💥Stage Stores Inc: Bankruptcy Soon? (Short Department Stores)💥

In August 2019’s “💥Tariffs Tear into Tech+💥,” we wrote:

We’ve previous noted the gradual unwind of Stage Stores Inc. ($SSI) in November 2018’s “💰Will Crypto Mine Some Bankruptcy Work?💰” “…noting that (a) its off-price business experienced a 9.9% comparable sales increase, alleviating negative 5.5% department store comps somewhat, equating to 2.8% total comp sales declines …,” in January 2019’s “💥A Retail Bloodbath💥,” (“…closing more stores and pivoting more into the discount space, replacing shuttered Goody’s stores with Gordmans locations.”), and in March 2019’s “Thanos Snaps, Retail Disappears👿” (“…closing between 40-60 department stores.”). On March 20, the stock was just barely hovering above penny-status, trading at $1.04/share. After the Trump-tweet/tariff-induced bloodbath on Friday, the stock now sits at $0.78/share.

Thursday was a big day for the company. One one hand, some big mouths leaked to The Wall Street Journal that the company retained Berkeley Research Group to advise on department store operations. That’s certainly not a great sign though it may be a positive that the company is seeking assistance sooner rather than later. On the other hand, the company reported Q2 ‘19 results that were, to some degree, somewhat surprising to the upside. Net sales declined merely $1mm YOY and comp sales were 1.8%, a rare increase that stems the barrage of consecutive quarters of negative turns. Off-price conversions powered 1.5% of the increase. The company reported positive trends in comps, transaction count, average transaction value, private label credit card growth, and SG&A. On the flip side, COGs increased meaningfully, adjusted EBITDA declined $2.1mm YOY and interest expense is on the rise. The company has $324mm of debt. Cash stands at $25mm with $66mm in ABL availability. The company’s net loss was $24mm compared to $17mm last year.

Some of the reported loss is attributable to offensive moves. The company’s inventory increased 5% as the company seeks to avoid peak shipping expense and get out ahead of tariff risk (PETITION Note: see a theme emerging here, folks?). There are also costs associated with location closures: the company will shed 46 more stores.

What’s next? Well, the company raised EBITDA guidance for fiscal ‘19: management is clearly confident that the off-price conversion will continue to drive improvements. No analysts were on the earnings call to challenge the company. Restructuring advisors will surely want to pay attention to see whether management’s optimism is well-placed.

Subsequently, the company issued a January 13 press release that spooked the markets. Interestingly, it reported positive comp sales (+1.4%) for the nine-week period ended 1/4/20. In retail-land these days, a positive comp sales figure is the equivalent of killing it. More compelling, for the 48-week year to date period, comp sales were up 4.2%. The problem? These figures didn’t live up to expectations.

The guidance didn’t help matters either. The company announced:

“In response to the holiday sales performance, we implemented incremental promotional efforts in the fourth quarter to ensure appropriate inventory levels as we enter fiscal 2020. As a result, we now expect full year 2019 earnings to be approximately $25 million to $30 million below the low end of the previously announced guidance range.”

Indeed, it appeared that management’s optimism was, in fact, misplaced.

Which gets us to yesterday’s The Wall Street Journal’s piece, entitled, “Discount Retailer Stage Stores Preps for Possible Bankruptcy.”

The Journal reported:

Stage Stores Inc. is preparing for a financial restructuring that could include a bankruptcy filing as the discount retailer contends with persistent losses at its department store outlets, according to people familiar with the matter.

The publicly listed, Houston-based company has recently been late in paying its vendors amid a liquidity squeeze, the people said.

The company is likely to file for chapter 11, although the situation remains fluid and Stage Stores could complete an out-of-court debt restructuring process, according to the people. (emphasis added)

The highlighted part above is the key, we think. It’s not that the company is stretching vendors per se … that much is fairly typical for companies with liquidity constraints. The question is why? Or more appropriately, who has risk?

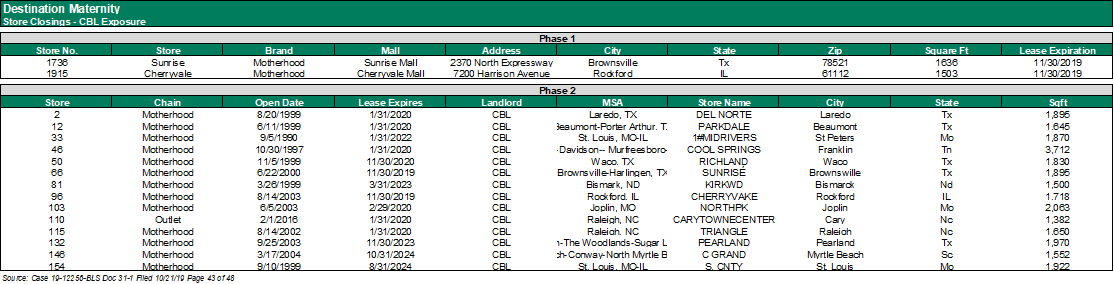

Wells Fargo Bank NA ($WFC) is the company’s administrative agent and primary lender under the company’s asset-based credit facility. Prior to Destination Maternity’s ($DEST) chapter 11 filing, Wells Fargo tightened the screws, instituting reserves against credit availability to de-risk its position. It stands to reason that it is doing the same thing here given the company’s sub-optimal performance and failure to meet projections. Said another way, WFC has had it with retail. Unlike oil and gas lending, there are no pressures here to play ball in the name of “relationship banking” when, at the end of the day, so many of these “relationships” are getting wiped from the earth.