⛽️New Chapter 11 Filing - Vanguard Natural Resources Inc.⛽️

Vanguard Natural Resources Inc.

March 31, 2019

It’s raining SCARLET 22s! Freefall!! We still STILL have a feasibility problem!!!

Vanguard Natural Resources Inc. ($VNRR) and affiliated debtors find themselves in bankruptcy court again — the second time in nearly exactly two years (its predecessor confirmed a plan of reorganization in July 2017). And they do so in crash and burn fashion: while discussions have been happening over the last several weeks with various constituencies within the company’s capital structure, the company has no deal agreed to — merely the outlines of a restructuring term sheet. This is curious given that, under the company’s proposed DIP credit facility ($130mm, of which $65mm is new money), the company has a mere 30 days from the petition date to file a plan of reorganization and must emerge from chapter 11 within 120 days. Send hopes and prayers to the Kirkland attorneys working on this one over the next few weeks.

The debtors are an oil and natural gas company with production and development activity in the Rocky Mountain, Mid-Continent, Gulf Coast and West Texas regions of the United States; they operate in eight states across nine geologic basins. They are a remnant of the first bankruptcy which saw the predecessor entity shed $850mm of debt and wipe out the existing equity. The current capital structure looks like this:

The second lien noteholders include Fir Tree Capital Management LP and York Capital Management Global Advisors LLC. And the company’s equity holders are:

Source: Chapter 11 Petition

This is another pretty cut and dry oil and gas bankruptcy given where oil and natural gas prices are. Many investors who took ownership of distressed E&P companies circa 2015-2017 were playing an option on oil and gas trading levels. That option is clearly out of the money.

Interestingly, that option was underwritten, in part, on the company’s projections. And, so, this statement by the company’s now-CEO was particularly intriguing to us and fits nicely within our recent general theme of inquiring as to whether the industry has a feasibility problem (see Paragon Offshore here, Gymboree here, and Payless here):

I understand that the Vanguard I Plan was predicated on various assumptions that ultimately did not materialize. As discussed further herein, it is my understanding that these may have included certain assumptions about: (a) commodity prices and basin differentials; (b) the pace and volume of divestments and the existence of valuable undeveloped resources to be sold; and (c) the expected returns on a number of capital investments pursued by Vanguard upon emergence—many of which have failed to come to full fruition and have challenged the Debtors’ liquidity over the last 18 months.

Former management, meet a big bad bus. You’ve just been thrown under it.

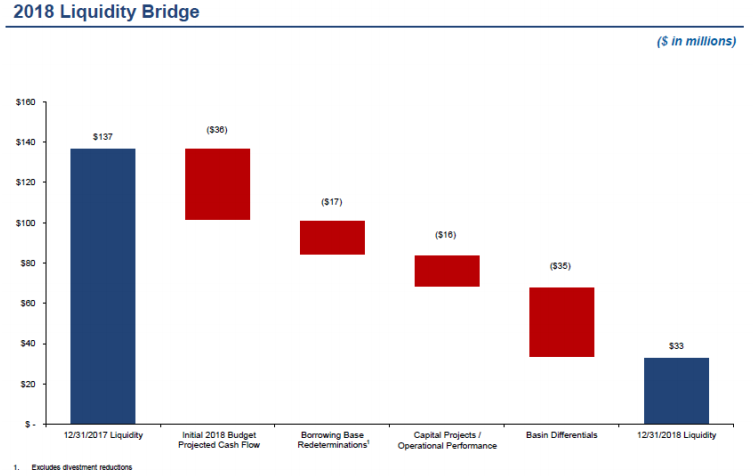

In fact, as if saying it wasn’t enough, the new CEO spared PETITION the trouble of having to dive into the 2017 filings to see just how badly these guys botched their liquidity projections:

Source: First Day Declaration

The following compounded matters: (a) mismanagement of the company’s hedge book, (b) borrowing base redeterminations, (c) refi roadshows met with “tepid” interest, (d) a series of asset sales that failed to live up to expectations — both in terms of time to completion and proceeds, and (e) capital investments that “delivered lower economic returns than expected.” It’s almost as if distressed investors who sit on boards of directors and hire their own operators have absolutely no effing clue how to run an oil and gas company. Who knew?

And so the company came dangerously close to tripping a series of covenants. That’s when the company brought in Kirkland & Ellis LLP and Evercore Group LLC and re-engaged Opportune LLP to help the company. The various advisors engaged in a number of processes that would have provided the company with crucial liquidity — including new financing, bank facility amendments and various discreet asset sales. But all prospective parties quickly realized that the assets…well…for lack of a better description…kinda, like, suck.

And so nothing could get done. Well, other than the company obtaining a commitment for $130mm of DIP financing to fund the cases (of which only $65mm is new money). What happens from here will be interesting to watch. Suffice it to say, distressed-investors-cum-oil-and-gas-owners are learning a ROUGH lesson.

And, once again, we have to ask whether company projections ought to get a bit more scrutiny than they have to date.

Jurisdiction: S.D. of Texas (Judge Jones)

Capital Structure: $677.7mm RCF and $123.4mm TL (Citibank NA), $80.7mm second lien notes (Delaware Trust Company)

Professionals:

Legal: Kirkland & Ellis LLP (James Sprayragen, Christopher Marcus, Brian Schartz, Aparna Yenamandra, Richard Howell, Yates French, Kent Hayden, Timothy Bow, James Fedell, Allyson Smith Weinhouse) & (local) Blank Rome LLP (James Grogan, Philip Guffy)

Board of Directors: Randall Albert, Patrick Bartels Jr., W. Greg Dunlevy, Joseph Hurliman Jr., Andrew Schultz, R. Robert Sloan, L. Spencer Wells

Financial Advisor: Opportune LLP

Investment Banker: Evercore Group LLC

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

DIP Agent ($130mm, $65mm New Money): Citibank NA

Legal: Latham & Watkins LLP (Mitchell Seider, Annemarie Reilly, Adam Malatesta) & (local) Hunton Andrews Kurth LLP (Timothy Davidson II, Joseph Rovira)

Ad Hoc Group of First Lien Lenders

Legal: Brown Rudnick LLP (Robert Stark, Steven Pohl, Justin Cunningham, Alexander Fraser) & (local) Quinn Emanuel Urquhart & Sullivan LLP (Patricia Tomasco)

Second Lien Ad Hoc Group (Fir Tree Capital Management LP, York Capital Management Global Advisors LLC)

Legal: Davis Polk & Wardwell LLP (Brian Resnick, Benjamin Schak) & (local) Porter Hedges LLP (John Higgins, Eric English, M. Shane Johnson)

Official Committee of Unsecured Creditors

Legal: Locke Lorde LLP (Philip Eisenberg)

Restructuring Advisor: Parkman Whaling LLC (Thomas B. Hensley Jr.)

Financial Advisor: The Claro Group LLC (Douglas Brickley)

Updated 5/10 at 12:25pm (#48)