🇺🇸Forever 21: Living the (American) Dream🇺🇸

Back in June we kicked off coverage of Forever 21 Inc. with “💥Nothing in Retail is "Forever💥".

We then issued quick follow-ups in “💥Fast Forward: Forever21 is a Hot Mess💥” and “🍩Forever21 is Forever F*cking Up.🍩”

Forgive us, then, for feeling like the company’s inevitable bankruptcy filing — which happened earlier this week — was a wee bit anticlimactic. After all, we all knew it was coming. As such, we felt the need to crank up some Kanye West to help get us through this additional coverage…

What you doing in the club on a Thursday?

She say she only here for her girl birthday

They ordered champagne but still look thirsty

Rock Forever 21 but just turned thirty — Kanye West in “Bound 2”

Just kidding, y’all. Kanye is garbage. We don’t listen to Kanye.*

Anyway, we’ve talked time and time again about how the papers that accompany a company’s chapter 11 bankruptcy petition are a perfect opportunity for a company to frame the narrative for the judge, parties in interest, the media and more. A company’s First Day Declaration, in particular, is the bankruptcy equivalent of home field advantage. Coupled with the first day hearing — usually held within a day or two of the bankruptcy filing — a debtor can leverage the First Day Declaration and the opportunity to present first to a courtroom to gain some sympathy from the judge for their current predicament and plant the seeds in the judge’s ears as to the direction of the case.

Except, over time, the judges must begin to get bored. After all, repetitive themes begin to emerge when you track bankruptcy cases. Themes like “the retail apocalypse.” Blah blah blah. The “Amazon Effect.” Oh, f*ck off. Disruption overcame the business! Zzzzzzz. Private equity is evil because they dividended themselves all of the company’s value! Yawn. There’s too much debt on the balance sheet! Typical. The lenders won’t play ball! Mmmm hmmm. The prior management was corrupt AF. Yup, it happens. Weather this year was uncharacteristically bad. Riiiight…that’s retail excuse-making 101.

And, so, it was with great excitement that we read that the Forever 21 bankruptcy stemmed from…wait for it…the American Dream. That’s right, the American Dream.

In other words, this is a story about unbridled ambition and optimism.

*****

Here’s the short version: two immigrants came to this country in the early 80s from South Korea. They had nothing; they worked hard; they sought out opportunity:

During his time as a gas station attendant, Mr. Chang took notice of the customers that drove the most luxurious cars—the customers working in the garment industry. This realization piqued Mr. Chang’s interest. He recognized that together with his wife, they were perfectly suited to enter the fashion industry. This would enable the couple to capitalize on Mr. Chang’s relationship-building prowess and Mrs. Chang’s keen sense of fashion.

Putting aside how shady the notion of your gas station attendant creeping on you is, this is pretty amazing sh*t.

Mrs. Chang, and her nearly-clairvoyant ability to predict trends, were part of the catalyst that boosted Forever 21’s upswing.

Take note, people: this is the kind of pandering you should get when you pay $1,600/hour.

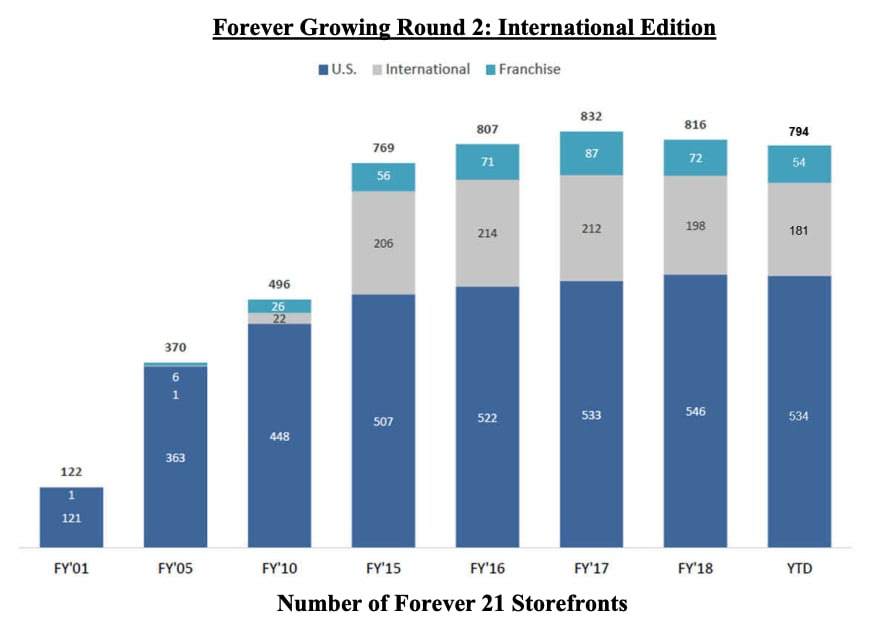

Anyway, over the years, the Changs built a business that employed tens of thousands of people and generated billions in sales. The Changs put their two daughters through ivy league schools and they subsequently joined the family business. This is a beautiful story, folks. Especially so in today’s fraught political environment where immigration remains a hot button issue. Together, as a family, the Changs grew this company to be a behemoth:

And therein lies the rub. The company went from 7 international stores in 2005 to 251 by 2015.

Unfortunately, this rapid international expansion challenged Forever 21’s single supply chain and the styles failed to resonate over time across other continents despite its initial success.

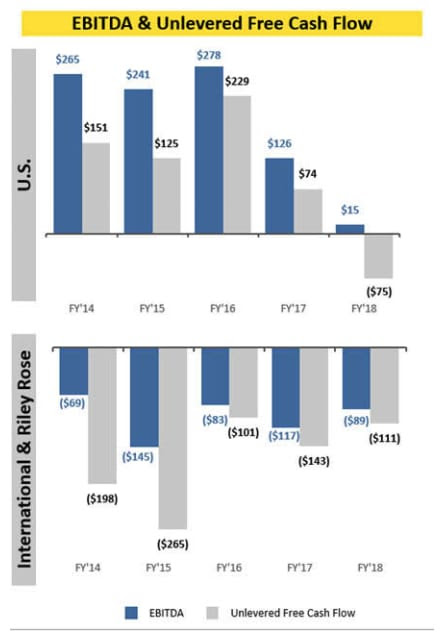

It appears that the same entrepreneurial spirit that allowed the Changs to conquer the US led them astray internationally. Indeed, those European and Asian adventures — and the Chang daughters’ vanity project, Riley Rose — proved to be too costly. As you can see, while the domestic business has been in decline,** it still shows some promise. The international business, on the other hand, has really sucked the air out of the business⬇️.

Sure, aside from the international issue, some of the usual excuses exist. Mall traffic is down. Not enough attention to e-commerce. Product assortment could have been better. The company had borrowing base issues under its asset-backed loan. Yada yada yada. But this doesn’t appear to be the absolute train wreck that other recent retailers have been. At least not yet.

So what now?

At the first day hearing, company counsel spared us any in-court singing,*** but did rely on some not-particularly-complex imagery. He said the company’s predicament is like a puzzle and that, to paraphrase, you sometimes just need to get all of the pieces to fit.

Those pieces are:

The Footprint. Right-sizing the business by shuttering underperforming locations, domestically and internationally. The company currently spends $450mm in annual rent, spread across 12.2mm total square feet. The company will close 178 stores in the US and 350 in total. In other words, the company is mostly erasing its overzealous expansion; it will focus on selling cheaply made crap to Americans and our southern friends down in Latin America rather than poisoning the clothes racks in Canada, Europe and Asia. The new footprint will be around 600 stores. Or, at least, that’s the plan for now. Let’s pour one out for the landlords. Here is CNBC mapping out where all of the closures are and which landlords are hit the most. Also per CNBC:

“At one point, two of Forever 21′s largest landlords, Simon Property Group and Brookfield Property Partners, were trying to come up with a restructuring deal where they would take a stake in the company to keep it afloat. It would’ve been similar to when Simon and GGP, which is now owned by Brookfield, bought teen apparel retailer Aeropostale out of bankruptcy back in 2016. But talks between Forever 21 and its landlords fell through, according to a person familiar with the talks. Simon and Brookfield are listed in court papers as two of Forever 21′s biggest unsecured creditors. Simon is owed $8.1 million, while Brookfield is owed $5.3 million, and Macerich $2.7 million.”

Only one of the locations marked for closure, however, belongs to Simon Property Group ($SPG).

The company notes:

To assist with the initial component of the strategy, Forever 21’s management team and its advisors worked with its largest landlords to right size its geographic footprint. Four landlords hold almost 50 percent of its lease portfolio. To date, Forever 21 and its landlords have engaged in productive negotiations but have not yet reached a resolution. The parties have exchanged proposals and diligence is ongoing. Forever 21 looks forward to continuing to work with its landlords to reach a mutually agreeable resolution and proceeding through these chapter 11 cases with the landlords’ support.

In tandem with these negotiations, Forever 21 and its advisors met with nearly all of its individual landlords to discuss potential postpetition rent concessions and other relief on a landlord-by-landlord basis. Many of these smaller, individual negotiations proved more fruitful than negotiations with the larger landlords. Although Forever 21 has not finalized the terms of a holistic landlord deal as of the Petition Date, Forever 21 anticipates that good-faith negotiations with its landlord constituency will continue postpetition, and that all parties will work together to reach a consensual, value-maximizing transaction.

Company counsel asserts that, for landlords, Forever 21 is “too big to fail.” This kinda feels like this:

But don’t worry: the A Malls are totally fine.

And don’t worry about the loans (CMBX) at all. Noooooo.

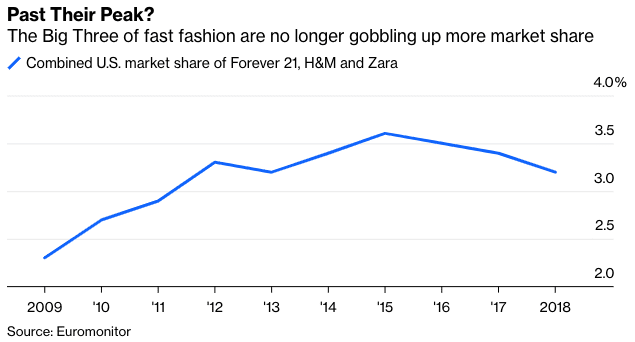

Merchandising. Getting “Back-to-Basics” on the merchandising front and focus on the company’s “core customer base.” Here is Bloomberg’s Jordyn Holman casting some shade on this plan. And here is Bloomberg’s Sarah Halzack. While the bankruptcy papers certainly don’t highlight the competition, bankruptcy counsel made a point of highlighting H&M, Zara and Fashion Nova. Retail Dive writes:

‘They did not grow with their target customer and the Millennials have graduated to Zara & H&M,’ Shawn Grain Carter, professor of fashion business management at the Fashion Institute of Technology, told Retail Dive in an email. ‘Gen. Z is more interested in rental fashion and vintage hand-me-downs because they are more environmentally conscious.’

Interestingly, Stitch Fix Inc. ($SFIX) was up 5% on Monday while the RealReal Inc. ($REAL) was up 15%. (PETITION Note: both got clobbered on Tuesday, but so did everything else).

The Washington Post piles on:

“Slimming down the operation and reducing costs is only one part of the battle,” Neil Saunders, managing director of GlobalData Retail, said in a note to clients. “The long-term survival of Forever 21 relies on the chain creating a sustainable and differentiated brand. This is something that will be very difficult to accomplish in a crowded and competitive sector.

Indeed, we’ve been writing for some time now that fast fashion seems out of sorts. Going “back to basics” may not actually be the right move in the end.

🤔

Vendor Management. A quick digression: back in May, we wrote about Modell’s Sporting Goods avoidance of bankruptcy. Mr. Modell himself worked the phones and reassured most of his vendors, prompting them to continue doing business with the shrinking sporting goods retailer. This is a feature that you don’t get in PE-backed retail bankruptcies where you have hired guns on management. There, Mr. Modell’s legacy was at stake. He hustled. Likewise, here, the Changs personal business is threatened. Accordingly, the company met with 100 vendors representing 80+% of the vendor base and got them comfortable with continued business; they secured 130 vendor support agreements for equal or better terms. Everyone is invested in making a viable go of the ‘19 holiday season. Sometimes it pays to have someone who is truly invested be all over the supply chain.

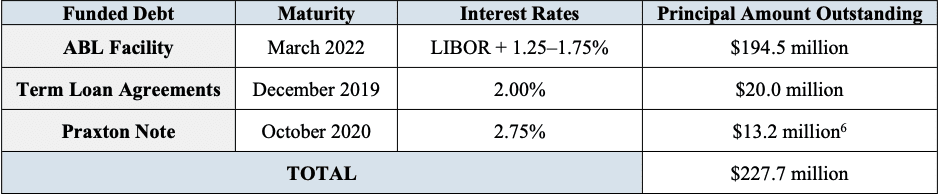

Financing. The company’s capital structure is rather simple:

The ABL is with JPMorgan Chase Bank NA as agent. The term loans were provided by the family. One from Do Won Chang for $10mm and the second from the Linda Inhee Chang 2012 Trust. Because nothing says “American Dream” like raiding your kid’s trust fund.

In conjunction with the bankruptcy, the company proposed a DIP credit facility in the form of (a) a $275 million senior secured super-priority ABL revolving credit facility, which includes a $75 million sub-limit for letters of credit and a “creeping roll up” of the pre-petition ABL Facility, and (b) a $75 million senior secured super-priority term loan credit facility, reflecting $75 million of new money financing. The company sought access to $60mm of the term loan at the hearing, indicating that with $40mm due in rent and $18mm in payroll, it would run out of cash without it. The judge approved this request.

And so here we are. The company intends to march forward with negotiations with its landlords, close tons of locations, sure up the vendor base, locate exit financing, and get this sucker out of bankruptcy in Q1 next year.

Ending up in bankruptcy certainly isn’t part of the American Dream. But living long enough to fight another day might just be.

*H/t to @JordynJournals, retail reporter for Bloomberg News on this.

**The company notes that domestic sales have increased over the last 4 quarters.

***For those new to PETITION, the same lawyer from Kirkland & Ellis LLP that represents Forever 21 represented Toys R Us. In the now-infamous “first day” hearing in Toys, the attorney sang the Toys R Us jingle — “I don’t want to grow up…” — in the courtroom. Suffice it to say considering the outcome of that case, that tactic didn’t particularly age well. Indeed, this will age better, we reckon (won’t play in email, only in browser):

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥. We recently added “Super Pumped: The Battle for Uber” by Mike Isaac, which we blew through rather quickly. Next up on our list: “What it Takes: Lessons in the Pursuit of Excellence” by Stephen A. Schwarzman, “The Ride of a Lifetime: Lessons Learned from 15 Years as CEO of the Walt Disney Company” by Bob Iger, and “That Will Never Work: The Birth of Netflix and the Amazing Life of an Idea,” by Netflix co-founder Marc Randolph.

💰New Opportunities💰

PETITION LLC lands in the inbox of thousands of bankers, advisors, lawyers, investors and others every week. Our website(s) are visited by thousands more. Are you looking for quality people. Posting your job opportunities with PETITION is a great way for your listing to stand out from the LKDN muck.

Email us at petition@petition11.com and write “Opportunities” in the subject line if you’re interested in information about posting your opportunities with us.

Nothing in this email is intended to serve as financial or legal advice. Do your own research, you lazy rascals.

IF YOU ENJOYED THIS PUBLIC POST, YOU’LL LOVE OUR PREMIUM NEWSLETTER. CLICK HERE TO SUBSCRIBE TO OUR KICK@$$ PREMIUM CONTENT AND GET THAT EXTRA EDGE OVER THE COMPETITION YOU’VE BEEN LOOKING FOR!