Last week was earnings week for investment banks with restructuring groups. Let’s dive in.

1. Evercore Inc. ($EVR) reported its second best year in history, generating over $2.03b in revenue, an eye-popping number. Still, this represented a 2% decline from 2018 — thanks mostly to lower global M&A volumes and transaction count. While, generally speaking, this was a strong quarter, the firm dropped this doozy:

In response to these financial results, we have undertaken an initiative to ensure that our resources are focused on our greatest growth opportunities and that our entire team is performing at the high standards that we and our clients expect. We began this initiative at the end of 2019 by identifying markets, sectors and people that exhibited at productivity below our expectations. We are reducing our commitment to those areas, redeploying personnel where feasible and realigning certain operations to better position the firm for future growth.

In other words, the second best year in history didn’t stop the bank from sh*tcanning a meaningful portion (6%) of its workforce. 😬 The equity market — never one to infuse empathy into its behavior — rewarded the bank with an 11% pop on the news.

What of restructuring?

Demand for restructuring and more broadly debt advisory advice remained elevated as accommodative credit markets are driving higher levels of financial leverage.

Reminder: we are deeeeeeeep into a bull market, folks. To satisfy this demand, EVR appears to be expanding its platform to offer “increasingly more creditor advisory services that can serve our clients both in-court and more frequently out of court.” Ladies and gentlemen, the demarcation between debtor-side shops and creditor-side shops gets blurrier and blurrier. Can’t win a debtor mandate? Just slide on down that beautiful cap stack y’all. Revenue is revenue.

Interestingly, for the second quarter in a row, management suggested that deals are taking longer to complete — and therefore attribute to revenue — due to regulatory reasons, erratic stock markets, and choppy capital markets.

Unfortunately, despite prodding from analysts, management refused to parse out how different segments are faring so we cannot say how EVR’s restructuring group compared to other public competitor firms. Management claims that different teams cross-pollinate deals and so it’s hard to attribute revenue to different advisory segments. Which is an annoying AF explanation but we suppose there’s some logic to it (PETITION Note: we suppose this is the benefit of lawyers having to bill time: they can quantitatively attribute departmental productivity). Still, management declared:

…even though it's a very low default environment there clearly are sectors that have experienced consistent distress, energy, shipping, retail and certainly our backlogs would suggest that there is not going to be a diminution of that in 2020.

Any one betting big on recoveries in the energy and retail sectors ought to heed their friendly banker friends.

*****

2. The problem with EVR’s management’s stance that transactions are hard to separate between various groups is that they can’t then go out to the market and thump their chests like PJT Partners Inc’s ($PJT) Paul Taubman, touting the singular performance of the restructuring team:

Our world-class restructuring franchise maintained its leadership position, ranking No. 1 globally in dollar value of announced and completed restructurings. The business meaningfully exceeded our initial revenue expectations for 2019, powered by substantial growth in U.S. restructuring revenues.

Or...maybe they can? And should? After all, that rah rah rah doesn’t mean much when it isn’t backed up by concrete numbers. In fact, PJT, like EVR, doesn’t delineate restructuring-specific numbers either. 🤔🤔

PJT, as a firm, is a fraction of the size of EVR. Revenues were $718mm for the fiscal year, up 24% versus 2018. These numbers reflect “a meaningfully higher level of activity than...forecast” for restructuring in 2019. And backlog is even higher going into 2020 than it was going into 2019!!

So, to summarize, numbers were good. Thanks to good backlog carrying into ‘19 from ‘18. Go-forward backlog carrying into ‘20 is even stronger than ‘19. Reminder #2: we are deeeeeeeep into a bull market, folks.

*****

3. And then there is Moelis & Company ($MC) and its unbalanced year. The firm reported $224mm in Q4 (down 6% YOY) amidst the strongest second half in firm history. Its first half, however, dragged down full year performance which came in at $747mm, down 17% versus 2018 and just slightly more than PJT. These results stemmed from fewer completed transactions, partially offset by … wait for it … higher average fees on completed transactions (across M&A and restructuring). Here comes some first-class touting:

Our restructuring franchise achieved record revenues for the full year, surpassing last year's peak level of activity. This was the fourth consecutive year of growth reflecting our continued market share gains in the strength of the team. We ended the year as the number one advisor globally and in the US were completed transaction volumes according to Refinitiv and advised on six of the year's top 10 completed restructuring deals globally.

Query given overall performance whether comp reflected these stellar results or whether the failure of the enterprise to grow dragged restructuring folks down? 🤔

Management was a bit unclear on the point. When challenged on a $40mm uptick in comp — an analyst basically asking whether Moelis bankers will win when they win and win when they lose ... to the detriment of shareholders — Mr Moelis responded by saying that the second half was robust and that the market is robust, justifying comp levels (PETITION NOTE: presumably he means both deal-wise and recruitment-wise, necessitating taking care of his people). But he also said the average MD “was down pretty significantly” and that he “did not boost pay.” But he also suggests that franchises that did well in H2 got paid. Was that restructuring? It’s unclear. What is clear is that analysts were flummoxed by this simple fact: revenues ⬇️, banker comp ⬆️. When asked to prognosticate restructuring activity for 2020, here’s what Mr. Moelis offered:

So, I expect our restructuring group to continue to gain market share. It was number one ranked this year. They did a spectacular job. It doesn't feel like the economy is going to give us a spike up there may be small amounts of growth, but we're talking about natural growth of the market just because the size of the market gets bigger, there's so much out there I don't sense a GDP problem that would cause us to have a leapfrog right now, but I expect we'll continue to gain market share.

He continued:

…all I know is sooner or later, the cycle does have a bit of an issue. And there's a lot of paper out there. I think we're in a 1% to 2% default market. We've been that way for five years now. Going back in time, we've always gotten the 3%, 4%. In the 2007, '08 cycle we got into the high-single digits in the fall. So, I know that's going to happen someday, not high, but I think we'll get into mid-single digits in a downturn and it will become a tremendous it will do a tremendous jump. That's a long way of saying, I don't expect anything spectacular out of them this year. Barring an event that I have not foreseen. I think it will just be steady improvement in our market share.

In agreement with EVR, Mr. Moelis also sees continued energy pain in ‘20:

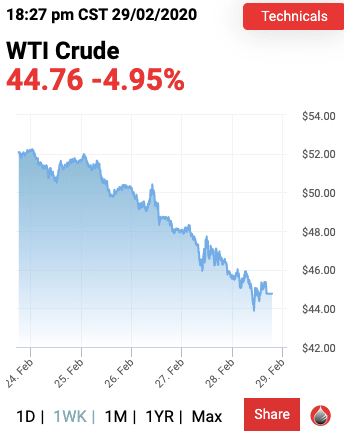

Our last year was a big, big I mean especially oilfield services and I think if oil stays down here around $50, you're going to see a continued March of companies in that sector.

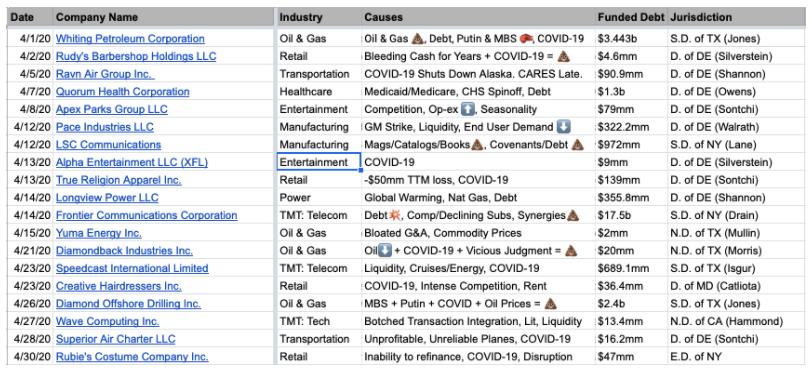

Thus far, 2020 has been chock full of restaurant and grocery bankruptcies. Count on energy stacking up some numbers soon.

*****

4. We’ve noticed that Greenhill & Co. Inc. ($GHL) appears to be upping its game. It had a creditor-side mandate in Clover Technologies Group LLC (prepack filed in Q4 ‘19), and debtor-side mandates in American Commercial Lines Inc. (prepack filed last week) and NPC International Inc., which is likely coming soon to a bankruptcy court near you. It also reported earnings last week and they were mixed: annual revenues of $301mm were down 14% YOY (blamed on industry-wide M&A decline and a softer year in Europe) but its Q4 ‘19 revenue of $106.7mm represented a 20% YOY increase. Is the bank turning around? Its bankers hope so: it sounds like comp may have been a bit disappointing this year.

Restructuring may be playing a part in the performance uptick. CEO Scott Bok noted:

By type of advice, we benefited from significant improvement in restructuring advisory revenue relative to recent years as our recently enlarged team gained increasing traction throughout the year.

And:

In restructuring advisory, we ended 2019 with a much-improved level of monthly retainer fees and a much larger backlog of assignments that should get to completion during 2020. Recent tightening of credit availability and increasing cost for borrowers with weaker credit rating should also be a positive factor for this business.

Backlog, backlog, backlog. It sure seems like every firm is saying the same thing: deal volume is up heading into 2020. Reminder #3: we are deeeeeeeep into a bull market, folks.

*****

5. And, finally, there’s Houlihan Lokey Inc. ($HLI). The firm reported its fiscal Q3 ended 12/31/19, highlighted by a 11.9% revenue increase amounting to a record $334mm, the first time quarterly revenues surpassed $300mm. Year-to-date revenues are $857mm, an 8% increase YOY. Not one to be left out, CEO Scott Beiser also engaged in some chest-pounding, asserting that Houlihan is #1 at…well…basically everything. Which, of course, doesn’t jive with PJT’s report but whatevs. This may just be cherry-picking. Or spin. Or “who the f*ck will actually verify.” Or “if we don’t parse out revenue by segments, how will anyone actually know?” Could be a number of these.

Relating to restructuring, Mr. Beiser said:

Our Financial Restructuring business continues to perform well, despite the current low default environment in the credit markets. Ongoing technology disruptors, changes in consumer buying habits, company mismanagement and over leverage have all contributed to current growth in our Restructuring business without the typical characteristics of a business downturn or higher interest rates.

Did we hear someone say disruption?? Music to our ears.👂👂👂

This bit was interesting as it validates our point earlier about restructuring firms no longer being beholden to traditional roles:

In Financial Restructuring, we continue to experience balance in our business between debtor and creditor work. And, in fact, in fiscal 2019 and fiscal 2020 year-to-date, our debtor revenues and our creditor revenues were pretty evenly split.

And yet most people still think of Houlihan as a creditor-side advisory firm. Just goes to show that there remains an information dislocation out in the marketplace.

We finished here with Houlihan because it is the one firm that actually has no problem delineating its restructuring revenue. All of the other firms duck and dive when asked for specifics, saying that it’s impossible to separate out work flows. Not Houlihan:

Financial Restructuring revenues were very strong this quarter at $93 million, a 24% increase from the same quarter last year, driven by higher transaction volume. We closed 28 transactions in the quarter, compared to 21 transactions in the same period last year. Average transaction fee on closed deals was relatively flat when compared to the same quarter last year.

In other words, Houlihan’s restructuring group did about as much revenue as all of Greenhill.

Again, energy was quite in focus as a huge potential revenue area in 2020. Here’s what Mr. Beiser had to say about that:

…we do see a little bit of a second pickup wave here in the oil and gas arena from a restructuring standpoint. It doesn’t feel like it’s going to necessarily be as big or as lengthy as what we saw before.

But as we’ve always looked at, it’s a combination of what kind of business plans people put together, what kind of financing package they have and what was the duration of that financing package and ultimately, where oil prices are. And all of those are causing some round of some additional conversations and mandates in restructuring. But at this juncture, don’t necessarily think it’s going to be the same size we saw a couple of years ago.

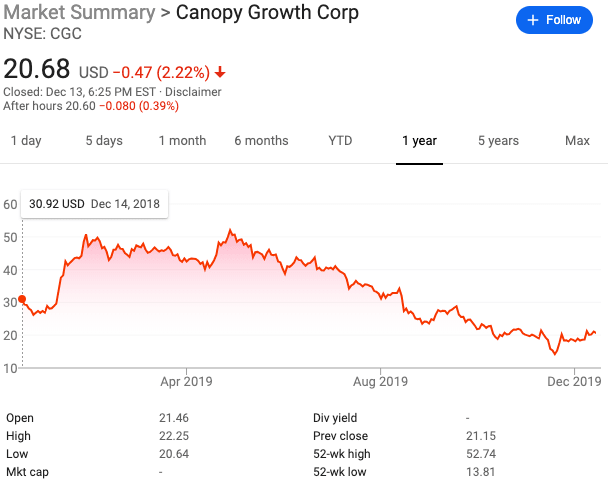

Interestingly benign assessment of what could end up being another bloodbath in energy this year. We think he’s understating the case. Just wait for it: there are a number of companies that either already went into BK back in the 14-17 time frame that are likely to fall back in (or do something out of court, i.e., Key Energy) and/or there are companies that avoided BK via an up-tier exchange of some other sleight-of-hand who can no longer fend off the inevitable — particularly with oil at $50/barrel.