💥Sycamore Partners is a B.E.A.S.T. Part I.💥

🔥Rinse Wash & Repeat (Long Sycamore Partners)🔥

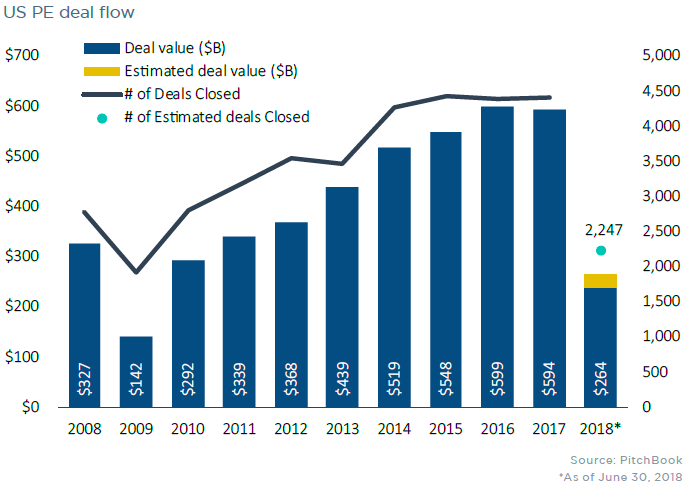

Sycamore Partners is a private equity firm that specializes in retail and consumer investments; it “partner[s] with management teams to improve the operating profitability and strategic value of their businesses.” Back in the summer of 2017, Sycamore Partners acquired Massachusetts-based office retailer Staples Inc. for $6.9b — a premium to the company’s then-trading price but a significant discount from its 2014 high. Your office supplies, powered by private equity! The acquisition occurred shortly after Staples ran afoul of federal regulators who prevented Staples from acquiring Florida-based Office Depot Inc. ($ODP)(which, itself, appears to just trudge along).

Sycamore’s reported thesis revolved around Staples’ delivery unit, a B2B supplier of businesses. Accordingly, per Reuters:

Sycamore will be organizing Staples along three lines: its stronger delivery business, its weaker retail business and its business in Canada, two sources familiar with the deal said. This structure will give Sycamore the option to shed Staples’ retail business in the future, one of the sources said.

The retailer had 1255 US and 304 Canadian stores at the time of the deal. The business reportedly had 48% of the office supply market, generating $889mm of adjusted free cash flow in 2016.

*****

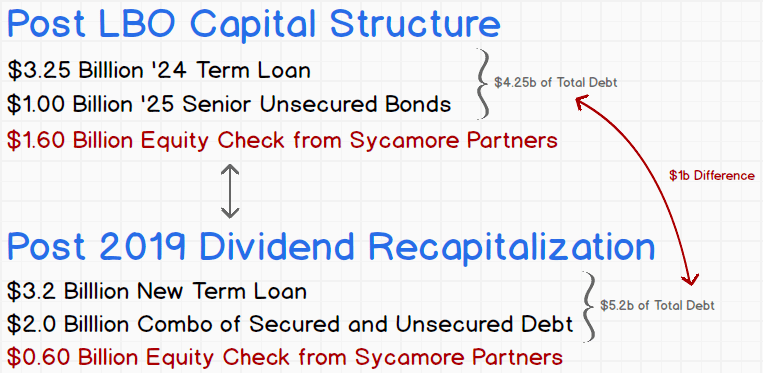

Fast forward 18 months and, Sycamore is already looking to take equity out of the company. According to Bloomberg, the plan is for Staples to issue $5.2b of new debt ($3.2b in term loans and $2b of other secured and unsecured debt), which will be used to take out an existing $3.25b ‘24 term loan and $1b of 8.5% ‘25 unsecured notes (which Sycamore reportedly owns roughly $71mm or 7% of).* This is textbook Sycamore, so much so that it’s actually cliche AF — or as Dan Primack said, “…this sort of myopic greed gives ammunition to private equity’s critics.” Like this guy:

And this gal:

Talk about reputations preceding…

Anyway, here’s what the deal would look like once consummated:

That $1b difference is the equity that Sycamore is taking out of the company. What does the company get in return? F*ck all, that’s what. Zip. Zero. Dan Primack also wrote:

Dividend recaps are a mechanism whereby private equity-owned companies issue new debt, and then hand proceeds over to the private equity firm (as opposed to using it to grow the business). Sometimes they don't matter too much. Sometimes they form leveraged anchors around a company's neck. (emphasis added)

Yup. That about sums it up. Here is Sycamore placing a leveraged anchor on…uh…improving “the strategic value” of Staples:

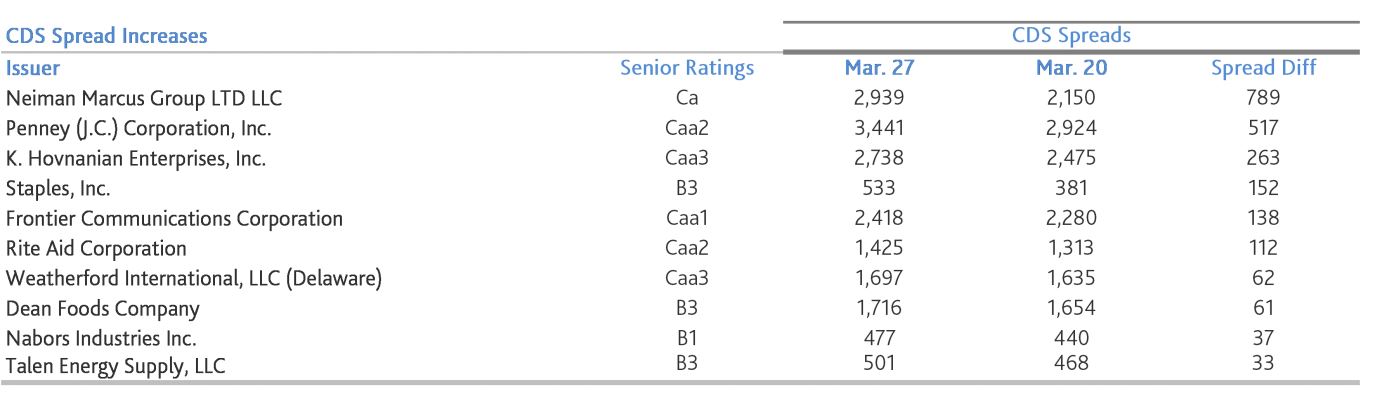

This is the market reacting to Sycamore’s strategy for Staples:

If the above GIF looks familiar, that’s because this is like the Taken series: Sycamore has a very particular set of skills. Skills it has acquired over a very long run. Skills that make them a nightmare for retailers like Staples. They look poised to deploy those particular skills over the course of a repetitive trilogy: the first chapter centered around Aeropostale. And here’s how that ended:

The sequel was Nine West and this is how that ended:

And, well, you get the point. Staples looks like it may be next to experience those very particular skills.

———

Okay, so the above was a bit unfair. In Aeropostale, the company went after Sycamore Partners hard, seeking to ding Sycamore, among others, for equitable subordination and recharacterization of their (secured) claims. Why? Well, Sycamore was not only the company’s term lender (to the tune of $150mm), but it was also a major equity holder with 2 board seats and the majority-owner of Aeropostale’s largest (if not, second largest) merchandise sourcer and supplier, MGF Sourcing Holdings Ltd.

NERD ALERT: for the uninitiated, equitable subordination is an equitable remedy that a bankruptcy court may apply to render justice or right some unfairness alleged by a debtor (or some other party in the shoes of the debtor, if applicable). It is generally VERY DIFFICULT TO WIN on this argument because the burden of proof is on the movant and there are multiple factors and subfactors that the accuser needs to satisfy — because, like, this is the law and so everything has a test, a sub-test, and a sub-sub-test and maybe even a sub-sub-sub-test. Judges love tests, sub-tests, and multi-pronged sub-tests. Three-prongs. Four-prongs. Everywhere a prong prong. Just take our word for it. It’s true.

Recharacterization is another equitable remedy that, if satisfied and granted by the court, would have resulted in Sycamore’s $150mm secured term loan position being reclassified as equity. This is a big deal. This would be like Mike Trout being on the verge of winning the MVP and the World Series AND securing a $350mm 10-year contract only to, on the eve of all of that, get (a) caught partying with R. Kelly til six in the morning with enough PED needles lodged in his butt to kill a team of horses, (b) suspended from baseball, (c) exiled into an early retirement a la Alex Rodriguez or Barry Bonds, and (d) forced into personal bankruptcy like Latrell Sprewell or Antoine Walker. Or, more technically stated, since secured debt is way higher in “absolute priority” than equity, this would instantaneously render Sycamore’s position worthless and juice the potential recovery of unsecured creditors. Then there is the practical side: for this remedy to apply, the bankruptcy court would have to make a “finding” that prong after prong has been satisfied and issue an order saying you’re the shadiest m*therf*cker on the planet because you’re actually dumb and careless enough to have met all of the prongs. So, as you might imagine, this is pretty much the worst case scenario for any secured party in bankruptcy and a career ender for the poor schmo who orchestrated the whole thing.

In Aeropostale, the Debtors argued that Sycamore and its proxy MGF engaged in inequitable conduct prior to Aeropostale’s filing, including (a) breach of contract, (b) “a secret and improper plan to buy Aeropostale at a discount” and (c) improper stock trading while in possession of material non-public information. This one had the added drama of arch enemies Kirkland & Ellis LLP (Sycamore) and Weil Gotshal & Manges LLP (Aeropostale) duking it out to the ego-extreme. Just kidding: this was all about justice! 😜

Anyway, there was a trial with fourteen testifying witnesses over eight presumably PAINFUL days that, in a nutshell, went like this:

WEIL GOTSHAL: “Sycamore are a bunch of conspiratorial PE scumbags who ran this company into the ground, your Honor!”

JUDGE LANE: “Not credible. Good day, sir. I said GOOD DAY!”

KIRKLAND & ELLIS/SYCAMORE:

In the end, Sycamore fared pretty well. They got nearly a full recovery** and releases under the plan of reorganization. Relatively speaking, the company also fared well. It didn’t liquidate.*** Instead, two members of the official committee of unsecured creditors — GGP and Simon Property Group ($SPG)— formed a joint venture with Authentic Brands Group and some liquidators and roughly 5/8 of the stores survived — albeit as a shell of its former self and with heaps of job loss (improved strategic value!!). Sure, millions of dollars were spent pursuing losing claims but that’s exactly the point: when Sycamore is involved, they win**** and others lose.***** The extent of the loss is just a matter of degree.

———

Speaking of degrees, all the while Nine West was lurking in the shadows all like:

WHOA. BOY. THIS ONE WAS A COMPLETE. AND UTTER. NEXT LEVEL. SH*TSHOW.

We’ve discussed Nine West at length in the past. In fact, it won our 2018 Deal of the Year! We suggest you refresh your recollection why (including the links within): it’s worth it. But what was the end result? We’ll discuss that and the (impressively) savage tactics deployed by Sycamore Partners therein in Part II, coming soon to an email inbox near you.

*At the time of this writing, the unsecured bonds last traded at $108.01 according to TRACE. This potentially gives Sycamore the added benefit of booking significant gains on the $71mm of unsecured notes in its portfolio.

**It’s unclear whether Sycamore recovered 100% but given that they got $130mm under the cash collateral order out of an approximately $160mm claim, it’s likely to have been close. Now, they did lose $53mm on AERO stock.

***A f*cking low bar, sure, but still. Have you seen what’s happening in these other retail cases?

****Putting aside nation-wide destruction, hard to blame LPs for investing in the fund. They get returns. Plain and simple. This ain’t ESG investing, people.

*****Sure, Weil “lost” its attempt to nail Kirkland…uh Sycamore…here but they got paid $15.3mm post-petition and $4.4mm pre-petition so that’s probably the best damn consolation prize we’ve ever heard of in the history of mankind. Weil has, to date, also avoided having a chapter 22 and liquidation in its stable of quals so there’s that too. In retail, you have to take the victories where you can get them.

GAIN THAT EXTRA EDGE WITH PETITION, SUBSCRIBE TO OUR KICKA$$ PREMIUM NEWSLETTER HERE.