There was a barrage of earnings over the last two weeks and they can sometimes be a bellwether of things to come for the economy so we figured we’d dig in. Here’s what we learned…

Evercore Inc. ($EVR) was among the first investment banks to report Q1 ‘19 earnings back in late April (though the Q was only filed on May 2) and, man, they came out of the gate fast and furious on the earnings call with all kinds of braggadocious talk about being fourth highest in global advisory revenue in ‘18, and how they’re kicking a$$ and taking names in ‘19 already, etc. Only then, however, to say that YOY results were down. Hahaha. Totally buried the lede. Revenues were $419.8mm, down 10% YOY. Investment banking fees were down 14%. This despite 59 fees greater than $1mm, as compared to 53 in the year ago period.

Regarding, M&A volume and Europe:

…if you look at the M&A environment generally the dollar volume of announced transactions in the first quarter was down mid teens and the number of announced transactions globally was down in the high 20s. In Europe there was actually a little bit more pronounced. The interesting thing is if one looks at our backlogs they're not really consistent with the announced activities in the first quarter and to be completely blunt about is we expect this year could be a pretty good year. We certainly don't see anything in our dialogues with clients that suggests that it won't be.

Some EVR-specific highlights include (i) increased emphasis on “liability management” as a source of revenue generation and (ii) in turn, no increased emphasis on coverage of smaller cap companies (like certain competitor banks). EVR says that is not a focus: the focus is on bigger deals or deals with “high quality companies that may not be big.” In other words, they don’t want quals for quals sake. They want to get paid. And get paid well.

Specifically relating to restructuring, this is what EVR had to say:

…our advisory revenues last year were up in every category including restructuring notwithstanding the fact that default levels are at almost all time lows. So I think we've been able – we've added talent in the restructuring area. We think we are well positioned to capitalize on a pickup of activity when that inevitably happens. But other than relatively isolated sector activity like retail or like we saw in energy two or three years ago, there certainly is no broad scale pick up in distressed companies at this point in time.

No sh*t. Though it does seem like things have picked up a notch, no?

*****

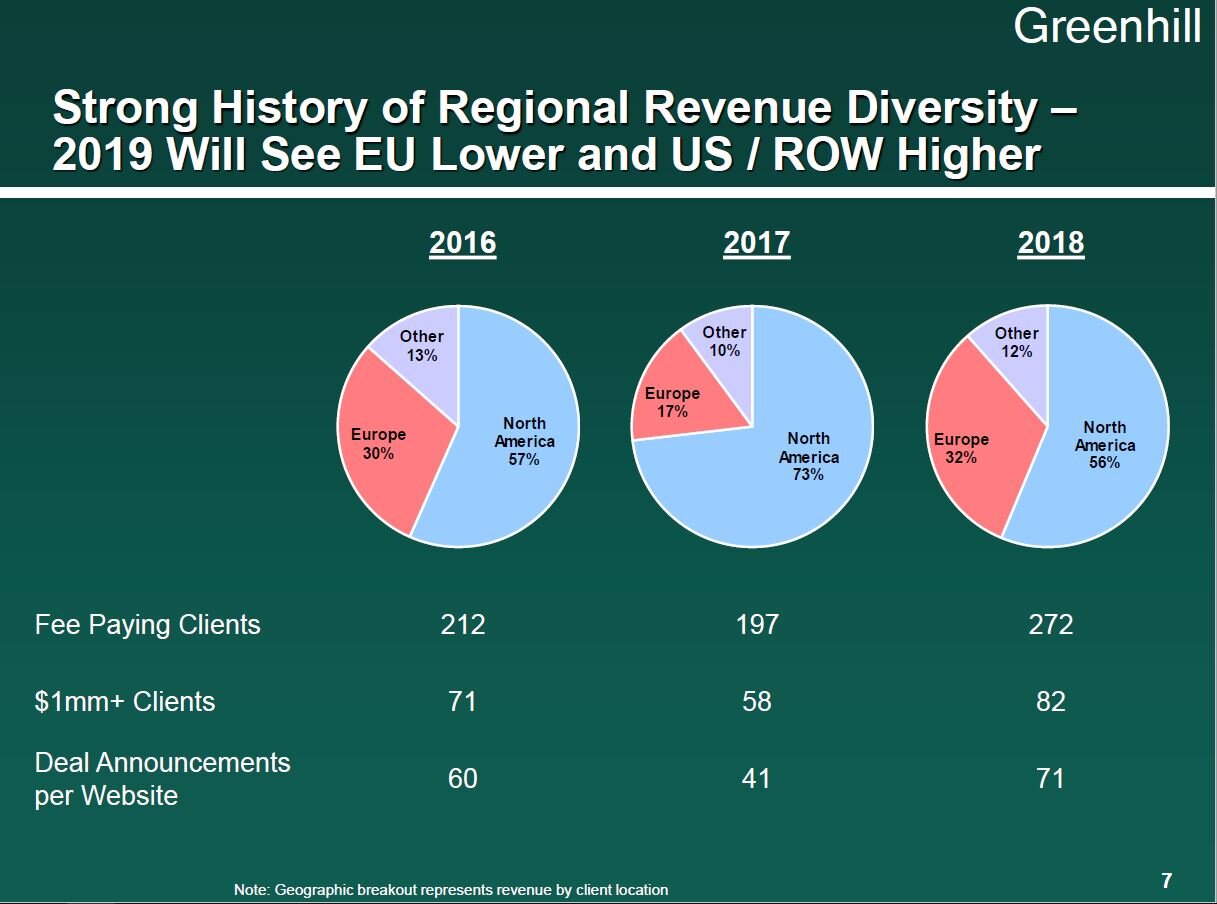

Greenhill & Co. Inc. ($GHL) reported only $51.2mm of revenue, down 42% on a “dearth of large completions and generally slower deal activity,” and a “decline in EU revenue” more than offsetting increases in other regions. Noticing a Euro-centric theme here?