🎆Lehman = Anniversary Fever🎆

Initiate the Deluge of Lehman Retrospectives (Short History)

The onslaught of “10 years ago” retrospectives about the collapse of Lehman Brothers, the “Great Recession,” and lessons learned (and not learned, as the case may be), has officially begun. Brace yourselves.

Bloomberg’s Matt Levine writes:

Next weekend marks 10 years since the day that Lehman Brothers Inc. filed for bankruptcy. I suppose you could argue for other dates being the pivotal moment of the global financial crisis, but I think most people sensibly take Lehman Day as the anniversary of the crisis. Certainly I have a vivid memory of where I was on Sept. 15, 2008 (on vacation, in Napa, very confused about why no one around me was freaking out), which is not true of, say, Bear Stearns Hedge Funds Day. So expect a lot of crisis commemoration in the next week or two.

Fair point about Bear Stearns. As we’ll note in a moment, that isn’t the only pivotal moment that is getting lost in the Lehman Brothers focus.

Anyway, Levine pokes fun at a Wall Street Journal piece entitled, “Lehman’s Last Hires Look Back.” It is worth a read if you haven’t already. The upshot: all four of the folks who started at Lehman on or around the day it went bankrupt ended up landing on their feet. In fact, it doesn’t sound like any of them really suffered much of a gap of employment, if any at all.

Levine continues:

I mean he stayed there for two and a half years and left, not because he was working for a bank that had imploded and couldn’t pay him anymore, but because he got “super jaded.” Another one “was fortunate that my position was maintained at Neuberger Berman [an investment-management firm then owned by Lehman], and I spent eight years there” — and now works for Dick Fuld at his new firm. It is all a bit eerie to read. Of course Lehman’s bankruptcy led, fairly rapidly, to many job losses in the financial industry, and particularly — of course — at Lehman. But there is a lot of populist anger to the effect that investment bankers brought down the global economy and escaped relatively unscathed, and that anger will not be much assuaged by learning that these young bankers — who, to be fair, had nothing to do with bringing down the economy! — kept their jobs for years after Lehman’s bankruptcy and left only when they felt super jaded.

He’s got a point.

It’s not as if this is a happy anniversary and so there are a number of folks who are doubling-down on the doom and gloom. McKinsey, for instance, notes that global debt continues to grow and households have reduced debt but are still over-levered. They also note, as we’ve written previously, that (i) corporate debt serves as a large overhang (e.g., developing country debt denominated in foreign currencies, growth in junk bonds, the rise in “investment grade” BBB bonds, the resurgence of CLOs), (ii) real-estate prices are out of control and creating housing shortages, (iii) China’s growth trajectory is becoming murkier in the face of significant debt, and (iv) nobody fully knows the extent to which high-frequency trading can affect markets in a panic. They don’t even mention the possible effects of Central Banks’ tightening and unwinding QE (Jamie Dimon must be shaking his head somewhere). Nevertheless, they conclude:

The good news is that most of the world’s pockets of debt are unlikely to pose systemic risk. If any one of these potential bubbles burst, it would cause pain for a set of investors and lenders, but none seems poised to produce a 2008-style meltdown. The likelihood of contagion has been greatly reduced by the fact that the market for complex securitizations, credit-default swaps, and the like has largely evaporated (although the growth of the collateralized-loan-obligation market is an exception to this trend).

But one thing we know from history is that the next crisis will not look like the last one. If 2008 taught us anything, it’s the importance of being vigilant when times are still good.

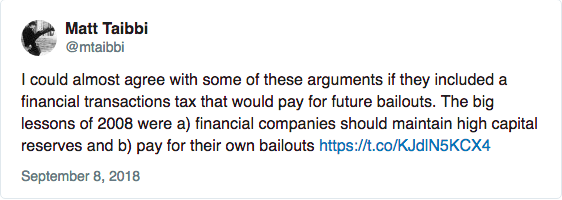

Arturo Cifuentes writes in The Financial Times that, unfortunately, ratings agencies, insurance companies and investment executives got off relatively unscathed (in the case of the former, some fines notwithstanding). The Economist notes that housing issues, offshore dollar finance, and the post-Great Recession rise in populism (which prevents a solution to the euro’s structural problems) continue to linger. Ben Bernanke, Timothy Geithner and Henry Paulson Jr. worry that Congress has de-regulated too much too soon.

Others argue that the crisis made us too afraid of risk, at least initially — particularly at the individual level. And that this is why the recovery has been so slow and, in turn, populism has been on the rise. Indeed, some note that the response to the crisis is why “the system is breaking now.” And still others highlight how the return of covenant-lite is Exhibit A to the argument that memories are short and any lessons went flying right out the window. Castles in the air theory reigns supreme.

Anyway, The Wall Street Journal has a full section devoted to “The Financial Crisis: 10 Years Later” so you can drown yourself in history all you want. This Financial Times pieceresonated with us: we remember embarking on the same prophylactic personal financial protections at the time. And how eerie it was.

But what haven’t we seen much of? We would love to see “A Man in the High Castle”-like coverage of what would have happened had AIG not been bailed out and been allowed to fail. The bailout of AIG has largely been relegated to a footnote in the history of the financial crisis — much like, as Levine implied, the failure of Bear Stearns. Make no mistake, it’s undoubtedly better off that way. But remember: the AIG bailout occurred one day afterLehman Brothers bankruptcy filing. It, therefore, didn’t take long for the FED to conclude amidst the carnage of Lehman’s failure that an AIG failure would do ever-more unthinkable Purge-like damage to the international financial system. In fact, many believed at the time that, through its relationships with all of the big banks and the extensive exposure it had to credit default swaps, that AIG was more strongly correlated to the international system (and hence more dangerous) than even Lehman.

After seeing what was happening once Lehman went bankrupt, this was simply a risk that the FED wasn’t willing to take. What if they were willing? Where would the world economy look like now? It’s interesting to think about.

One last note on AIG: Lehman had 25,000 employees. AIG is currently twice that. Even from the perspective of headcount, it was literally too big to fail.