Mostly Non-Black-Friday Retail Report (Macy's, J.Crew, Signet Jewelers)

A Week of Nonstop Retail

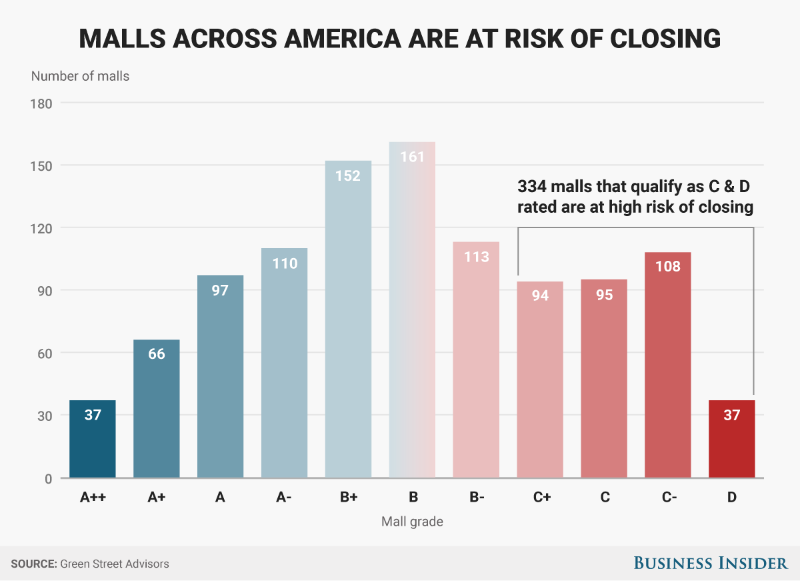

Don't worry: Macy's ($M) has a plan (must read) and it includes finally trying to address what competitors - not just Amazon ($AMZN) - have been doing for, literally, decades. Of course, maybe, just maybe, the first part of their plan should be to make sure they're able to collect payment from their customers. But, we're not #BlackFriday experts. Anyway, thanks, millennials, you're killing the mall-based low-cost jewelry sellers. This week, Signet Jewelers ($SIG) reported dogsh*t numbers with same-store sales down 5% and downward-adjusted guidance for 2018. J.Crew Group Inc. = 💩💩💩. The company reported revenue down 5%, and aggregate comp sales down 9% (JCrew down 12%, but Madewell up 13%); it reported an all-in $17.6mm net loss (driven, in part, by its restructuring efforts...FEES!). The company also announced plans to close more stores for a total '17 tally of 50 closures. Elsewhere, people are concerned about derivative effects of big box retail: here, what happens to Salvation Army? Finally, happy 10 year anniversary Circuit City.