⛽️2019 Can’t End Fast Enough for Oil & Gas (Long Pain in TX)⛽️

Some numbers: the US now produces 13mm barrels per day and exports 3mm bpd. Per Reuters:

But the outlook for 2020 comes with growing skepticism from those inside the industry - and should growth fall short, it could shift the balance of power in world supply back to the Organization of the Petroleum Exporting Countries.

An increase in U.S. crude output by 1 million bpd would satisfy nearly all of the 1.2 million bpd increase in world demand next year, the International Energy Agency expects. [IEA/M]

That would keep a lid on prices, pressure OPEC to extend production cuts and leave shale producers still trying to achieve elusive profits. As a result, most industry executives and consultants said they expect slower U.S. shale growth.

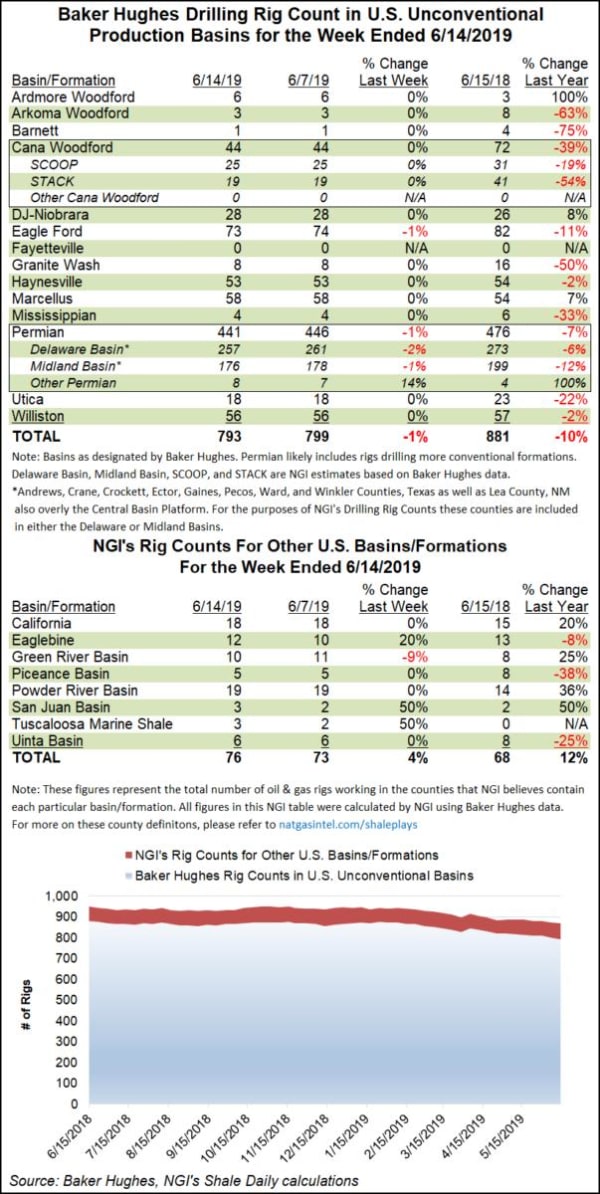

Apropos, layoffs are starting to mount in the Permian. Austerity measures are now taking hold in the Eagle Ford. Per Bloomberg:

In the wake of the oil price crash that began in 2014, new drilling in the Eagle Ford dwindled as management teams cut budgets, and output in the region is now down about 20% from pre-crash levels.

That austerity finally began to pay off this year as the Eagle Ford as a whole generated free cash flow for the first time, according to IHS Markit.

And things may only get worse.* The state of Texas is expected to double its solar electricity output next year and again the following year. This would obviously have a negative impact on natural gas demand and prices.

Nevertheless, the Trump administration intends to bring MORE drilling online! Per The Houston Chronicle, the administration…

THIS IS A SUBSCRIBER’S POST. CLICK HERE, TO SUBSCRIBE AND READ THE REST OF THIS ARTICLE. DISRUPT THE COMPETITION WITH PETITION.