Bloomberg Finds Chapter 22s "Enticing"

Ah, Poor Headlines...

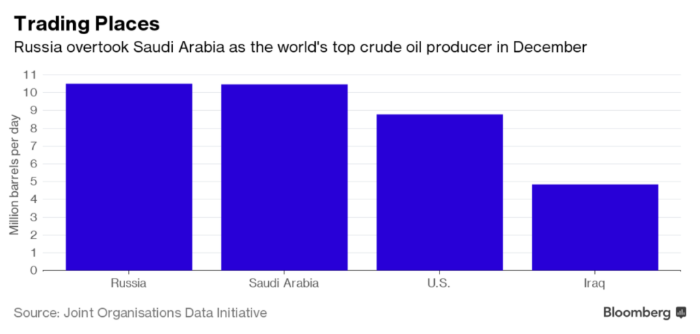

Bloomberg is getting a little lax here with this headline, "Filing 'Chapter 22' Becomes Enticing Option for Ailing Retailers." We get what they're TRYING to say here which is that restructuring retail right now is really tough. And that a number of retailers, e.g., Wet Seal, American Apparel, General Wireless & Eastern Outfitters, have filed for bankruptcy twice in a short time span. Get it? Chapter 11 + Chapter 11 = Chapter 22. So creative these restructuring folk. Anyway, we've highlighted this issue too (see "Rewind II" here). But to suggest that filing a 22 is "enticing" is a bit of a stretch, yeah? All four of those businesses are effectively gone now and a lot of investor money was lost along the way: not much "enticing" about any of that. But they make tons of money and we do a free newsletter so what the hell do we know? P.S. the article short-changed the industry-agnostic, cough, appeal, of a chapter 22: it neglected to mention Venoco LLC and the possibility of a few solid oil and gas 22s to come.