Cracks in Malls Grow Deeper (Long Thanos, Short CMBS)

Retail Carnage Continues Unabated (R.I.P. Payless, Gymboree, Charlotte Russe & Shopko)

Talk of retail’s demise is so pervasive that the casual consumer may be immune to it at this point. Yeah, yeah, stores are closing and e-commerce is taking a greater share of the retail pie but what of it?

Well, it just keeps getting worse.

Consider 2019 alone. The Payless ShoeSource, Gymboree, Charlotte Russe, Shopko, and Samuels Jewelers* liquidations constitute thousands of stores evaporated from existence. It’s like Thanos came to Earth and snapped his fingers and — POOF! — a good portion of America’s sh*tty unnecessary retail dissipated into dust. Tack on bankruptcy-related closures for Things Remembered, Beauty Brands and Diesel Brands USA Inc. and you’re up to over 4,300 stores that have peaced out.

That, suffice it to say, would be horrific enough on its own. But “healthy” (read: non-bankrupt) retailers have only added to the #retailapocalypse. Newell Brands Inc. ($NWL)is closing 100 of its Yankee Candle locations to focus on “more profitable” distribution channels. Gap Inc. ($GPS) announced it is closing 230 of its more unprofitable locations and spinning Old Navy out into its own separate company — the good ol’ “good retail, bad retail” spinoff. Chico’s FAS Inc. ($CHS) is closing 250 stores. Stage Stores Inc. ($SSI) — which purchased once-bankruptcy Gordmans — is closing between 40-60 department stores. Kitchen Collection ($HBB) is closing 25-30 stores. E.L.F. Beauty ($ELF) is closing all 22 of its locations. Abercrombie & Fitch Co. ($ANF)? Yup, closing stores. Up to 40 of them. GNC Inc. ($GNC) intends to close hundreds more stores over the next three years. Foot Locker Inc. ($FL)? Despite a strong earnings report, it is closing a net 85 stores. J.C. Penney Inc. ($JCP)…well…it didn’t report strong earnings and, not-so-shockingly, it, too, is closing approximately 27 stores this year. Victoria’s Secret ($LB)? 53 stores. Signet Jewelers Ltd. ($SIG)? Mmmm hmmm…it’s been closing its Zales and Kay Jewelers stores for years and will continue to do so. As we noted on Sunday, The Children’s Place Inc. ($PLCE) also intends to close 40-45 stores this year. Build-A-Bear Workshop Inc. ($BBW) will close 30 stores over the next two years. Ascena Retail Group Inc. ($ASNA) recently reported and disclosed that it had closed 110 stores (2% of its MASSIVE footprint) in the last quarter. Even the creepy-a$$ dolls at American Girl aren’t moving off the shelves fast enough: Mattel Inc. ($MAT) indicated that it needs to rationalize its retail footprint. There’s nothing Wonder Woman — or even a nightmare-inducing American Girl version of Wonder Woman — can do to prevent all of this carnage.

As a cherry on top, EVEN FRIKKEN AMAZON INC. ($AMZN) IS CLOSING ALL 87 OF ITS POP-UP SHOPS! Alas, The Financial Times pinned the total store closure number for 2019 alone at 4,800 stores (and just wait until Pier 1 hits). Attached to that, of course, is job loss at a pretty solid clip:

All of this begs the question: if there are so many store closures, are the landlords feeling it?

In part, surprisingly, the number appears to be ‘no.’ Per the FT:

“Investors in mall debt have also shown little sign of worry. The so-called CMBX 6 index — which tracks the performance of securitised commercial property loans with a concentration in retail — is up 4.4 per cent for 2019.”

Yet, in pockets, the answer also appears to be increasingly ‘maybe?’

For example, take a look at CBL & Associates Properties Inc. ($CBL) — a REIT that has exposure to a number of the names delineated above.

On its February 8th earnings call, the company stated:

“We are pleased to deliver results in line with expectations set forth at the beginning of the year notwithstanding the challenges that materialized.”

Translation: “we are pleased to merely fall in line with rock bottom expectations given all of the challenges that materialized and could have made sh*t FAR FAR WORSE.”

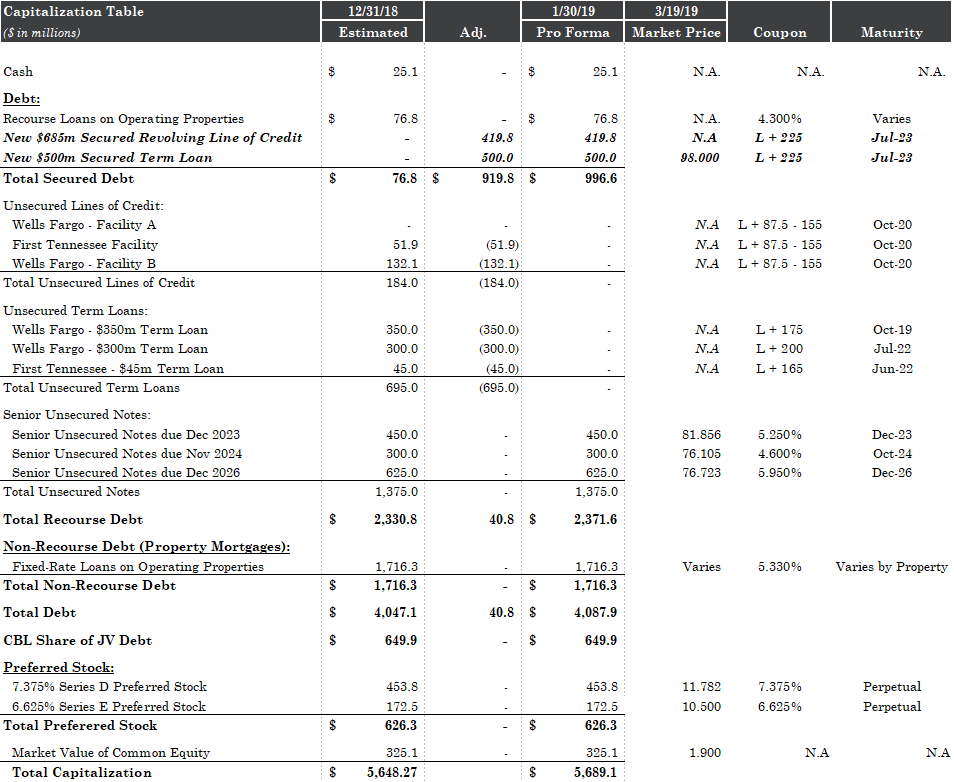

The company reported a 4.4% net operating income decline for the quarter and a 6% same-center net operating income decline for the year. The company is performing triage and eliminating short-term pressure: it secured a new $1.185b ‘23 secured revolver and term loan with 16 banks as part of the syndicate (nothing like spreading the risk) to refinance out unsecured debt (encumbering the majority of its ‘A Mall’ properties and priming the rest of its capital structure in the process); it completed $100mm of gross dispositions plus another $160mm in “sales” of its Cary Towne Center and Acadiana Mall; it reduced its dividend (which, for investors in REITs, is a huge slap in the face); and it also engaged in “effective management of expenses” which means that they’re taking costs out of the business to make the bottom line look prettier.

Given the current state of affairs, triage should continue to remain a focus:

“Between the bankruptcy filings of Bon-Ton and Sears, we have more than 40 anchor closures.”

“…rent loss from anchor closures as well as rent reductions and store closures related to bankrupt or struggling shop tenants is having a significant near-term impact to our income stream.”

They went on further to say:

“Bankruptcy-related store closures impacted fourth quarter mall occupancy by approximately 70 basis points or 128,000 square feet. Occupancy for the first quarter will be impacted by a few recent bankruptcy filings. Gymboree announced liquidation of their namesake brand and Crazy 8 stores. We have approximately 45 locations with 106,000 square feet closing.”

Wait. It keeps going:

“We also have 13 Charlotte Russe stores that will close as part of their filing earlier this month, representing 82,000 square feet.”

Earlier this week, Things Remembered filed. We anticipate closing most of their 32 locations in our portfolio comprising approximately 39,000 square feet.”

And yet occupancy is rising. The quality of the occupancy, however — on an average rental basis — is on the decline. The company indicated that new and renewal leases averaged a rent decline of 9.1%. With respect to this, the company states:

As we've seen throughout the years, certain retailers with persistent sales declines have pressured renewal spreads. We had 17 Ascena deals and 2 deals with Express this quarter that contributed 550 basis points to the overall decline on renewal leases. We anticipate negative spreads in the near term but are optimistic that the positive sales trends in 2018 will lead to improved lease negotiations with this year.

Ahhhhh…more misplaced optimism in retail (callback to this bit about Leslie Wexner). As a counter-balance, however, there is some level of realism at play here: the company reserved $15mm for losses due to store closures and co-tenancy effects on company NOI. In the meantime, it is filling in empty space with amusement attractions (e.g., Dave & Buster’s Entertainment Inc. ($PLAY), movie theaters, Dick’s Sporting Goods Inc ($DKS) locations, restaurants, office space and hotels. Sh*t…given the amount of specialty movie theaters allegedly going into all of these emptying malls, America is going to need all of those additional gyms to work off that popcorn (and diabetes). Get ready for those future First Day Declarations that delineate that, per capita, America is over-gym’d and over-theatered. It’s coming: it stretches credulity that the solution to every emptying mall is Equinox and AMC Entertainment Holdings Inc. ($AMC). But we digress.

All of these factors — the average rent decline, the empty square footage, etc. — are especially relevant considering the company’s capital structure and could, ultimately, challenge compliance with debt covenants. Net debt-to-EBITDA was 7.3x compared with 6.7x at year-end 2017. Here is the capital structure and the respective market prices (as of March 19):

The new Senior secured term loan due ‘23:

The Senior unsecured notes due ‘23:

The notes due ‘24:

The notes due ‘26:

Additionally, the company is trying to promote how flexible it is with its ability to pay down debt and invest in redevelopment properties. Here is a snippet of the company presentation that displays the debt covenants on its revolver, term loan and other unsecured recourse debt:

What is the real value of the mall assets that are left unencumbered? Recently, the Company has been slowly impairing a number of its assets and many of the Company’s tier 2 and 3 malls have yet to be revalued. If appraisers lower the value of these assets that are really supposed to be supporting the debt, what then?

And that doesn’t even take into consideration the co-tenancy clauses. As anchor tenants fall like flies, you’ll potentially see a rush to the exits as retailers with four-wall sales that don’t justify rents (and rising wages) exercise their rights.

So, given all of above, does the market share management’s (misplaced) optimism?

J.P. Morgan’s Michael W. Mueller wrote in a February 7, 2019 equity research report:

"While commentary in the earnings release noted some sequential improvement in 4Q results, we still see it being a grind for the company over the near to intermediate term."

BTIG’s James Sullivan added on February 20, 2019:

"We see no near-term solution for the owners of more marginal “B” assets like CBL & Associates. Sales productivity for such portfolios has shown little growth over the last eight quarters in contrast to the better-positioned “A” portfolios."

"The recent re-financing provides CBL with some near-term liquidity but limits future access to the mortgage market as only a small number of readily “bankable” assets remain unencumbered."

“We expect the challenging conditions in the industry to continue to create pressure on the operating metrics of mall portfolios with average sales productivity of less than $400/foot. More anchor closures are likely and in-line tenants are also likely to manage their brick-and-mortar exposure aggressively and close marginal locations. We reiterate our Sell rating and $2 price target.”

“With overall flat sales productivity in the portfolio, there is limited evidence that a turnaround in performance is likely in the next 24 months. Instead, we expect continued declines in SSNOI with negative leasing spreads and lower operating cost recovery rates.”

“CBL’s new facility which totals $1.185B is secured and replaces a series of unsecured term loans and a line of credit. Collateral includes 20 assets, of which three are Tier 1 Malls, 14 are Tier 2 Malls, and three are Associated Centers. As a result, CBL now has a much smaller number of unencumbered malls.”

“There are no unencumbered Tier 1 Malls (Sales exceeding $375/foot). There are nine unencumbered Tier 2 Malls (sales $300 -$375/foot) and those malls averaged $337/foot in 2017. The 2018 data is not available yet, but sales/foot for Tier 2 assets in 2018 declined by an average $5/foot. So assuming the law of averages applies, the average productivity of the unencumbered Tier 2 assets is $332/foot. Malls with that level of productivity cannot be financed in the CMBS market per CBL management.”

“With limited access to financing using their unencumbered malls, CBL has to look to its available capacity on its new line of credit, $265m, and projected free cash flow after paying its dividends, we estimate, of $155m in 2019 and $135m in 2020. CBL is currently estimating an annual capital requirement of $75m - $125m to redevelop closed anchor boxes. The per box range is $7m - $10m which we believe is low compared to peers whose cost per unit is closer to $17m. So CBL faces dwindling capital sources at the same time that its portfolio is suffering significant quarterly drops in SSNOI.”

Apropos, the shorts are getting aggressive on the name:

The historical stock chart is ugly AF:

Which brings us to commercial mortgage-backed securities (CMBS) — derivative instruments comprised of loans on commercial properties. Canyon Partners’ Co-Chairman and co-CEO Joshua Friedman is shorting the sh*t out of mall-focused CMBS (containing among many other things, CBL properties) via a well known CDS index: the Markit CMBX.BBB- (and lower Indices) — to the tune of approximately $1b (out of $25b AUM). This is the mall-equivalent of the big short, except for commercial real estate. 🤔🤔

Here is a CMBX primer for anyone who wants to nerd out to the extreme. Choice bit:

CMBX allows investors to short CMBS credit risk across a wide array of vintages and credit ratings. Shorting individual cash bonds is difficult and rarely done, with the exception of a few very liquid names. The market for cusip level CMBS CDS used to exist, but the liquidity proved very poor and it was quickly replaced by trading of the synthetic indices.

And here is some color on what Mr. Friedman said regarding his trade:

Wowzers. Just imagine what happens to retail — including the malls — when the noise gets even louder.

*Samuels Jewelers filed chapter 11 last year but announced liquidation this year after failing to secure a buyer for its assets.