🇨🇦Oh Canada (Short Mary Wanna)🇨🇦

If we were to be accused — and we haven’t really — of being too US-centric we would be…well…GUILTY AF. We admit it: we act like snobby Americans — like the rest of the world doesn’t really exist. Shockingly, though, it does. Who knew?😜

One thing that caught our eye recently is the apparent proliferation of cannabis-related distress in Canada — something that, due to federal law limitations, you couldn’t see…at least in court…in the United States.

On December 2nd, an Ontario-based company called AgMedica Bioscience Inc. filed a CCAA proceeding to give itself some breathing room and access much needed DIP capital. The company obtained a $7.5mm DIP credit facility from a Canadian lender, Hillmount Capital Inc., and seeks to use the bankruptcy to restructure several tranches of secured and unsecured debt.

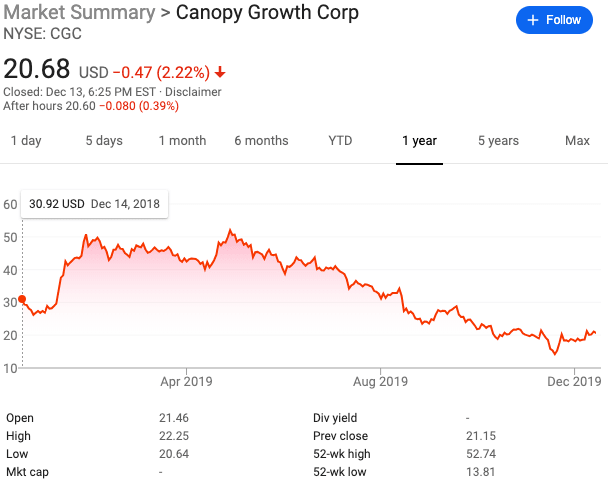

What’s interesting is the timeline. In late 2018, everyone thought cannabis was going to be a 21st century gold rush. Canopy Growth Corporation ($CGC) was reportedly the first federally regulated and licensed cannabis producer to trade on a public exchange in Canada (artfully under the ticker “WEED”) and then went public in the United States in May 2018. The stock opened around $26/share and then rocket-shipped to as high as $52.74. It has since come WAY BACK DOWN TO EARTH and trades here:

Similarly, Tilray Corporation ($TLRY) went public in June 2018, debuting on Nasdaq at $17/share. Here is the chart since then:

TIRED OF SEEING THIS PAYWALL? US TOO, SO CLICK HERE AND GIVE YOURSELF SOME RELIEF (AS WELL AS SOME KICK@$$ INSIGHTS ON EVERYTHING DISRUPTION, DISTRESSED DEBT, AND BANKRUPTCY) BY SUBSCRIBING TO OUR BI-WEEKLY PREMIUM MEMBER’S NEWSLETTER.

DISRUPT YOUR COMPETITION, WITH #PETITION!