What to Make of the Credit Cycle. Part 14. Refinitiv Edition.

Long Blackstone. Short Market Timing.

🎶 Sing it with us now: “Yield, baby, yield.” 🎼

Let’s pretend for a second that you’re a trader “sitting on the desk” of a fund with a high yield mandate. Limited partners have given your Portfolio Manager millions upon millions (if not billions) of dollars to get access to — and active management of — high yield debt. They expect your PM and the team to deploy that capital. That’s what you said you’d do when you were out pounding the pavement fundraising. They don’t want to pay you whatever your management fee is for you to simply be sitting in cash, waiting on the sidelines counting your “dry powder.” So when a big issuance goes out to market, you’ve got to make your move. The pressure is on.

The first order of business it to simply make sure that you even get in the room. You’d better be on your game. There’s a lot of appetite for yield these days, so you better be working those phones, dialing up that “left lead” clown you suffered beers with a few weeks back with the hope of getting an opportunity to put in an allocation. You’re dialing and dialing and hoping that he doesn’t remember that your PM passed on — much to your chagrin — the last 4 or 5 looks that clown — let’s call him Krusty — gave you. Fingers crossed.

Your PM is pacing behind you. It’s creeping you out. Angst fills the room. The desk lawyer is running around screaming bloody hell about some covenants or something. Maybe it was a lack thereof. You’re not sure. You don’t care, damn it. Those LPs want that money deployed so you’re damn well gonna deploy it. Forget about covenants. Forget about risk. That lawyer can pound sand. Literally nobody cares. Because you and your team are super savvy. Surely you’ll be able to dump these turds of loans and bonds before the market speaks and the debt trades down. Or before all liquidity dries up. Either way, you’ll get out. You’re sure of it. Market timing is your jam.

You finally get through. Krusty says “what’s your number?” You turn to your PM and without much time to really crunch numbers — after all, the yield, the potential discount, the Euro piece vs. the US piece all keep changing — he shrugs and throws out a hefty number. And then does the Sam Cassell dance. You smile. There’s momentarily silence on the other end. Finally, Krusty says he’ll call you back; he seems wildly unimpressed. Your PM shrinks.

You know this same scene is playing out on trading desks all over Wall Street time and time again when there’s a juicy new issuance.

And so does Blackstone. So does Refinitiv.

This week the high yield universe worked itself into a tizzy as Refinitiv priced and issued $13.5 billion of debt to finance Blackstone’s multi-billion dollar ~55% takeover of Thomson Reuters’ Financial & Risk division. Why is this a big deal? Well, in part, because its a big deal. And the lack of (high yield) supply has led to pent up demand. Pent up demand can lead to some interesting compromises.

On September 8, the International Financing Review wrote:

The debt package is divided into US$8bn of loans and US$5.5bn of high-yield bonds. Those debts, combined with separate payment-in-kind notes (with a 14.5% coupon), will result in annual interest payments of US$880m at current price talk. A separate US$750m revolving credit facility will also need servicing.

“The banks had no choice but to price it attractively and it’ll be interesting to see how it goes,” a loan investor in London said. (emphasis added).

Furthermore,

The deal is being marketed with leverage of 4.25 times secured and 5.25 times unsecured, based on adjusted Ebitda of US$2.5bn, which includes US$650m of cost savings from the business’s reported Ebitda of US$1.9bn.

Wait. Take a step back. Cost savings? What cost savings? Blackstone is claiming that they can take $650mm out of the business thereby driving the leverage ratio down. That’s quite a gamble for investors to take. Particularly combined with loose interpretations of EBITDA and considerable add-backs.

The International Financing Review quoted some investors:

A portfolio manager in London said that he had calculated that leverage for the deal is “nearer six and seven times”.

“It’s very late cycle. I don’t really like it when you see a deal with this order of magnitude of projected cost savings as you really don’t know if and when they will be realised,” he said.

“It will be a bit of a test for the market given the size of the deal. But Blackstone and its partners have a good reputation and deep pockets.”

Moody’s and Fitch put leverage between 6.1x and 7.6x.

Covenant Review was nonplussed about the bond protections. It wrote:

“The notes are being marketed with extremely defective sponsor-style covenants riddled with flaws and loopholes that reflect the worst excesses of covenant erosion over the last two years.”

Tell us how you really feel.

Reuters channeled the ghosts of TXU:

The return of big buyouts to the leveraged finance market has rekindled memories of the 2006 and 2007 bad old days of risky underwriting and excessive debt.

So, in the end, how DID the issuance go?

The Wall Street Journal wrote:

One of the largest-ever sales of speculative-grade debt was completed with ease on Tuesday, a sign of the favorable environment for U.S. borrowers at a time of robust economic growth and strong demand from investors.

The $13.5 billion sale—which a Blackstone Group LP-led investor group is using to acquire a 55% stake in a Thomson Reuters Corp. data business called Refinitiv—comprised $9.25 billion of loans and $4.25 billion of secured and unsecured bonds, with different pieces denominated in U.S. dollars and euros.

Including a $750 million revolving credit line, the bond-and-loan deal amounted to the ninth-largest leveraged financing on record in the U.S. and Europe, and was the fourth-largest since the financial crisis, according to LCD, a unit of S&P Global Market Intelligence.

Said another way, demand was so high for the issuance that — aside from upsizing the loan component by $1.25 billion (with a corresponding bond decrease) and a reduction of future permitted debt incurrence — the company was able to offer bond investors LOWER interest rates at par, despite the fact that both Moody’s and S&P Global Ratings rated the issuance near the bottom of the ratings spectrum. Read: thanks to fervent demand, the banks were able to price a wee bit less aggressively than originally planned. That includes the loans: the company was also able to decrease the original guided discount (“OID”) for investors.

Per Bloomberg, orders…

“…total[ed] double the $13.5 billion of bonds and loans it needed to raise. The scale of the response was spurred on by a ravenous bid from collateralized loan obligations and other investors amid fears that there may be fewer new deals going into the fourth quarter."

🎶 One more time: “Yield, baby, yield.” 🎼

So here you had a 2x over-subscription despite some troubling characteristics:

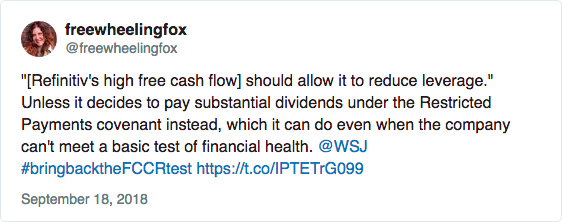

High leverage wasn’t the only way Refinitiv has tested investors. Under the proposed terms of its bonds, the company could pay dividends to its owners even if it came under severe financial distress, a provision that the research firm Covenant Review described as “wildly off market.”

Back to International Financing Review quoting a high yield investor:

“It got to the point where the only thing I liked about the (Refinitiv) deal was the yield. And I’ve learned after 25 years in this business, that’s not enough.”

Among his concerns were business challenges that the Refinitiv business has already faced from competitors like Bloomberg and FactSet. But Blackstone’s ambitious cost-savings target also made him leery.

“When you look at the investment thesis of the sponsor, it’s very much about achieving cost synergies,” said the investor.

“The synergies they forecast are based on their story that they know how to do this better as sponsors than the corporate parent.”

Reasonable minds can debate the merits and reality of sponsor-driven cost “synergies.” But let’s be honest. Nobody is investing in this capital structure because they are whole-hearted endorsers of the Blackstone-promulgated cost-reduction narrative.

“Among the rationales for investors is confidence in the economy - it’s looking good right now, it’s looking good next year, and the belief that they can sell before the quality of the debt deteriorates,” Christina Padgett, a senior vice-president at Moody’s, told IFR.

In other words, market timing is their jam.