⚡️Earnings Season Ushers in More Bad News for Retail⚡️

In “Thanos Snaps, Retail Disappears👿,“ “Even Captain America Can’t Bring Back This Much Retail (Long Continued Closures)“ and “💸The #Retailapocalypse is a Boon for...💸,” we’ve chronicled the seemingly endless volume of retail store closures that continue to persist in the first half of 2019. As we’ve said time and time again, there are no signs of this trend disappearing. In fact, it continues to get worse.

Last week brought us a deluge of retail news and earnings. And, indeed, along with earnings came more store closure announcements and more indications of who are the “haves”* and the “have nots.”

Let’s start with department stores where there’s a lot of pain to go around in “have not”-ville.

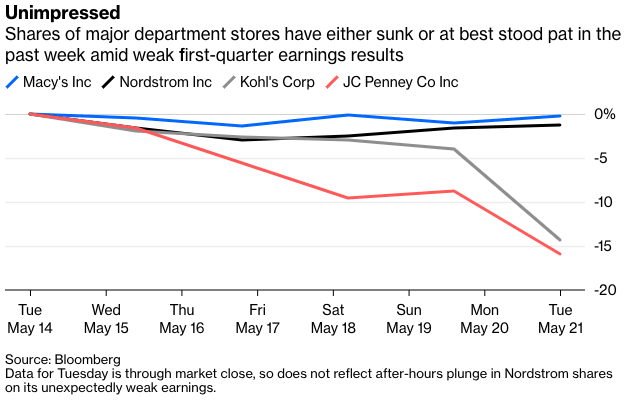

Macy’s ($M) kicked things off with a surprise increase in same-store sales and so it was ONLY down approximately 0.9% on the week. In contrast, Kohl’s ($KSS), Dillard’s ($DDS), J.C. Penney ($JCP) and Nordstrom ($NWN) all got hammered — each down more than 7% — after across-the-board dismal earnings. Kohl’s performance was particularly interesting given its acclaimed experimentation, including partnerships with Amazon ($AMZN) and, coming soon, Fanatics. The company reported a 2.9% revenue decline and a same-store comp decline of 3.4%. Adding fuel to the fire: the company cut its full-year earnings guidance, citing…wait for it…tariffs(!) as a massive headwind.

Kohl’s wasn’t alone there. Home Depot ($HD) also indicated that new tariffs on China might cost it $1b in revenue — on top of the $1b it already anticipated from the prior round of tariffs. 😬

Other have nots in retail? Party City ($PRTY) is closing 45 stores. Tuesday Morning Corp. ($TUES) is closing a net 12 stores. Fred’s ($FRED) announced 104 more closures in addition to the 159 previously announced closures. Burberry Group Plc ($BURBY) is closing 38 stores. Topshop is now bankrupt and will close 11 stores in the US (and more abroad). Hibbett Sports ($HIBB) is adding 95 store closures to the pile (despite otherwise nice results). Of course, we’d be remiss if we didn’t mention the dumpster fire that is Dressbarn:

Finally, all of the pain in retail already has at least one ratings agency questioning whether David’s Bridal is out of the woods post-bankruptcy. We can’t wait to add that one to our “Do We have a Feasibility Problem?” series.

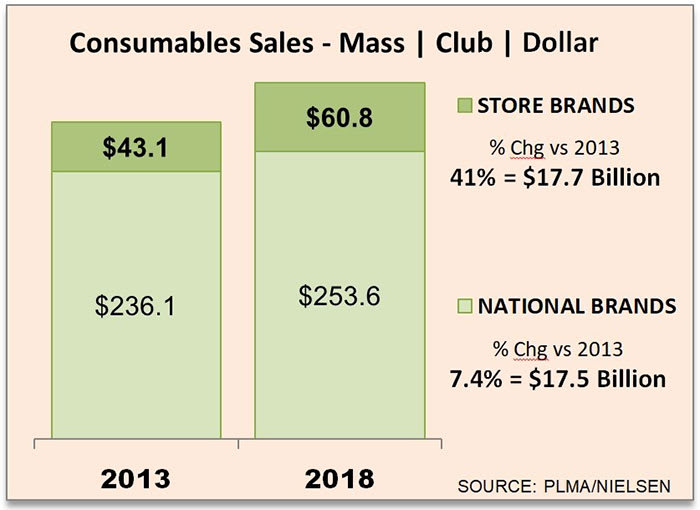

All of this has people scattered wondering what’s the next shoe to drop (more tariffs!) and, in turn, what can possibly stop the bleeding? Here is a piece discussing how private brands are on fire.

Here is to hoping that Generation Z saves malls. What draws them to malls? Good food. Malls with great food options apparently experience more sales. Now Neiman Marcus and H&M are going the resale route. Urban Outfitters ($URBN) is experimenting with a monthly rental service. Startups like Joymode look to benefit from the alleged shift from ownership to “access.”

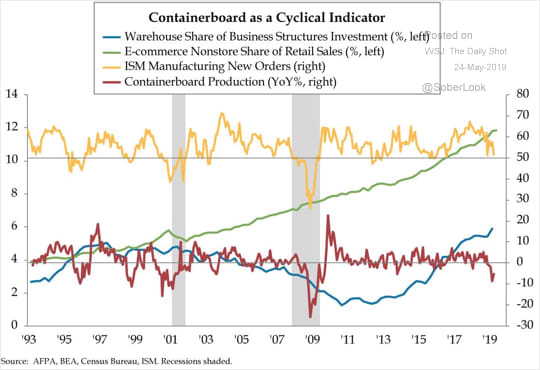

As for continued bleeding, here is yet another sign that things may continue to worsen for retail:

Notably, production of containerboard — a type of paperboard specially manufactured for the production of corrugated board (or cardboard) — is suffering a YOY production decline. Is that indicative of a dip in e-commerce sales to boot? 😬

*On the flip side, there have been some clear winning “haves.” Take, TJX Companies Inc. ($TJX), for instance. The owner of T.J. Maxx reported a 5% increase in same store sales. Target Inc. ($TGT) and Walmart Inc. ($WMT) also appear to be holding their own. The former’s stock had a meaningful pop this week on solid earnings.