💥Forever 81. Million.💥

Forever 21 Gets a Landlord Bailout

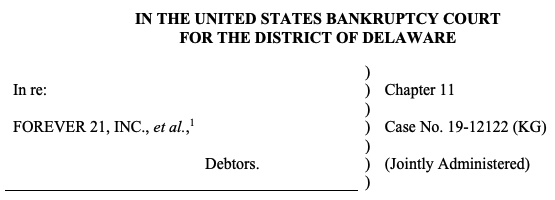

The bid deadline in the Forever 21 Inc. bankruptcy cases has come and gone and, well, the stalking horse bidders — a consortium between Simon Property Group Inc. ($SPG), Brookfield Property Partners LP and Authentic Brands Group LLC — won the day. The debtors filed a “notice of suspended auction” on Sunday that says it all:

The headline purchase price figure therefore remains $81mm for the distressed retailer (though, counting liabilities like costs to cure defaults, etc., the bankers assert the total deal is worth approximately $290mm). As indicated in the image above, the hearing to approve the sale is set for Tuesday, February 11 at 9am in the Delaware bankruptcy court.

This is not a good result for suppliers who claim they’re owed approximately $347mm, many of whom objected to the bid procedures and proposed sale. While they ultimately wrestled a small concession from the debtors/purchasers on the proposed break-up fee, they were otherwise shut out. Now, even that concession is worthless.

These vendors need to realize: virtually all of these retailers who file for bankruptcy are administratively insolvent on day 1. Forever 21 was supposed to be different. It wasn’t.

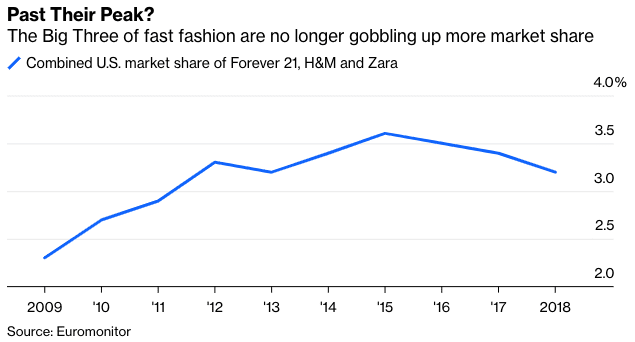

Indeed, in December, Bloomberg reported that the debtors were underperforming heading into the holiday season; that exit financing avenues were foreclosing; and that all hopes of a reorganization via its filed plan were going out the window. Indeed, we later learned that the debtors were in default under their DIP credit facility (heads up, academics). All of this precipitated the pivot to a quick sale.

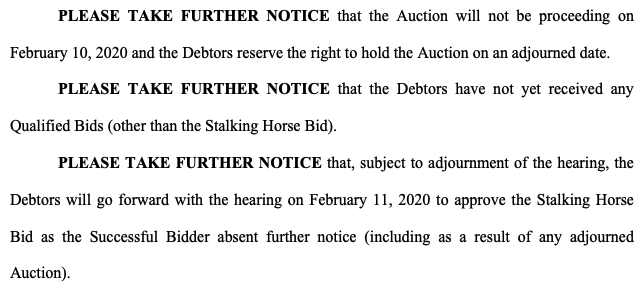

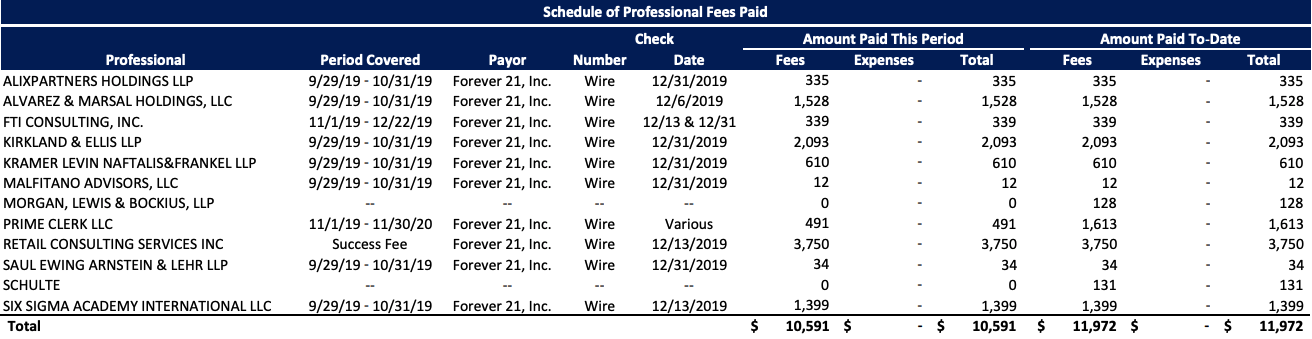

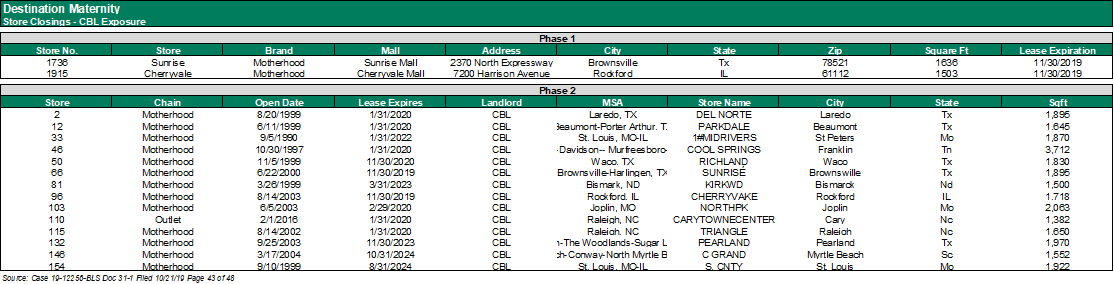

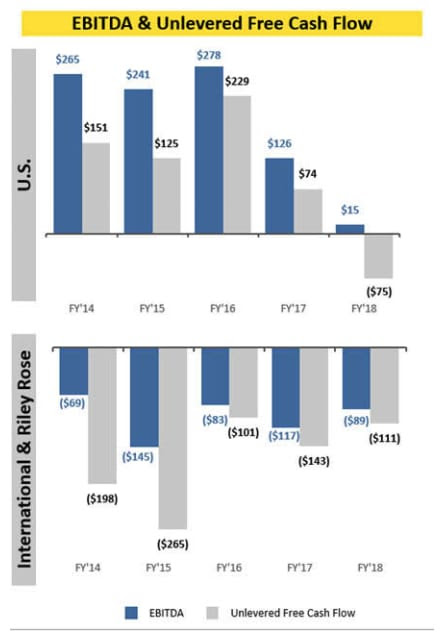

Take a look at the debtors’ operating performance and it’s easier to understand the lender skittishness and strategic pivot. On October 15, 2019, the debtors filed their 13-week DIP budget wherein they projected $722.3mm in total receipts from the petition date through December 21, 2019. Actual receipts, however, totaled only $705.3mm through January 4, 2020. For the math challenged, that’s a $17mm underperformance against budget — EVEN WITH THE BENEFIT OF AN ADDITIONAL TWO WEEKS THAT SUBSUMED THE CRITICAL HOLIDAY SHOPPING PERIOD. This is yet another case where projections didn’t comport with reality: while the projections showed steadily increasing weekly receipts throughout the holiday period, the reality is that people simply didn’t shop at Forever 21 as much as anticipated. Despite millions upon millions of professional fees, this is still a business very much in need of an actual “turnaround” to survive (PETITION Note: the fees reflected below, for the most part, only cover the cases through the end of October).* The high fees further necessitated a quick sale.

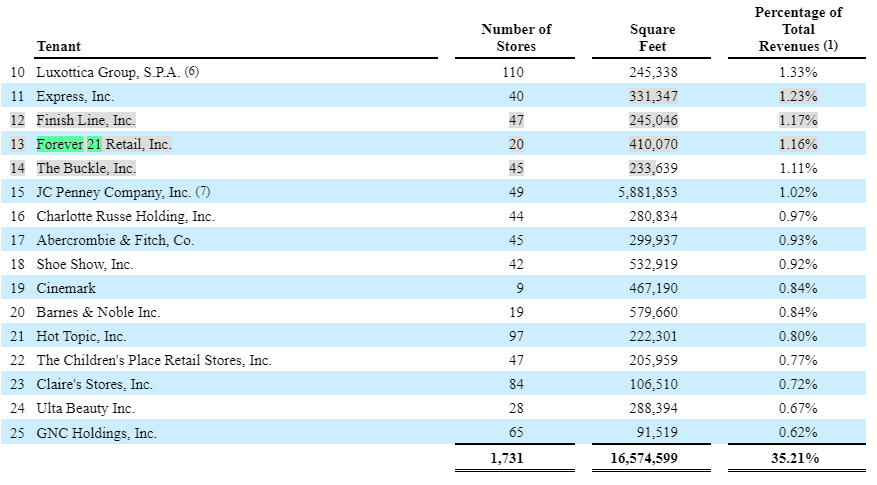

SPG and ABG clearly think they are best positioned to ride out an option here. The purchase price is cheap, and there are other benefits that only, as landlord, SPG can derive (i.e., continued rent, full boxes, less in-line tenant risk, etc.). We’ve seen this movie before and it was called Aeropostale.

Here’s what SPG CEO David Simon had to say last week about Aeropostale:

…our cash investment in Aero OpCo was approximately $25 million. We have already received $13 million of distributions, so I have $12 million of cash invested in Aero OpCo. At the time we bought it, it was producing a negative EBITDA of $100 million and had over 500 stores. Today, today, we expect Aero OpCo to produce EBITDA pre-royalty from 575 stores of approximately $80 million of EBITDA.

We believe Aero is approximately, if you put a market multiple on it $350 million today and our ownership is 50%. 12 to three -- to 50% of $350 million. That's the math.

This was a private equity deal, complete with dividends. Only, unlike private equity firms, SPG has a residual interest in maintaining the AERO enterprise as its success directly contributes to the success of its other tenants. This is PE+.

Of course, SPG also has an investment in ABG. Here’s what Simon said about that:

Now with respect to ABG we invested -- we made a recent investment in it. So we have a total of 600 -- or sorry $67 million in ABG, Authentic Brands Group. At the time of our original investment, which was roughly $33 million, ABG produced EBITDA of approximately $150 million. Today our value is worth $190 million of our $67 million and ABG is expected to produce EBITDA well north of $350 million and the value is growing every day.

This means that, indirectly, SPG also owns Barney’s New York and Nine West, among other brands that have wound their way into bankruptcy courts near you.

With respect to Forever 21, he added:

…we have recently participated with Brookfield and Authentic Brands Group on behalf of the NewCo, SPAR Group, F21, LLC in a stocking horse bid for certain assets and liabilities in a going concern transaction under Section 363 of the Bankruptcy Code. Our Group's successful turnaround of Aero after climbing out of bankruptcy in 2016 gives us confidence with our ability to do the same with Forever 21.

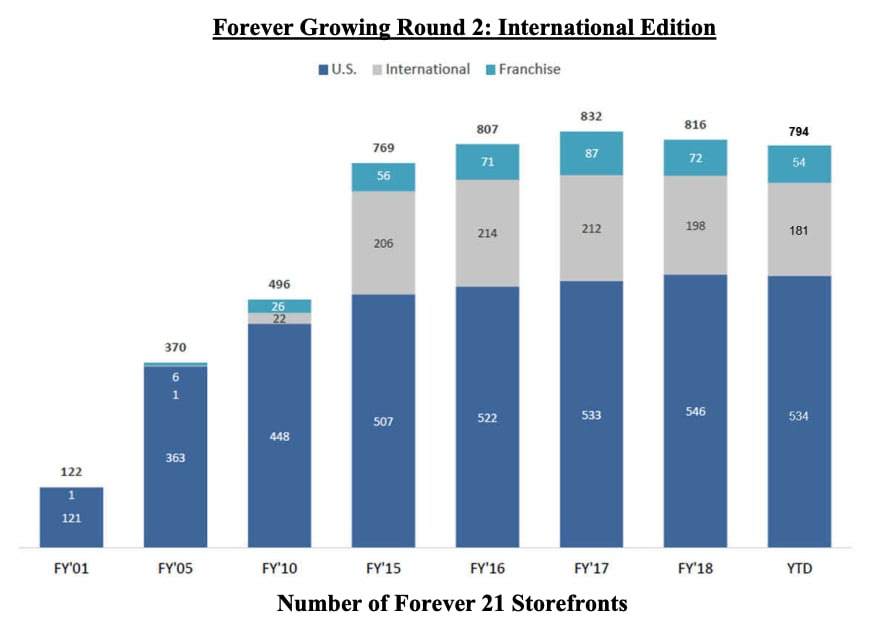

Forever 21 is a storied and well -- widely recognized brand with over $2 billion in global sales. We believe F21 similar to Aero presents a very interesting repositioning opportunity. If the transaction is consummated the newco contemplates the continued operations of many of Forever 21 stores and e-commerce business and maintaining many jobs.

Our interest in the new venture will be approximately 50%. The aggregate purchase price -- acquisition price is approximately $81 million, plus the assumption of certain ongoing operating liabilities.

Again, this is a private equity deal. He continued:

We would not have done Aero and we're -- and we would not be attempting to do Forever 21 for the sole purpose of maintaining our rent. And that's the biggest misnomer out there when I read various publications and analyst notes and media notes. We do it -- we make these investments for the sole purpose of we think there's a return on investment.

Now the fact of the matter is we did all this that Aero and the reality is they kept paying us rent. So that's like -- that's obviously beneficial and I don't want to understate that but that's not why we do it. At the same time with F21, we do think there is a business there, but it's got to be turned around. And I'm not going to project today to you what those numbers are, but we've got our work ahead of us.

But if we are successful in turning around, we will make money at F21 and we'll get paid our rent.

It’s interesting. SPG is beta-testing, in real time, becoming a retail-focused venture and private equity firm. If retail continues to get decimated, we’ll see the extent of their ability to scoop up brands/businesses on the cheap. It seems safe to presume that its portfolio will be larger in a few years than it is now.

*Which is not to say that good work hasn’t been done. As we noted on Twitter here, the debtors, with the help of their advisors, closed 102 stores (creating $91mm of rent relief), reduced operational costs of $100mm, and sold two warehouses for $37mm (the proceeds of which were used to pay down a portion of the DIP credit facility).

Still — and we write this knowing we harp on professional fees a lot — the DIP budget line-itemed $25.1mm for professional fees in the first 13 weeks of the case. According to the most recent operating report, the debtors are already at $11.97mm and that’s really only accounting for the end of October. Query whether 7+ weeks of work topped the budgeted delta of $13.13mm? 🤔