Neal Donnelly, Patricia Walsh, Jeffrey Recher) & Porter Hedges LLP (John Higgins, Eric English, M. Shane Johnson)

Financial Advisor: Houlihan Lokey Capital Inc.

Large Creditor: Chanel Inc.

Legal: Sheppard Mullin Richter & Hampton LLP (Justin Bernbrock, Michael Driscoll)

Large Creditor: Louis Vuitton USA Inc.

Legal: Barack Ferrazzano Kirschbaum & Nagelberg LLP (Nathan Rugg)

Large Creditor: Moncler USA Inc.

Legal: Morrison Cohen LLP (Joseph Moldovan, David Kozlowski)

Marble Ridge Capital LP & Marble Ridge Master Fund LP

Legal: Brown Rudnick LLP (Edward Weisfelner, Sigmund Wissner-Gross, Jessica Meyers, Uchechi Egeonuigwe)

Mudrick Capital Management LP

Legal: Gibson Dunn & Crutcher LLP (Michael Rosenthal, Mitchell Karlan, David Feldman, Keith Martorana, Jonathan Fortney)

Sponsor: CPP Investment Board USRE Inc.

Legal: Debevoise & Plimpton LLP (Jasmine Ball, Erica Weisgerber) & Pillsbury Winthrop Shaw Pittman LLP (Hugh Ray, William Hotze, Jason Sharp)

Sponsor: Ares Capital Management

Legal: Milbank LLP (Dennis Dunne, Thomas Kreller)

Official Committee of Unsecured Creditors

Legal: Pachulski Stang Ziehl & Jones LLP (Richard Pachulski) & Cole Schotz PC (Daniel Rosenberg)

Financial Advisor: M-III Advisory Partners LP (Mohsin Meghji)

Valuation Expert: The Michel-Shaked Group (Israel Shaked)