When you’re buying assets at inflated prices/values and levering them up to fund the purchase, what could possibly go wrong?

*****

What really caught our eye is Brown’s statement about medical practices. Ownership there can be direct via outright purchases. Or they can be indirect, through loans. Which, in a rising rate environment, may ultimately turn sour.

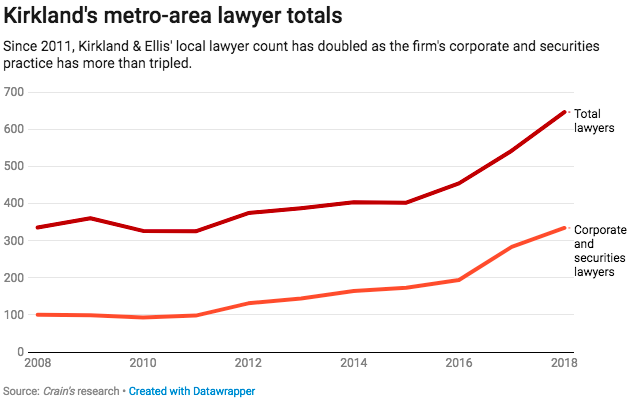

Consider for a moment the recent news that private equity is taking over from and competing with banks in the direct lending business. KKR, Blackstone Group, Carlyle Group, Apollo Global Management LLC and Ares Management LP are all over the space, raising billions of dollars, the latter recently closing a new $10 billion fund in Q2. They’re looking at real estate, infrastructure, insurance, healthcare and hedge funds. Per The Wall Street Journal:

Direct loans are typically floating-rate, meaning they earn more in a rising-rate environment. But borrowers accustomed to low rates may be unprepared for a jump in interest costs on what’s often a big pile of debt. That risk, combined with increasingly lenient terms and the relative inexperience of some direct lenders, could become a bigger issue in a downturn.

Regulators like that banks are wary of lending to companies that don’t meet strict criteria. But they are concerned about what’s happening outside their dominion. Joseph Otting, U.S. Comptroller of the Currency, said earlier this year: “A lot of that risk didn’t go away, it was just displaced outside of the banking industry.”

What happens when the portfolio companies struggle and these loans sour? The private equity fund (or hedge fund, as the case may be) may end up becoming the business’ owner. Take Elements Behavioral Health, for instance. It is the US’s largest independent provider of drug and alcohol addiction treatment. In late July, the bankruptcy court for the District of Delaware approved the sale of it the centers to Project Build Behavioral Health, LLC, which is a investment vehicle established by, among others, prepetition lender BlueMountain Capital Management. In other words, the next time Britney Spears or Lindsay Lohan need rehab, they’ll be paying a hedge fund.

The hedge fund ownership of healthcare treatment centers thing doesn’t appear to have worked out so well in Santa Clara County.

These aren’t one-offs.

Apollo Global Management LLC ($APO) is hoping to buy LifePoint Health Inc. ($LPNT), a hospital operator in approximately 22 states, in a $5.6 billion deal. Per Reuters:

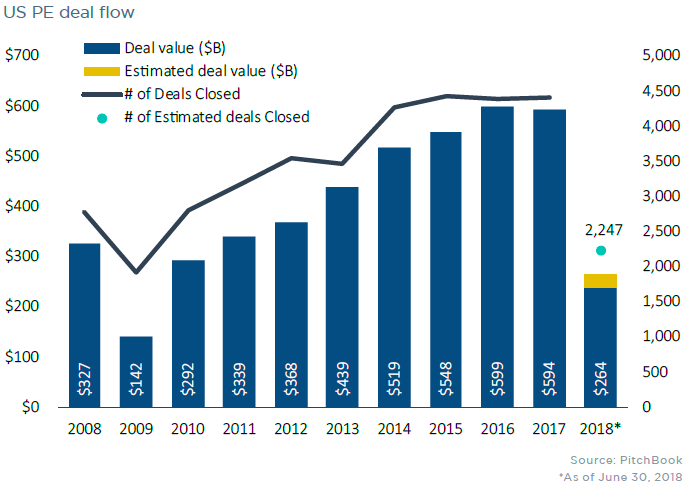

Apollo’s deal - its biggest this year - is the latest in a recent surge of public investments by U.S. private equity, the highest since the 2007-08 global financial crisis.

With a record $1 trillion in cash at their disposal, top private equity names have turned to healthcare. Just last month, KKR and Veritas Capital each snapped up publicly-listed healthcare firms in multi-billion dollar deals.

Indeed, hospital operators are alluring to investors, Cantor Fitzgerald analyst Joseph France said. Because their operations are largely U.S.-based, hospital firms benefit more from lower tax rates than the average U.S. company, and are also more insulated from global trade uncertainties, France said.

Your next hospital visit may be powered by private equity.

How about dentistry? Well, in July, Bloomberg reported KKR & Co’s purchase of Heartland Dental in that “Private Equity is Pouring Money Into a Dental Empire.” It observed:

In April, the private equity powerhouse bought a 58 percent stake that valued Heartland at a rich $2.8 billion, the latest in a series of acquisitions in the industry. Other Wall Street investment firms -- from Leonard Green & Partners to Ares Management -- are also drilling into dentistry to see if they can create their own mega chains.

Here’s a choice quote for you:

"It feels a bit like the gold rush," said Stephen Thorne, chief executive officer of Pacific Dental Services. "Some of these private equity companies think the business is easier than it really is."

Hang on. You’re saying to yourself, “dentistry?” Yes, dentistry. Remember what Brown said: recurring revenue. People are fairly vigilant about their teeth. Well, and one other big thing: yield baby yield!

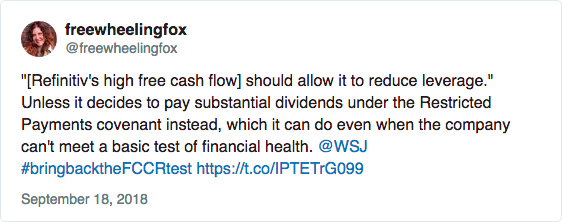

The nitrous oxide fueling the frenzy is credit. Heartland was already a junk-rated company, with debt of 7.4 times earnings before interest, taxes, depreciation and amortization as of last July. KKR’s takeover pushed that to about 7.9, according to Moody’s Investors Service, which considered the company’s leverage levels "very high."

Investors were so hungry that they accepted lenient terms in providing $1 billion of the leveraged loans that back the deal, making investing in the debt even riskier.

Nevermind this aspect:

Corporate dentistry has come under fire at times for pushing unnecessary or expensive procedures. But private equity firms say they’re drawn by efficiencies the chains can bring to individual dental practices, which these days require sophisticated marketing and expensive technology. The overall market for dental services is huge: $73 billion in 2017, according to investment bank Harris Williams & Co. Companies such as Heartland pay the dentists while taking care of everything else, including advertising, staffing and equipment. (emphasis added)

Your next dental exam powered by private equity.

Sadly, the same applies to eyes. Ophthalmology practices have been infiltrated by private equity too.

Your next cataracts surgery powered by private equity.

Don’t get us wrong. Despite the fact that we harp on about private equity all of the time, we do recognize that not all of private equity is bad. Among other positives, PE fills a real societal need, providing liquidity in places that may not otherwise have access to it.

But we want some consistency. To the extent that Congressmen, members of the mainstream media and workers want to bash private equity for its role in Toys R’ Us ultimate liquidation and in the #retailapocalypse generally, they may also want to ask their emergency room doctor, dentist and ophthalmologist who cuts his or her paycheck. And double and triple check whether a recommended procedure is truly necessary to service your eyes and mouth. Or the practice’s balance sheet.