New Chapter 11 Filing - iHeartMedia Inc.

iHeartMedia Inc.

3/14/18

iHeartMedia Inc., a leading global media company specializing in radio, outdoor, mobile, social, live media, on-demand entertainment and more, has filed for bankruptcy -- finally succumbing to its $20 billion of debt ($16 billion funded) and $1.4 billion of cash interest in 2017. WOWSERS. The company purports to have "an agreement in principle with the majority of [its] creditors and [its] financial sponsors that reflects widespread support across the capital structure for a comprehensive plan to restructure...$10 billion..." of debt.

The company notes $3.6 billion of revenue and unparalleled monthly reach ((we'll have more to say about this in this Sunday's Members-only newsletter (3/18/18) - this claim deserves an asterisk)).

Still, as it also notes, the company faces significant headwinds. It states in its First Day Declaration,

"Among other factors, the global economic downturn that began in 2008 resulted in a decline in advertising and marketing spending by the Debtors’ customers, which resulted in a corresponding decline in advertising revenues across the Debtors’ business. Then, as the economy recovered, the Debtors’ industry faced new and intense competition from the rapidly-growing internet and digital advertising industry and the entry of on-demand streaming services, both of which siphoned off the share of advertiser revenues allocated by agencies and brands to broadcast radio. The Debtors have taken various operational steps to stem the negative effect of these trends; among other initiatives, the Debtors have successfully developed emerging platforms including its industry-leading iHeartRadio digital platform and nationally-recognized iHeartRadio-branded live events that are audio and video streamed and televised nationwide."

The company ought to expect these trends to continue.

Large creditors include Cumulus Media Inc. (~$5.6 million...yikes) and Spotify (~$2 million).

- Jurisdiction: S.D. of Texas

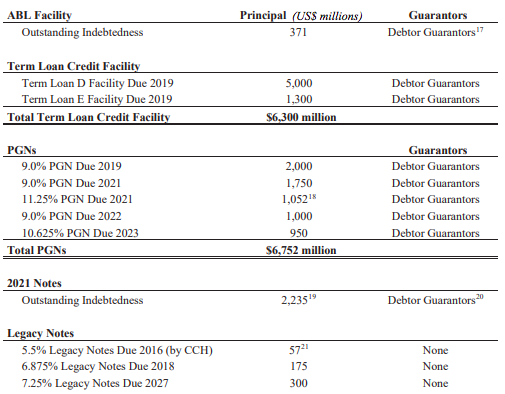

- Capital Structure:

- Company Professionals:

- Legal: Kirkland & Ellis LLP (James Sprayragen, Anup Sathy, Brian Wolfe, William Guerrieri, Christopher Marcus, Stephen Hackney, Richard U.S. Howell, Benjamin Rhode, AnnElyse Gibbons) & Jackson Walker LLP (Patricia Tomasco, Matthew Cavenaugh, Jennifer Wertz)

- Financial Advisor to the Company: Moelis & Co.

- Legal: Latham & Watkins LLP (Caroline Reckler, Matthew Warren)

- Restructuring Advisor to the Company: Alvarez & Marsal LLC

- Legal for the Independent Directors: Munger Tolles & Olson LLP (Kevin Allred, Seth Goldman, Thomas Walper, John Spiegel)

- Financial Advisor to the Independent Directors: Perella Weinberg Partners LP

- Claims Agent: Prime Clerk LLC (*click on company name above for free docket access)

- Other Parties in Interest:

- Large Equity Holders: Bain Capital & Thomas H. Lee Partners

- Legal: Weil Gotshal & Manges LLP (Matthew Barr, Christopher Lopez, Gabriel Morgan)

- Potential Buyer: Liberty Media Corporation & Sirius XM Holdings Inc.

- Legal: Weil Gotshal & Manges LLP (Stephen Karotkin, Ray Schrock, Alfredo Perez)

- Successor Trustee for the 6.875% '18 Senior Notes and 7.25% '27 Senior Notes: Wilmington Savings Fund Society, FSB

- Legal: White & Case LLP (Thomas Lauria, Jason Zakia, Erin Rosenberg, J. Christopher Shore, Harrison Denman, Michele Meises, Mark Franke, Michael Garza) & Pryor Cashman LLP (Seth Lieberman, Patrick Sibley, Matthew Silverman) & (local) Andrews Kurth Kenyon LLP (Robin Russell, Timothy A. Davidson II, Ashley Harper)

- Successor Trustee for the 11.25% '21 Priority Guaranty Notes

- Legal: Kelley Drye & Warren LLP (Eric Wilson, Benjamin Feder, Kristin Elliott)

- Successor Trustee for the 14.00% Senior Notes due 2021

- Legal: Norton Rose Fulbright (US) LLP (Jason Boland, Christy Rivera, Marian Baldwin Fuerst)

- Term Loan/PGN Group

- Legal: Jones Day (Thomas Howley, Bruce Bennett, Joshua Mester)

- Ad Hoc Group of Term Loan Lenders

- Legal: Arnold & Porter Kaye Scholer LLP (Michael Messersmith, Tyler Nurnberg, Sarah Gryll, Christopher Odell, Hannah Sibiski)

- TPG Specialty Lending Inc.

- Legal: Schulte Roth & Zabel LLP (Adam Harris, David Hillman, James Bentley) & (local) Jones Walker LLP (Joseph Bain, Laura Ashley)

- Special Committees of the Board of Clear Channel Outdoor Holdings Inc.

- Legal: Willkie Farr & Gallagher LLP (Matthew Feldman, Paul Shalhoub, Christopher Koenig, Jennifer Jay Hardy)

- Ad Hoc Committee of 14% Senior Noteholders of iHeart Communications

- Legal: Gibson Dunn & Crutcher LLP (Robert Klyman, Matt Williams, Keith Martorana, Matthew Porcelli) & (local) Porter Hedges LLP (John Higgins, Aaron Power, Samuel Spiers)

- 9.00% Priority Guarantee Notes due 2019 Trustee: Wilmington Trust NA

- Legal: Stroock & Stroock & Lavan LLP (Jayme Goldstein, Daniel Fliman, Brian Wells) & (local) Haynes and Boone, LLP (Charles Beckham Jr., Martha Wyrick, Kelsey Zottnick)

- Citibank N.A.

- Legal: Cahill Gordon & Reindel LLP (Joel Levitin, Richard Stieglitz Jr.) & (local) Locke Lord LLP (Berry Spears)

- Delaware Trust Company

- Legal: Quinn Emanuel Urquhart & Sullivan LLP (Benjamin Finestone, K. John Shaffer, Monica Tarazi, Victor Noskov)

- Official Committee of Unsecured Creditors

- Legal: Akin Gump Strauss Hauer & Feld LLP (Ira Dizengoff, Philip Dublin, Naomi Moss, Charles Gibbs, Marty Brimmage)

- Large Equity Holders: Bain Capital & Thomas H. Lee Partners

Updated 3/30/18