🥛New Chapter 11 Filing - Southern Foods Group LLC (d/b/a Dean Foods Company)🥛

Southern Foods Group LLC (d/b/a Dean Foods Company)

November 12, 2019

We’ve published these charts before here but they’re worth revisiting:

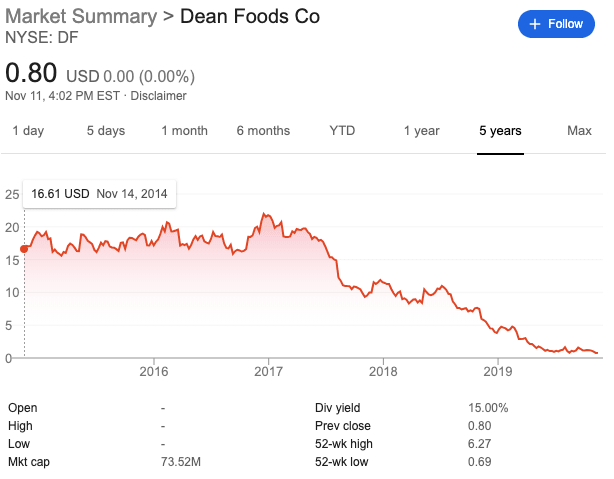

Since we’re all about the charts right now, here’s another one — perhaps the ugliest of them all:

Yup, Southern Foods Group LLC (d/b/a Dean Foods Company) has been a slow-moving train wreck for some time now. In fact, we wrote about the disruption it confronts back in March. It’s worth revisiting (we removed the paywall).

Alas, the company and a long list of subsidiaries finally filed for bankruptcy yesterday in the Texas (where things seem to be getting VERRRRRY VERRRRRY busy these days; see below ⬇️).

Once upon a time everyone had milk. Serena and Venus Williams. Dwight Howard. Mark McGuire. Tyra Banks. The Olsen twins. David Beckham. Giselle. The “Got Milk? campaign was pervasive, featuring A-listers encouraging folks to drink milk for strong bones. Things have certainly changed.

Dean Foods’ long history begins in 1925; it manufactures, markets and distributes branded and private label dairy products including milks, ice cream, creamers, etc. It distributes product to schools, QSRs like McDonald’s Inc. ($MCD), small format retailers (i.e., dollar stores and pharmacies), big box retailers like Walmart Inc. ($WMT)(which accounted for 15.3% of net sales in ‘18), and the government. Its products include, among many others, Friendly’s, Land O Lakes and Organic Valley. This company is a monster: it has 58 manufacturing facilities in 29 states, 5000 refrigerated trucks and 15,000 employees (40% of whom are covered by collective bargaining agreements). Milk, while on the decline, remains big business.

How big? Per the company:

In 2018, Dean Foods’ reported consolidated net sales of $7.755 billion, gross profit of $1.655 billion, and operating income of $(315.2) million. Through the first 6 months of 2019, Dean Foods’ reported consolidated net sales of $3.931 billion, gross profit of $753.2 million, and operating income of $(96.2) million.

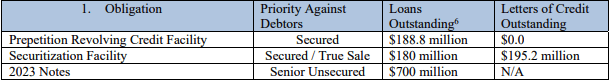

Those are some serious sales. And losses. And the company also has a serious capital structure:

Milk production is a capital intensive business requiring a variety of inputs: raw milk, resin to make plastic bottles (which likely infuse all of us with dangerous chemicals, but whatevs), diesel fuel, and juice concentrates and sweeteners. Hence, high debt. So, to summarize: high costs, low(er) demand, lots of debt? No wonder this thing is in trouble.

What are the stated reasons for the company’s chapter 11 filing?

Milk Consumption Declines. “For the past 10 years, demand has fallen approximately 2% year-over-year in North America.” This is consistent with the chart above.

Loss of Pricing Power. Because volumes declined, economies of scale also decreased. “Delivered cost per gallon rose approximately 20.7% between 2018 and 2013 as a result of volume deleverage.” That’s vicious. Talk about a mean spiral: as volumes went down, the company couldn’t support the input volumes it had previously and therefore lost pricing power. “Dean Foods suffered a full year 2018 year-over-year decline in fluid milk volume of 5.8% following a 2017 year-over-year decline of 4.2%. Moreover, Dean Foods’ volume declines continue to outpace the overall category; while category volumes declined by approximately 4%8 year-over-year through the end of September, 2019, Dean Foods experience declines of over 11.4%.” Apparently, this impacted Dean Foods disproportionately. Any buyer looking at this has to wonder how these issues can be remedied.

Market Share Disruption. New forms of “milk” have taken market share. “Sales of nut and plant beverages grew by 9% in 2018 and had sales of $1.6 billion, according to the Plant Based Foods Association.”

Retail Consolidation. It doesn’t help when, say, Dollar General merges with Family Dollar. That gives the dollar stores increased leverage on price. And that’s just one example.

“The BigBox Effect.” The biggest retailers have become increasingly private label focused and, in turn, vertically integrated. Take Walmart, for example. In 2018, the retailer opened its first U.S. food production facility in Indiana. Want to guess what kind of food? Why would we be mentioning it? This new facility amounted to a 100mm gallon loss of volume to Dean Foods.

“The Loss Leader Effect.” We often talk about the venture-backed subsidization of commonplace lifestyle items, e.g., Uber Inc. ($UBER). Retailers have, in recent years, aggressively priced private label milk to drive foot traffic. “As retailers continue to invest in private-label milk to drive foot traffic, private label margin over milk contracted to a historic low of $1.26 in June, before falling even further to $1.24 in September.”

Freight Costs. They’ve been up over the last few years. This is a different version of

”The Amazon Effect” ($AMZN).

All of these are secular issues that a balance sheet solution won’t remedy. Buyer beware. 😬🤔

So, what CAN the bankruptcy achieve? Yes, the obvious: the balance sheet. Also, there is a contingent liability of over $722.4mm that results from the company’s participation in an underfunded multi-employer pension plan. And liquidity: the bankruptcy will avail the company of a $850mm DIP credit facility. It may also allow the company to pursue a sale transaction to its long-time commercial partner and largest single raw milk vendor, Dairy Farmers of America (which is wed $172.9mm). Surely they must be aware of the secular trends and will price any offer accordingly, right? RIGHT? Either way, those ‘23 notes look like they might be about to take a bath.*

*Likewise certain trade creditors. The debtors state that that they have $555.7mm of total outstanding accounts payable and claim $257mm needs to go to critical vendors and another $189.2mm to 503(b)(9) admin claimants. That leaves a small subset of creditors due a bit more than $100mm holding the bag. This also explains the sizable DIP.

Meanwhile, one of the largest unsecured creditors is Acosta Inc., with a contingent, disputed and unliquidated claim arising out of litigation. Acosta is unlikely to recover much on this claim which is a bit ironic considering that an Acosta bankruptcy filing is imminent. Womp womp.

Jurisdiction: S.D. of Texas (Judge Jones)

Capital Structure: see above

Professionals:

Legal: Davis Polk & Wardwell LLP (Brian Resnick, Steven Szanzer, Daniel Meyer, Nate Sokol, Alexander Bernstein, Charlotte Savino, Cameron Adamson) & Norton Rose Fulbright LLP (William Greendyke, Jason Boland, Bob Bruner, Julie Goodrich Harrison)

Financial Advisor: Alvarez & Marsal LLC (Jeffrey Stegenga, Brian Fox, Tom Behnke, Taylor Atwood)

Investment Banker: Evercore Group LLC (Bo Yi)

Claims Agent: Epiq Bankruptcy Solutions LLC (*click on the link above for free docket access)

Other Parties in Interest:

Receivables Securitization Agent, RCF Agent & DIP Agent: Rabobank USA

Legal: White & Case LLP (Scott Greissman, Philip Abelson, Elizabeth Fuld, Rashida Adams, Andrew Zatz) & Gray Reed & McGraw LLP (Jason Brookner, Lydia Webb, Amber Carson)

Unsecured Bond Indenture Trustee: Bank of New York Mellon NA

Legal: Emmett Marvin & Martin LLP (Thomas Pitta, Edward Zujkowski, Elizabeth Taraila)

Ad Hoc Group of 6.5% ‘23 Unsecured Noteholders: Ascribe III Investments LLC, Broadbill Investment Partners LLC, Ensign Peak Advisors Inc., Kingsferry Capital LLC, Knighthead Capital Management LLC, MILFAM Investments LLC

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Andrew Rosenberg, Robert Britton, Douglas Keeton, Grace Hotz) & Pillsbury Winthrop LLP (Hugh Ray III, William Hotze, Jason Sharp)

Official Committee of Unsecured Creditors: Central States Southeast and Southwest Areas Pension Fund, The Bank of New York Mellon Trust Company NA, Pension Benefit Guaranty Corporation, Land O’ Lakes Inc., California Dairies Inc., Consolidated Container Company LP, Select Milk Producers Inc.

Legal: Akin Gump Strauss Hauer & Feld LLP (Ira Dizengoff, Philip Dublin, Meredith Lahaie, Martin Brimmage, Joanna Newdeck, Julie Thompson, Patrick Chen, Madison Gardiner)

Financial Advisor: Berkeley Research Group LLC (Christopher Kearns)

Investment Banker: Miller Buckfire & Co. LLC (Richard Klein)

Update 1/11/20