What to Make of the Credit Cycle. Part 14.1. (Long Div Recaps; Long Blackstone; Short Refinitiv)

On Sunday in “What to Make of the Credit Cycle. Part 14. (Long Blackstone; Short Refinitiv),” we provided our colorful take on the fervent (and 2x over-subscribed) demand for the $13.5 billion Thomson Reuters’ Refinitiv loan and bond issuance. Our take was framed from the perspective of the high yield trader and was meant to provide some insight into the machinations that occur behind the scenes at a high yield fund. But what does this deal mean for private equity firms and leveraged buyouts?

Spoiler alert: all good things.

Reuters wrote:

The rousing results are likely to boost secondary pricing and will intensify pressure on primary pricing and other terms and conditions, after investors won a reprieve in the summer from aggressive transactions amid a surge in supply.

The SMi100, an index that tracks the 100 most widely held loans, stands at 98.73, the highest point since February. About 42% of US loans are now trading above par, according to LPC data. Average US high-yield bonds, meanwhile, have rallied sharply over the past couple of weeks to Treasuries plus 325bp, or just 3bp off post-crisis lows, according to ICE BAML data. (emphasis added)

Private equity firms likely smell blood in the water. More from Reuters:

The successes could also herald a more aggressive underwriting era as private equity firms squeeze arranging banks harder, which could open the door to another round of opportunistic repricings, refinancings and dividend recapitalizations that allow sponsors to take advantage of weak documentation.

“The next stuff behind the scenes is going to be punchy,” the global debt head said.

Ah, dividend recapitalizations. We miss those.

Reuters continued:

While the results are undeniably good for private equity firms, they may not be good for investors who are increasingly nervous about aggressive deals as an economic downturn draws closer at the end of an unusually long economic cycle.

With Refinitiv, Akzo and Envision, technical factors – primarily huge demand and a small visible pipeline of deals – overwhelmed any specific credit concerns and fears about aggressive documentation that allow sponsors to extract dividends quickly or make transformative asset sales and acquisitions without investors’ consent.

The three jumbo loans, each of which are capital-stretching, represent half of the forward calendar, which is already looking thinner. Worries about future supply encouraged investors to join the big, liquid deals in droves, particularly as new money carve-outs have previously proved to be particularly profitable.

All of this continues to worry financial regulators who are watching the fervor play out. The Bank of International Settlements recently warned that, per Bloomberg:

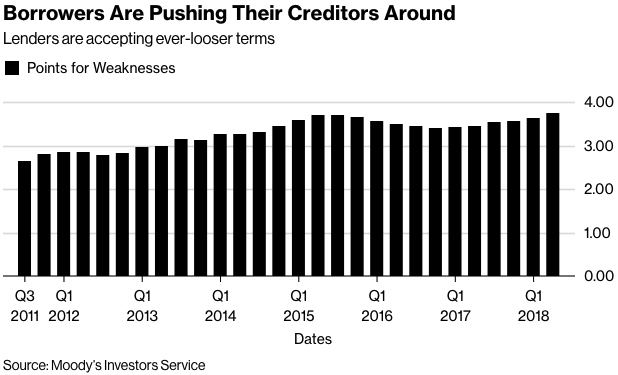

…likely distress among indebted borrowers may spread into the wider economy as central banks raise interest rates. It’s not just the total debt, but the fact that investors seem less and less concerned about protecting themselves against losses, the BIS said.

Yes, indeed. The return of covenant-lite debt has been well documented.

And the borrower-favorable market has been well documented.

“When there’s tons of liquidity, lenders don’t value covenants and they’re willing to lend at very high leverage values,” said Douglas Diamond, a finance professor at the University of Chicago Booth School of Business. “If you get a negative shock after that, you’ve now got a very vulnerable sector. The crisis won’t happen tomorrow but the vulnerability is there.”

The BIS report identified other concerns, including the prospect of fire sales by loan funds if ratings downgrades push some of their investments into junk. Diamond said there’s potential for such leveraged mutual funds to cause havoc.

“The borrowing that they do is usually from a bank,” he said in an interview. “They buy a loan from a bank, they borrow money from the bank to buy the loan from the bank -- not necessarily the same bank. So the risk would ultimately get back to bank balance sheets.”

But high yield mutual funds aren’t the only vehicles driving this meshugas. Don’t forget about CLOs, which, as we discussed in “💥The CLO Market is Going Bananas💥,” are in full-on volume mode. Relating to factors driving demand for borrower-friendly paper, Alexandra Scaggs wrote in Barron’s:

Another is the robust demand for floating-rate debt such as leveraged loans to protect against Federal Reserve rate increases. Funds investing in loans have seen $14.4 billion of inflows this year, according to EPFR, following on $16 billion of inflows in 2017 and $11 billion in 2016. It is not clear the scramble for floating-rate securities will stop any time soon, as the Fed is expected to raise rates four times in the next 12 months, according to Bloomberg data. The demand for loans has also been fueled by the rise of the market for collateralized loan obligations, securitized products that hold pools of loans as collateral and pay their investors the interest collected from those loans in order of tranche quality.

For the uninitiated, here is an excellent recently published primer from S&P Global Ratings on how CLOs function. Pour yourself a cup of coffee and give it a perusal. It’s worth it. CLO dynamics will definitely play into the next cycle.

*****

In a separate segment on Sunday, we snarked about over-the-transom strategic-alternatives pitch deck” and banker boredom. Distressed and high yield investors are, no doubt, equally if not more bored. Aside from Q1, 2018 has been a barren wasteland for restructuring and bankruptcy professionals looking for things to do. Long bitching come bonus time.

But all of this flippant high yield activity has to come home to roost at some point. The question, as always, remains “when?”

PETITION provides analysis and commentary about restructuring and bankruptcy. We discuss disruption, from the vantage point of the disrupted. Get our Members’-only a$$-kicking newsletter by subscribing here.