Factorers Flex Their Muscles

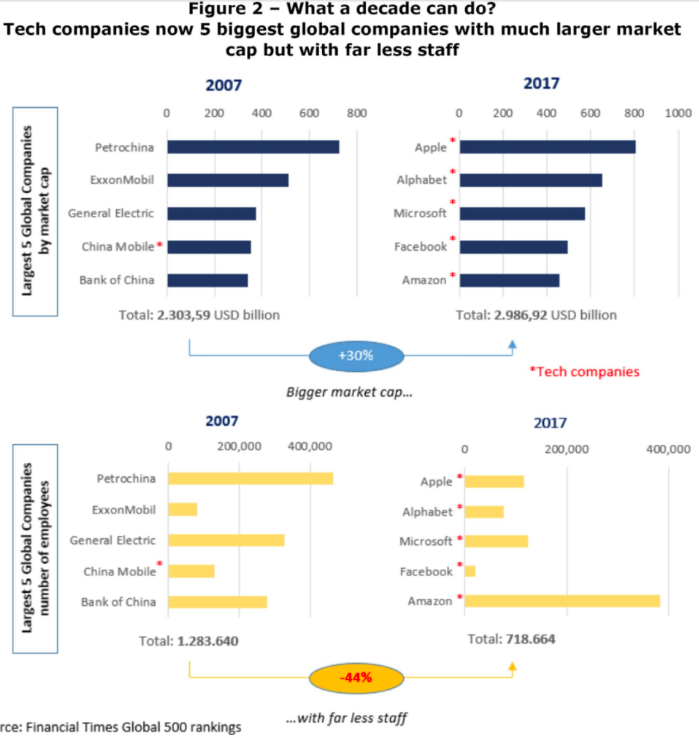

We're getting amped up for Star Wars and so we figured we'd use a SW-like subtitle here. Anyway, Toys R Us'trouble sparked a vendor awakening (see what we did there?) and attendant media speculation, which, combined (with an obnoxious level of PE-placed debt), sparked the behemoth-retailer's surprise bankruptcy filing. Its logical to draw a direct line from that to the circumstances unfolding now in Bon Ton Stores ($BONT) and Charming Charlie, where both retailers reportedly had to get extended access to capital under their credit facilities to make it through the holiday season (after which they'll both probably file for bankruptcy anyway, but whatevs). Likewise, Sears Holdings Corp. ($SHLD) has had to recently tap all available resources to ward off retailers. Notably, it indicated that "[m]erchandise payables were $0.8 billion and $1.6 billion at October 28, 2017 and October 29, 2016, respectively, as we have significantly reduced our dependency on vendor financing." Sure, broheims. Is "significantly reduced our dependency on vendor financing" a euphemism for "nobody will extend us credit anymore"? Anyway, earlier this week, Calypso St. Barth couldn't make it that far as vendors filed an involuntary bankruptcy petition against it in New Jersey. Apparently, vendors don't like it when a company stonewalls them and refuses to pay. Go figure. But, wait:there's more. Unbeknownst to casual observers of the #retailapocalypse, many suppliers rely on specialty lenders called "factorers." Factorers purchase accounts receivable from suppliers so that suppliers have some near-term liquidity - rather than waiting 30-120 days for, say, Toys R Us to pay them (or waiting forever, as the case may be, e.g., Vitamin World, now liquidating). In turn, there are specialty insurers who provide the factorers cover in the event that the receivables are never paid. Which, given the volume of retail bankruptcies today, seems like a pretty likely risk. Apropos, (i) insurers are charging factorers more for insurance, (ii) factorers are seeking more favorable terms from suppliers and (iii) suppliers are therefore seeking tighter payment terms from retailers. Without the ability to satisfy those terms, well, you get it: Toys R Us. It's like a nice big game of dominoes played among one big unhappy family. With Uncle Amazon watching from above with an evil-a$$ grin on his face.