Recent Feedback - The (Hard) Business of Eating

"Excellent narrative on the restaurant industry in Sunday’s Petition. Btw, I really love the snarky tone of the writing – it’s awesome!" - Managing Director, Financial Advisor.

PETITION Response: Thank you! We love receiving feedback like this; we noted that QSRs were generally doing fine while fast casual was looking a bit shaky and casual dining was looking like total dogsh*t. Insert Restaurant Brands International Inc. ($QSR), owner of Burger King (comps up 3.6%), Tim Hortons (up 0.3%), and Popeyes (down 1.8%). It reported an earnings beat on higher revenues (and then stock traded down). Meanwhile, Chipotle Inc.($CMG) - bloodbath. No queso for you. Meanwhile, if you feel like trusting Uber with even MORE of your data, maybe THIS new credit card (which promotes 4% off UberEATS) is for you. With news that Aldi's move into the US is compressing grocery prices even further, the casual dining space looks primed for a lot more hurt.

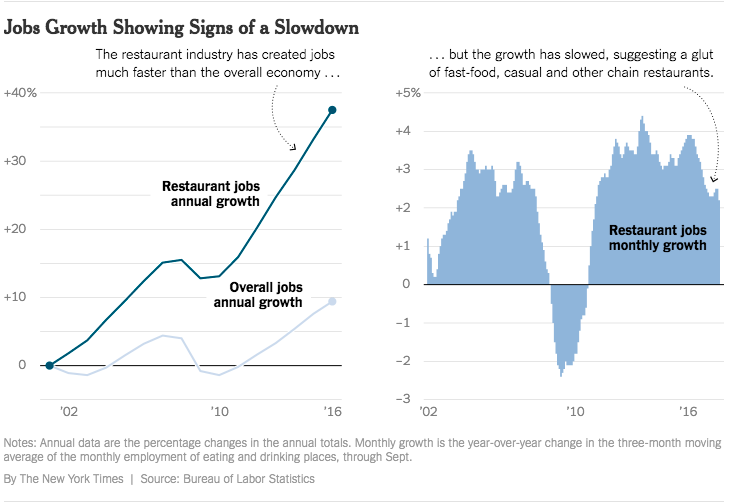

10/31/17 Updated: Not to belabor the point, but this story by The New York Times helps drive home the issue currently in the restaurant space. There are currently 620,000 eating establishments in the United States. 620,000. That is bananas.

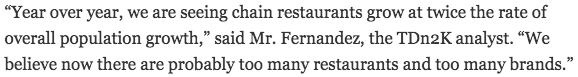

Too many restaurants? Too many brands? You think? It's a shame that so many folks are sinking their livelihoods into these businesses. We expect the chart to the right to show continued downward trends given recent reports of the likes of McDonalds ($MCD) and Shake Shack ($SHAK) automating.