🚛Dump Trucks🚛

Manufacturing, Trucking & the Ports

We’re old enough to remember a narrative that went something like this:

Amazon Inc. ($AMZN) is dominating retail with 2-day (now 1-day) shipping +

Traditional brick-and-mortar retailers are converting to e-commerce +

Digitally-native-vertical-brands are cutting out brick-and-mortar and going direct-to-consumer =

Increased need for logistics and shipping capabilities.

Because of these developments, among others, this country — it was said — was suffering from a trucking shortage relative to the demand and so wages rose rapidly and seemingly every retailer reported that rising shipping expenses were harming the bottom line. Given this, you’d think truckers would be crushing it.

Maybe…not? At least anymore.

In August we noted the following:

ACT research reflects two straight quarters of negative sector growth and DAT reported a 50% decline in spot market loads, with no category immune to the declining trend. Van load-to-truck is down 50%, flatbed load down 74.5% and reefer load down 55.5%. Some fear this may be a leading indicator of recession. Alternatively, it may just be the short-term effects of tariffs and the acceleration of orders into earlier months to avoid them.

Still, the trucking industry is worried.

Van spot rates were down 18.5%, flatbed spot rates down 18.4%% and reefer spot rates down 16.8%. The word “bloodbath” is now being bandied about. Per Business Insider:

“There has been a spate of trucking companies declaring bankruptcy this year, too. The largest was New England Motor Freight, which was No. 19 in its trucking segment. Falcon Transport also shut down this year, abruptly laying off some 550 employees in April.

"We have become increasingly convinced that freight is likely to remain weak through 2019 followed by falling truckload and intermodal contract rates in 2020," the UBS analyst Thomas Wadewitz wrote to investors in a June 18 note.

Trucking's biggest companies have been slashing their outlooks. Knight-Swift and Schneider both cut their annual outlooks earlier this year.”

Will this trend continue as manufacturing numbers continue to slip?

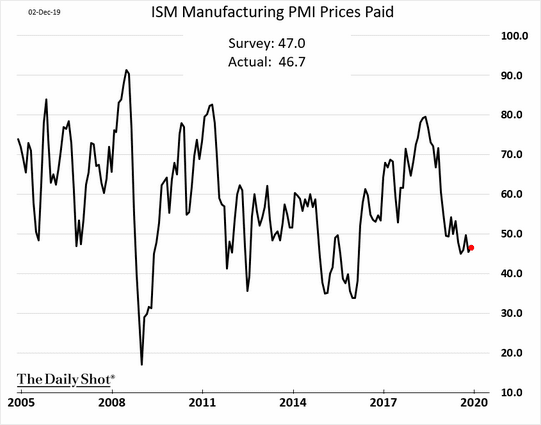

That was a good question. And, indeed, manufacturing does continue to slip — at least according to the ISM Manufacturing PMI report:

With the foregoing context, take some more recent news:

1. Hendrickson Truck Lines Co.

The family-owned trucking company recently filed for bankruptcy in the Eastern District of California (a chapter 22, actually). The company is on the smaller side: liabilities between $10-50mm; roughly 90 trucks and 100 drivers; operations in 10 states. Per FreightWaves:

“The company said its financial problems started in January with a sharp decline in overall freight tonnage. This, combined with excess truck capacity, resulted in a 21% rate drop compared with 2018, resulting in a $400,000 per month revenue drop, according to its petition.

Two of the carrier’s top customers, which accounted for nearly 50% of its business, switched to lower-cost providers, the company said.” (emphasis added)

The company also blamed a poor truck leasing deal for its filing.

2. Truck Orders Are Down

The Wall Street Journal recently reported:

Order books for heavy-duty truck manufacturers are thinning out as a weaker U.S. industrial economy pushes fleet operators to put the brakes on plans to expand freight-carrying capacity.

Trucking companies in November ordered 17,300 Class 8 trucks, the big rigs used in highway transport, according to a preliminary estimate from industry data provider FTR. That was down 39% from November 2018 and a 21% decrease from October, providing a weak start for what is typically the busiest season for new-equipment orders.

The orders last month were the lowest for a November in four years, and analysts said they expect a backlog at factory production lines that has been dwindling this year to pull back even more.

It continued:

Truck-equipment makers have started scaling back production and laying off workers this year as demand for new trucks has weakened.

Daimler Trucks North America LLC said in October it planned to lay off about 900 workers at two North Carolina Freightliner plants as “the market is now clearly returning to normal market levels.”

Engine-maker Cummins Inc. cut its annual revenue forecast in October and the company last month said it plans to lay off about 2,000 workers early next year. “Demand has deteriorated even faster than expected, and we need to adjust to reduce costs,” the Columbus, Ind.-based manufacturer said in a statement.

What’s going on here? Well, yes, manufacturing is down. But “global trade tensions are weighing on transportation demand.” More from the WSJ:

U.S. factory activity contracted in November for the fourth straight month, according to the Institute for Supply Management.

Freight volumes and trucking prices have been on the decline. U.S. domestic freight shipments fell 5.9% in October compared with the same month last year, while truckload linehaul rates were down 2.5% year-over-year, according to Cass Information Systems Inc., which handles freight payments for companies.

🤔

3. Trade, Declining Truck Orders, and Imports (Short the Ports?)

We’re curious: if tariffs and trade wars are trickling down to trucking, what must this mean for ports in this country? Per Transport Topics:

Three West Coast ports saw significant drop-offs in cargo volume last month, the latest indication that the United States’ long-simmering trade dispute with China is impacting operations at the nation’s ports.

The Port of Los Angeles, the nation’s busiest facility, saw a 19.1% decline in 20-foot-equivalent units (TEUs) container volume, moving 770,188 compared with 952,553 in the same period a year ago. Imports and exports were both down 19%. The drop-off also means the Los Angeles port is 90,697 TEUs behind last year’s record pace, having processed 7,861,964 TEUs through the first 10 months, compared with 7,723,159 at this point last year.

Port Executive Director Gene Seroka and other officials were in Washington on Nov. 12, and he is sounding the alarm over the damage being done to the economy because of the ongoing trade battle and the resulting tariffs on hundreds of billions of dollars worth of products.

And this, apparently, isn’t isolated to the West Coast:

Will we start seeing some port distress in the near future? Fewer trucks and fewer trains mean lower revenue. 🤔

4. Celadon Group Files for Bankruptcy

Indianapolis-based Celadon Group Inc. ($CGIPQ) is a truckload freight services provider with a global footprint. Founded in 1985, the company professes to have pioneered the commerce trail between the United States and Mexico. Thereafter, it IPO’d and used the proceeds for growth capital, expanding its freight-forwarding business with the acquisition a UK-based company and another 36 companies thereafter. Not only did these acquisitions expand its geographic footprint, but they also expanded the company’s freight capabilities, opening up revenue possibilities attached to refrigerated and flatbed transportation. In all, today the company operates a fleet of 3300 tractors and 10000 trailers with 3800 employees. Its primary focus continues to be NAFTA countries; its customers include the likes of Lowes Companies Inc. ($LOW), Philip Morris International Inc. ($PM), Walmart Inc. ($WMT), Fiat Chrysler Automobiles NV ($FCAU), Procter & Gamble Inc. (($PG) and Honda Motor Co Ltd. ($HMC).

All of the above notwithstanding, it is now a chapter 11 debtor. Worse yet, it will, in short order, wind down and no longer be in existence. In an instant, the aforementioned 3800 employees’ livelihoods have been thrown into disarray.

Not that the signals weren’t there. The company has been in trouble for some time now. In addition to macro woes, it has a large number of self-inflicted wounds.

Back in July, the company teetered on the brink of bankruptcy but it bought itself a short leash. On July 31, 2019, the company refinanced its term loans held by Bank of America NA ($BAC), Wells Fargo Bank NA ($WFC) and Citizens Bank NA ($CFG) with a new facility agented by Blue Torch Finance LLC* that counted Blue Torch and Luminus Partners Master Fund as lenders.** The new lenders provided $27.9mm of new term loans and, in exchange, received $8mm in original issue discount and fees. The banks, it appears, got out just in the knick of time. Indeed, the company and its lenders have been engaged in an endless stream of negotiations, concessions and waivers ever since: the credit docs have been amended ad nauseam ever since the initial transaction because the company was in constant danger of breaching its covenants.

Why so much drama? Per the company:

“The need to file these chapter 11 cases was a result of a confluence of factors including industry-wide headwinds, former management bad acts, an unsustainable degree of balance sheet leverage and an inability to address significant liquidity constraints through asset sales and other restructuring strategies. In mid-2019, the trucking freight market began to soften. The combination of a decline in overall freight tonnage and excessive truck capacity in the market led to a significant decline in freight rates, and customers began to take bids at lower freight rates. Compared to the year immediately prior, 2019 showed a steady decline in freight rates, including spot freight rates and contractual rates. In addition to declining freight rates, volumes of loads in freight have experienced decreasing numbers for a significant portion of 2019.”

Sound familiar? Well, these issues alone should have been enough to present problems but they were accentuated by the fact that the company’s prior senior management allegedly engaged in some shady a$$ sh*t. That shady a$$ sh*t ultimately led to a Deferred Prosecution Agreement and a $42.2mm fine. While only $5mm has been paid to date, that $37mm overhang is substantial.

With all of these issues piling up, the company ultimately defaulted on its revolver. Consequently, MidCap Financial Trust, the company’s revolver lender, froze lending and the company’s already-growing liquidity problem became a wee bit more problematic. With barely enough money to fund payroll and payroll taxes, the company had no choice but to file for chapter 11. To put an exclamation point on this, the company had merely $400k of cash on hand when it pulled the trigger on bankruptcy.

So what now? The company ceased operations and will commence an orderly wind down of its businesses, preserving only Taylor Express Inc. as a going concern. Taylor Express is a NC-corporation that the company acquired in 2015; it is a dry van and dry bulk for-hire services provider, operating principally for the tire and retail industries and primarily in the South and Southeast regions of the US. To fund the cases, the debtors secured a commitment from Blue Torch for $8.25mm in DIP financing. The DIP mandates that any sale order relating to the liquidating business be entered by January 22.

As for the employees? Well:

Yeah, they’re understandably pissed. For starters, they were laid off en masse with no notice. One employee, on behalf of all employees, filed an Adversary Complaint alleging a violation of the WARN Act, which requires 60 days’ advance written notice of a mass layoff and/or plant closing. In response, the truckers have formed a “Celadon Closure Assistance and Jobs” group on Facebook. It has 1300 members. Per Fast Company,

“Truckers in [a] Facebook group are posting about having 20 minutes to clear out their trucks and go. CBS also reported that some drivers “were stranded when their company gas cards were canceled.”

YIKES. All told, this is a hot mess. Per SupplyChainDive:

“’This is noteworthy because of the size of the fleet,’ Donald Broughton, the principal and managing partner at Broughton Capital, told Supply Chain Dive in an interview. ‘It’s noteworthy because less than 10 years ago Celadon was known as one of the most active, prolific and successful at salvaging small fleets that were struggling and in trouble.’

The failure of Celadon represents the largest trucking failure this year and ‘certainly one of the largest in history,’ Broughton said.”

“Largest [insert industry here] failure” is not an honor that anyone wants.

*Blue Torch Finance LLC was also active in another DLA Piper LLP bankruptcy, PHI Inc., as DIP lender.

**Blue Torch hold a priority right of payment on the term loan collateral with Luminus second and revolver lender, MidCap Financial Trust, third.