🌎 New Chapter 11 Filing - Lakeland Tours LLC (d/b/a WorldStrides) 🌎

Lakeland Tours LLC (d/b/a WorldStrides)

July 20, 2020

Virginia-based Lakeland Tours LLC (d/b/a WorldStrides) and 22 affiliates (the “debtors”) filed for bankruptcy in the Southern District of New York, the latest in a relatively small group of COVID-related victims to end up in bankruptcy court. Similar to other pure-play filings (e.g., several Latin American airlines and Hertz Corporation $HTZ)), the debtors are in the travel industry; they are a provider of educational travel experiences in the US and abroad; they are the US’ largest accredited travel program serving hundreds of thousands of students and hundreds of universities annually. And they were doing well before the pandemic: in fiscal ‘19, the company generated approximately $650mm in net revenue and management projected $840mm in net revenue in ‘20. As we all know, “experiences” are all the rage these days and international student travel is far more common today than it was even five years ago (PETITION Note: seriously, folks, the company doesn’t even try to hide the social element to this … the above photo just screams “Pay us for an experience racked with non-stop selfies!). According to StudentUniverse and Skift, “[t]he student traveler represents fully one-fifth of all international arrivals in the travel industry, today. They command a market value of some $320 billion….”

A worldwide travel shutdown will obviously negatively impact that trend. And, by extension, obliterate the company’s projections. Indeed, the debtors were “decimated” by the worldwide shutdown of nonessential travel. Revenue? Lost. Future bookings? Crushed. Refund requests? Voluminous. The “negative net bookings” must have been off the charts. All in, these factors created a $200mm liquidity hole for the debtors.

This need for new capital, when coupled with the debtors’ burdensome capital structure ($768mm of funded debt), precipitated the need for a restructuring. And, alas, the debtors have a restructuring support agreement (the “RSA”) agreed to by the debtors’ prepetition secured lenders, their hedge provider and their equity sponsors, Eurazeo North America and Primavera Capital Limited. The RSA commits these consenting stakeholders to, among other things, a $200mm new capital infusion (exclusive of fees) split 50/50 between the consenting lenders and the sponsors which will roll into exit debt and equity.* Here are the highlights:

The $100mm provided by the lenders will roll into an exit facility;

The $150mm roll-up will roll into a second-out term loan take-back facility; and

The $100mm provided by the equity sponsors will convert into 100% of the common stock of the reorganized debtors (subject to dilution from a management incentive plan).

Holders of $126mm in subordinated seller notes will get wiped out along with existing equity interests.

General unsecured creditors will ride-through paid in full.

The major parties to the RSA will get releases under the proposed plan: creditors who vote to reject the plan will need to affirmatively opt-out of the releases.

The debtors already commenced solicitation and hope to confirm the plan on or about August 19. The post-reorg capital structure will look like this:

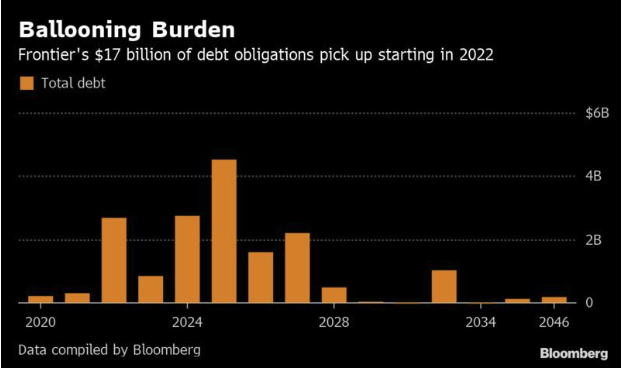

The above graphic is the biggest “tell” that the filing is predominantly about access to fresh capital. The deleveraging (of only $100mm) is rather secondary and inconsequential relative to the $200mm cash infusion. Which begs the question: if the debtors perform dramatically under business plan in coming years — perhaps, uh, due to a decrease in international student travel — will the company be in need of another restructuring? PETITION Note: as we write this, a talking head is pontificating on CNBC that business travel will be significantly lower in coming years than it had been — confirming the premise of this Bloomberg piece. If parents aren’t traveling for work, will they let their children travel for school?

The debtors certainly acknowledge the risks. In the “risk factors” section of their Disclosure Statement, they note that a “second wave” of COVID-19 could impact results (PETITION Note: we need to conquer the “first wave” to get to the “second wave,” but, yeah, sure.). They state:

The Debtors cannot predict when any of the various international or domestic travel restrictions will be eased or lifted. Moreover, even when travel advisories and restrictions are lifted, demand for study abroad and student travel may remain reduced for a significant length of time, and the Debtors cannot predict if and when demand will return to pre-pandemic levels. Due to the discretionary nature of educational travel spending, the Debtors’ revenues are heavily influenced by the condition of the U.S. economy and economies in other regions of the world. Unfavorable conditions in these broader economies have resulted, and may result in the future, in decreased demand for educational travel, changes in booking practices and related policies by the Debtors’ competitors, all of which in turn have had, and may have in the future, a strong negative effect on the Debtors’ business. In particular, the Debtors’ bookings may be negatively impacted by the adverse changes in the perceived or actual economic climate, including higher unemployment rates, declines in income levels and loss of personal wealth resulting from the impact of COVID-19. The Debtors’ bookings may also be impacted by continued and prolonged school closings.

And they add:

This is the first time since September 11, 2001 that the Debtors have suspended their tours, and is the first time the Debtors have completely suspended their tours for an extended period of time. As a result of these unprecedented circumstances, the Debtors are not able to predict the full impact of such a suspension. In particular, the Debtors cannot predict the impact on financial performance and cash flows required for cash refunds of fares for cancelled tours as a result of a suspension of tours if such suspensions are prolonged further than anticipated, as well as the public’s concern regarding the health and safety of travel, and related decreases in demand for travel. Depending on the length of the suspension and level of customer acceptance of future tour credits, the Debtors may be required to provide additional cash refunds for a substantial portion of the balance of deferred tours, as customers who have opted to defer tours may request a cash refund.

And so it looks like the debtors are conservatively projecting $367.9mm of revenue in fiscal year 2021, slightly more than half of what they did in ‘19. They don’t expect to revert back to projected ‘20 numbers until at least 2024. Yes, 2024.

Now, generally, projections are almost always worthless. As the debtors’ risk factors suggest here, they may be even more worthless than usual depending upon how COVID shakes out. At least management appears to be realistic here that the business will not return to pre-COVID levels for some time. Let’s hope that a vaccine comes and they’re positioned to surprise to the upside.**

_____

*$150mm of pre-petition secured debt will roll-up into the DIP.

**Houlihan Lokey pegs valuation between approximately $625mm and $745mm as of September 30, 2020.

Jurisdiction: S.D. of New York (Judge Garrity)

Capital Structure: $642mm RCF/TL/LOCs, $126mm subordinated seller notes

Professionals:

Legal: Kirkland & Ellis LLP (Nicole Greenblatt, Jennifer Perkins, Susan Golden, Whitney Fogelberg, Kimberly Pageau, Elizabeth Jones)

DIrectors: Bob Gobel, Lisa Mayr (ID)

Financial Advisor: KPMG LLP (James Grace, Thomas Bibby)

Investment Banker: Houlihan Lokey Capital Inc. (Sam Handler, Stephen Spencer)

Claims Agent: Stretto (*click on the link above for free docket access)

Other Parties in Interest:

Prepetition & DIP Agent: Goldman Sachs Bank USA

Legal: Latham & Watkins LLP (Adam Goldberg, Hugh Murtagh)

Seller Noteholders: Metalmark Capital Holdings LLC & Silverhawk Capital Partners

Legal: Davis Polk & Wardwell LLP (Michael Davis)

Sponsors: Eurazeo North America & Primavera Capital Limited

Legal: Cravath Swaine & Moore LLP (Paul Zumbro, George Zobitz) & Simpson Thacher & Bartlett LLP (Michael Torkin)

Financial Advisor: PJT Partners LP

Ad Hoc Group of Consenting Lenders

Legal: Gibson Dunn & Crutcher LLP (Scott Greenberg, Steven Domanowski, Jeremy Evans)

Financial Advisor: Rothschild & Co.