💩Acosta = Not a Good Look, Carlyle💩

Disruption Flummoxes Carlyle. Destroys Billions of Value.

Back in September 2018’s “Trickle-Down Disruption from Retail Malaise (Short Coupons),” we noted a troubled trio of “sales and marketing agencies.” We wrote:

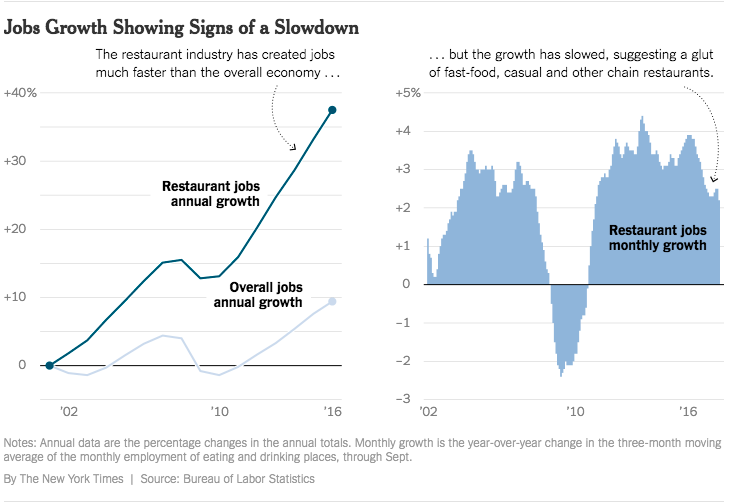

With the “perfect storm” … of (i) food delivery, (ii) the rise of direct-to-consumer CPG brands, (iii) increased competition from private-brand focused German infiltrators Aldi and Lidl, and (iv) the increasingly app-powered WholeFoods, there are a breed of companies that are feeling the aftershocks. Known as “sales and marketing agencies” (“SMAs”), you’d generally have zero clue about them but for the fact that you probably know someone who is addicted to coupon clipping. Or you’re addicted to coupon clipping. No shame in that, broheim. Anyway, that’s what they’re known for: coupons (we’re over-simplifying: they each perform other marketing, retailing, and data-oriented services too). The only other way you’d be familiar is if you have a private equity buddy who is sweating buckets right now, having underwritten an investment in one of three companies that are currently in distress. Enter Crossmark Holdings Inc., Acosta Inc., and Catalina Marketing (a unit of Checkout Holding Corp.). All three are in trouble.

What’s happened since?

Catalina Marketing filed for chapter 11 bankruptcy. ✅

Crossmark Holdings Inc. effectuated an out-of-court exchange transaction, narrowing averting a chapter 11 bankruptcy filing. ✅

And, as of last week, Acosta Inc. launched solicitation of a prepackaged chapter 11 bankruptcy filing. It will be in bankruptcy in the District of Delaware very very soon. We’ve basically got ourselves an SMA hat-trick. ✅💥

Before we dive into what the bloody hell happened here — and it ain’t pretty — let’s first put some more meat on those SMA bones. In doing so, mea culpa: we WAY over-simplified what Acosta Inc. does in that prior piece. So, what do they do?

Acosta has two main business lines: “Sales Services” and “Marketing Services.” In the former, “Acosta assists CPG companies in selling new and existing products to retailers, providing business insights, securing optimal shelf placement, executing promotion programs, and managing back-office order-to-cash and claims deduction management solutions. Acosta also works with clients in negotiations with retailers and managing promotional events.” They also provide store-level merchandising services to make sure sh*t is properly placed on shelves, stocks are right, displays executed, etc. The is segment creates 80% of Acosta’s revenue.

The other 20% comes from the Marketing Services segment. In this segment, “Acosta provides four primary Marketing Services offerings: (i) experiential marketing; (ii) assisted selling and training; (iii) content marketing; and (iv) shopper marketing. Acosta offers clients event-based marketing services such as brand launch events, pop-up retail experiences, mobile tours, large events, and trial/demo campaigns. Acosta also provides Marketing Services such as assisted selling, staffing, associate training, in-store demonstrations, and more. Under its shopping marketing business, Acosta advises clients on consumer promotions, package designs, digital shopping, and other shopper marketing channels.”

In the past, the company made money through commission-based contracts; they are now shifting “towards higher margin revenue generation models that allow the Company to focus on aligning cost-to-serve with revenue generation to better serve clients and maximize growth.” Whatever the f*ck that means.

We’re being flip because, well, let’s face it: this company hasn’t exactly gotten much right over the last four years so we ought to be forgiven for expressing a glint of skepticism that they’ve now suddenly got it all figured out. Indeed, The Carlyle Group LP acquired the company in 2014 for a staggering $4.75b — a transaction that “ranked … among the largest private-equity purchases of that year.” Score for Thomas H. Lee Partners LP(which acquired the company in 2011 from AEA Investors LP for $2b)!! This was after the Washington DC-based private equity firm reportedly lost out on its bid to acquire Advantage Sales & Marketing, a competitor which just goes to show the fervor with which Carlyle pursued entry into this business. Now they must surely regret it. Likewise, the company: nearly all of the company’s $3b of debt stems from that transaction. The company’s bankruptcy papers make no reference to management fees paid or dividends extracted so it’s difficult to tell whether Carlyle got any bang whatsoever for their equity buck.*

Suffice it to say, this isn’t exactly a raging success story for private equity (calling Elizabeth Warren!). Indeed, since 2015 — almost immediately after the acquisition — the company has lost $631mm of revenue and $193mm of EBITDA. It gets worse. Per the company:

“Revenue contributions from the top twenty-five clients in 2015 have declined at approximately 14.6 percent per year since fiscal year 2015. Furthermore, adjusted EBITDA margins have decreased year-over-year since fiscal year 2015 from over 19 percent to approximately 16 percent as of the end of fiscal year 2018.”

When you’re losing this money, it’s awfully hard to service $3b of debt. Not to state the obvious. But why did the company’s business deteriorate so quickly? Disruption, baby. Disruption. Per the company:

Acosta’s performance was disrupted by changes in consumer behavior and other macroeconomic trends in the retail and CPG industries that had a significant impact on the Company’s ability to generate revenue. Specifically, consumers have shifted away from traditional grocery retailers where Acosta has had a leadership position to discounters, convenience stores, online channels, and organic-focused grocers, where Acosta has not historically focused.

Just like we said a year ago. Let’s call this “The Aldi/Lidl/Amazon/Dollar Tree Effect.” Other trends have also taken hold: (a) people are eating healthier, shying away from center-store (where all the Campbell’s, Kellogg’s, KraftHeinz and Nestle stuff is — by the way, those are, or in the case of KraftHeinz, were, all major clients!); and (b) the rise of private label.

Moreover, according to Acosta, consumer purchasing has declined overall due to the increased cost of food (huh? uh, sure okay). The company adds:

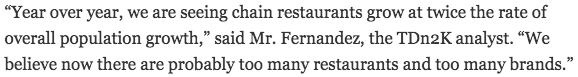

These consumer trends have exposed CPG manufacturers to significant margin pressure, resulting in a reduction in outsourced sales and marketing spend. In the years and months leading to the Petition Date, several of Acosta’s major clients consolidated, downsized, or otherwise reduced their marketing budgets.

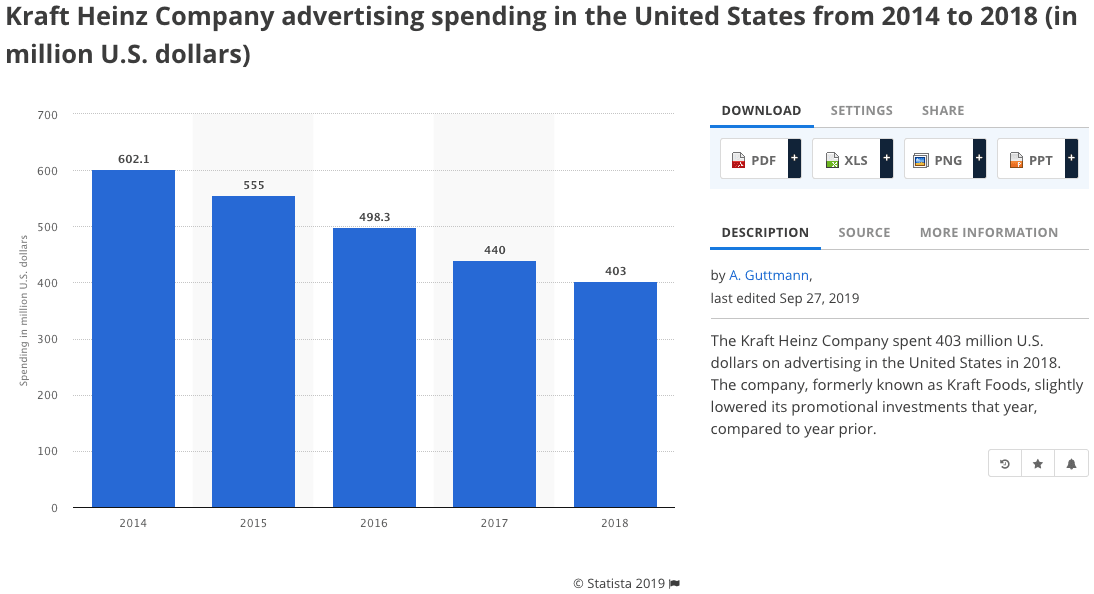

By way of example, here is Kraft Heinz’ marketing spend over the last several years:

Compounding matters, competition in the space is apparently rather savage:

“Acosta also faced significant pressure as a result of the Company’s heavy debt load. Clients have sought to diversify their SMA providers to decrease perceived risk of Acosta vulnerability. In fact, certain of Acosta’s competitors have pointed to the Company’s significant indebtedness, contrasting their own de-levered balance sheets, to entice clients away from Acosta. Over time, these factors have tightened the Company’s liquidity position and constrained the Company from making necessary operational and capital expenditures, further impacting revenue.”

So, obviously, Acosta needed to do something about that mountain of debt. And do something it did: it’s piling it up like The Joker, pouring kerosene on it, and lighting that sh*t on fire. The company will wipe out the first lien credit facility AND the unsecured notes — nearly $2.8b of debt POOF! GONE! What an epic example of disruption and value destruction!

So now what? Well, the debtors clearly cannot reverse the trends confronting CPG companies and, by extension, their business. But they can sure as hell napalm their balance sheet! The plan would provide for the following:

Provide $150mm new money DIP provided by Elliott, DK, Oaktree and Nexus to satisfy the A/R facility, fund the cases, and presumably roll into an exit facility;

First lien lenders will get 85% of the new common stock (subject to dilution from employee incentive plan, the equity rights offering, the direct investment preferred equity raise, etc.) + first lien subscription rights OR cash subject to a cap.

Senior Notes will get 15% of new common stock + senior notes subscription rights OR cash subject to a cap.

They’ll be $250mm in new equity infusions.

So, in total, over $2b — TWO BILLION — of debt will be eliminated and swapped for equity in the reorganized company. The listed recoveries (which, we must point out, are based on projections of enterprise value) are 22-24% for the holders of first lien paper and 10-11% for the holders of senior notes.

We previously wrote about how direct lenders — FS KKR Capital Corp. ($FSK), for instance — are all up in Acosta’s loans. Here’s what KKR had to say about their piece of the first lien loan:

We placed Acosta on nonaccrual due to ongoing restructuring negotiations during the quarter and chose to exit this position after the quarter end at a gain to our third quarter mark.

This was the mark back in December 2018 = $2.4mm fair value:

And this is the mark as of Q3 close, September 2019 = $1.3mm fair value:

Soooooo….HAHAHAHA. Now THAT is some top-notch spin! Even if they did mark to a gain versus the Q3 mark, they undoubtedly lost money on this position: the mark was cut in half in less than a year.

You have to take the benefits of quarterly reporting where you can, we suppose. 😬😜

*There have been two independent directors appointed to the board; they have their own counsel; and they’re performing an investigation into whether “any matter arising in or related to a restructuring transaction constituted a conflict matter.” There is no implication, however, that this investigation has anything to do with potential fraudulent conveyance claims. Not everything is Payless, people.