New Chapter 11 Bankruptcy Filing - DiTech Holding Corporation

Ditech Holding Corporation

February 11, 2019

Source: PETITION

The benefit of building a track record of writing/reporting is that various themes emerge over time that can be built upon. Ben Thompson, the eponymous writer of Stratechery, often comments about how newsletters are a better forum for writing than books because thought processes can evolve, themes can be strung together and built-upon or amended, and the reader isn’t purchasing a finished product, per se, but a relationship with the writer. And that relationship can grow over time. We hope that our PETITION readers feel similarly.

Apropos, we wrote back in “We Have a Feasibility Problem” back in November 2016 that, in the context of the Paragon Offshore bankruptcy case, the bankruptcy profession may be suffering from what we dubbed a “feasibility problem.” We wrote:

We're thankful this week for Judge Sontchi's decision last week in the Paragon Offshore bankruptcy cases. The decision was more than just a victory for the company's term loan lenders: it was a much-needed warning signal to the restructuring industry.

First, a quick synopsis of the opinion. In short, Judge Sontchi sustained most, but not all, of the term lenders objections on the basis that the Debtors' (i) deployed unrealistic rig utilization and day rate assumptions and (ii) failed to take into consideration macro considerations that would affect the Debtors' eventual ability to refinance debt upon maturity in 2021 (if they didn't run out of cash before then).

We added:

Putting aside the specifics of this case, the decision is important for another reason: it highlights the importance of feasibility. Now, granted, the term lenders had to object for Sontchi to arrive at his conclusion in Paragon but there is an increasing likelihood of Judges scrutinizing feasibility. This Fox Business piece notes, "Some critics say bankruptcy judges too often focus on hammering out an agreement without paying enough attention to companies' chances of long-term survival." Will this continue?

Maybe we need Judges to be activists and save us from ourselves. Deals are being cut, sure, but are they for the right reasons? Are they cut to ensure the viability of the companies underneath capital structures or to uphold "castles in the air" theory and line the pockets of distressed investors? Hard to say: seemingly, these deals aren't doing them any favors either. Without greater transparency to the markets, it's hard to know.

Here's what we do know. In the last several years, there have been a number of repeat restructurings: American Apparel LLC. Global Geophysical Services LLC. Hercules Offshore Inc. Essar Steel Algoma Inc. Fresh and Easy. A&P. Sbarro LLC. Revel Casino. Catalyst Paper. Perhaps we all -- judges included -- ought to ask ourselves why that might be.

We’ve since continued that line of inquiry.

Three weeks ago in “⚡️Why is Gymboree an Unmitigated Disaster?⚡️” — a piece worth revisiting — we explained that, in the context of plan confirmation, debtors submit financial projections and either proffer written testimony or provide live testimony to the effect that the projections are realistic and that, therefore, the plan is feasible and compliant with Bankruptcy Code section 1129(a)(11). We also highlighted — of course with the benefit of 20/20 hindsight — that, as it turned out in the Gymboree chapter 11 case, those projections were complete and utter dogsh*t. We deconstructed, nearly line-item by line-item, how amiss the company’s actual performance was vis-a-vis the projections and concluded:

In summary, the actual operating performance has made a joke of the company’s financial projections and a mockery of the evidence presented to the bankruptcy court to satisfy feasibility.

Again, we insist that you revisit the piece. We concluded by snarking:

…perhaps we’ve arrived at the point in bankruptcy proceedings where the bankruptcy court, itself, ought to hire professionals to verify or challenge the evidence presented to it. We could see it now: Judge Nebraska hiring Banker EFF&D to serve as her banker to determine whether the feasibility proffer is a total clusterf*ck like the one here. Why has this not happened yet? Don’t even tell us it’s fee sensitivity.

And then the Sears sale hearing happened. In “Sears Sales Process “Ends” With an Anticlimactic Flourish (Long Strong PR),” we wrote the following as just one small part of our fulsome discussion of the Sears sale approval hearing:

But this part was especially interesting:

Drain made clear during the course of the hearing he was well aware of the uncertainty pertaining to Sears' future viability. That uncertainty however, did not appear strong enough to override a deal that would have saved 45,000 jobs.

"Whether it's a company that used to print educational books or used to sell plus-sized clothes, the internet has changed everything – and any projection is more in doubt than a projection you would have had 15 years ago or 10 years ago," said Drain, seemingly referring to the bankruptcies of Houghton Mifflin and Fullbeauty, respectively.

Wait, what?!? Is a bankruptcy judge calling into question the very idea of projections in retail bankruptcy cases? How does that affect a feasibility analysis? Is this Judge Drain acknowledging that “we have a feasibility problem?”

What we should have said — given that the commentary in Sears related to an adequate assurance analysis — was “how would that affect a feasibility analysis going forward?” It remains a good question.

This is where we add Ditech Holding Corporation to the discussion. Ditech Holding Corporation and its affiliated debtors (the “Debtors”) filed for bankruptcy in Southern District of New York on February 11, 2019. The case will be heard by Judge James L. Garrity Jr., who, in case you were curious, was the judge the last time this company filed for bankruptcy in November of 2017 (under the name Walter Investment Management Corporation). The Debtors, along with certain non-debtor subsidiaries, act as an independent servicer and originator of mortgage loans and servicer of reverse mortgage loans. Per the Debtors via the First Day Declaration of CFO Gerald Lombardo:

For more than 50 years, the Company has offered a wide array of loans across the credit spectrum for its own portfolio and for GSEs (as defined below), government agencies, third-party securitization trusts, and other credit owners. The Company originates and purchases residential loans through consumer, correspondent and wholesale lending channels that are predominantly sold to GSEs and government entities. The Company also operates two complimentary businesses: (i) asset receivables management and (ii) real estate owned property management and disposition.

Lombardo continues:

In recent years, the Debtors’ business has been impacted by significant operational challenges and industry trends that have severely constrained its liquidity and ability to implement much needed operational initiatives. In an effort to address the burden of its overleveraged capital structure—a remnant of its historical acquisitions—the Company consummated a fully consensual prepackaged chapter 11 plan on February 8, 2018. Given the significant liquidity and operational headwinds facing the Company in 2019, it became clear to the Company’s new senior management team that additional relief was needed.

Curiously, though, the very next sentence states:

Beginning in June 2018, the Company began its formal review of strategic alternatives, including a potential merger or sale of all or substantially all of the assets of the Company.

That’s right. Merely four months post-emergence from bankruptcy, the company was already flittering around grasping at straws. Attempts to consummate an out-of-court transaction with a third-party purchaser failed and, faced with “increased uncertainty in 2019, and an anticipated end-of-first-quarter going-concern qualification from its auditors” in December 2018, the company initiated negotiations with groups of holders of approximately $736.6mm of its debt on an in-court recapitalization. These discussions resulted in a restructuring support agreement (the “RSA”) with an ad hoc group of term lenders which will extinguish $800mm in funded debt, transfer ownership of the company to the term lenders, and leave the company with approximately $400mm of term loan debt (plus an exit facility) upon emergence from bankruptcy. Mind you that, in the first go around, the company reduced its debt by approximately $800mm. All in, the Debtors have managed to destroy a significant amount of value over a short period of time.

This last point cannot be overstated. In the prior restructuring, the company: (i) amended and restated its term loan, eliminating $200mm of principal amounts outstanding in the process, (ii) the senior noteholders received $250mm in 9% second lien PIK toggle take-back paper due 2024 (so optimistic!) and 73% of the equity in the reorganized company, extinguishing nearly $300mm of debt in the process, and (iii) the convertible noteholders received the remainder of the equity in exchange for cancelling their $242.5mm of debt. This chart sums up the proposed restructuring:*

First Day Declaration, Walter Investment Management Chapter 11 Filing.

Said another way, all of the parties agreed that, based on the valuation of the company, the fulcrum security was at the senior noteholder level, leaving the likes of Canyon Capital Advisors LLC, CQS UK LLP, Deer Park Road Management Company LP, Lion Point Capital LP, Oaktree Capital Management LP, and Omega Advisors Inc. as the post facto owners of the company.

Docket 57, Walter Investment Management Chapter 11 case.

Well…that didn’t last long. The gist of this new chapter 11 filing is that all of the recoveries secured by the senior and convertible noteholders are now officially wiped out to zero (assuming they still hold the paper and haven’t dumped it on some other unsuspecting fool…uh…”investor”). Now the term lenders** own the company — not without taking quite a haircut themselves. For the debtholders, especially the senior and convertible noteholders, that sure isn’t a great way to start off 2019. Hopefully those 2018 bonuses based on paper gains (assuming some of the holders bought in at super-distressed levels) were pretty. It seems we may also have a valuation problem. 😬

In addition to moving forward with the restructuring transaction governed by the RSA, the company will parallel-path a marketing process and will toggle to a sale transaction if there are viable bids prior to plan confirmation. This could take the form of an all-in asset sale, a sale of a portion of the Debtors’ assets, or a sale of the master servicing business because, like, let’s be honest: we can’t imagine the term lenders want to be in the mortgage servicing business. Or…maybe…gulp…they do?? Apparently the area is hot! Meanwhile, the company has secured $1.9b in DIP warehouse financing to refinance the Debtors existing warehouse and servicer advance facilities.

So, how does so much value get destroyed so quickly? What happened here? Per the Debtors:

Notwithstanding the Company’s efforts to implement its business plan, which included further cost reductions, operational enhancements and streamlining of its business, following emergence from the WIMC Chapter 11 Case, the Company continued to face liquidity and performance challenges that were more persistent and widespread than anticipated. Coupled with the industry and market factors, these performance challenges have resulted in less liquidity, making the implementation of key operational enhancements more difficult—resulting in their postponement.

In other words, the business plan was, prima facie, unrealistic to begin with. Ladies and gentlemen, we appear to be experiencing an epidemic of bad business plans in bankruptcy (PETITION Note: we’re SUPER-DUPER-SURE-WITH-A-CHERRY-ON-TOP that Sears’ Transform Holdco will be the exception.)

Still, to be fair to the Debtors, they don’t control the FED. Interest rate increases had a negative impact on the Debtors’ business. Per the Debtors:

The increase in interest rates has also negatively impacted mortgage originators and servicers generally—the Debtors are no exception. As interest rates have risen, less borrowers are refinancing loans in a higher interest rate environment, resulting in lower origination volume for the Company.

Tack on the Debtors’ still-overlevered balance sheet, its burdensome interest and amortization obligations, and tightening rates from lending counterparties and you’ve got a world of hurt. Due to diminishing liquidity and scheduled amortization payments of approximately $110mm in 2019, the company faced risk of a going-concern qualification from auditors, which would have stream-rolled into even more hurt by way of triggered defaults and terminations throughout the the Debtors’ debt and working capital facilities.

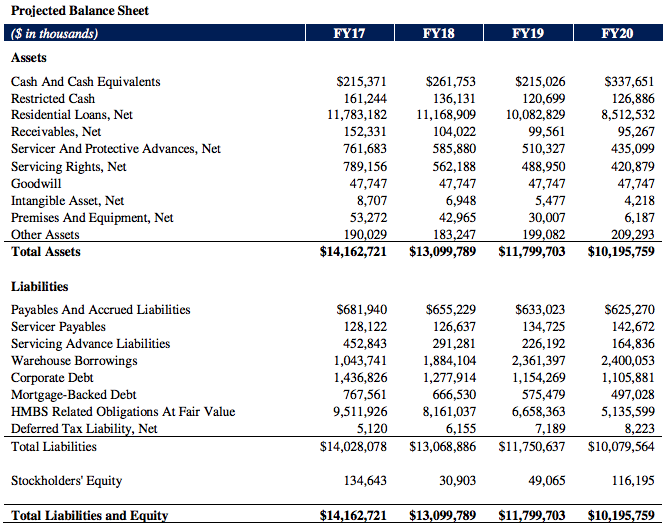

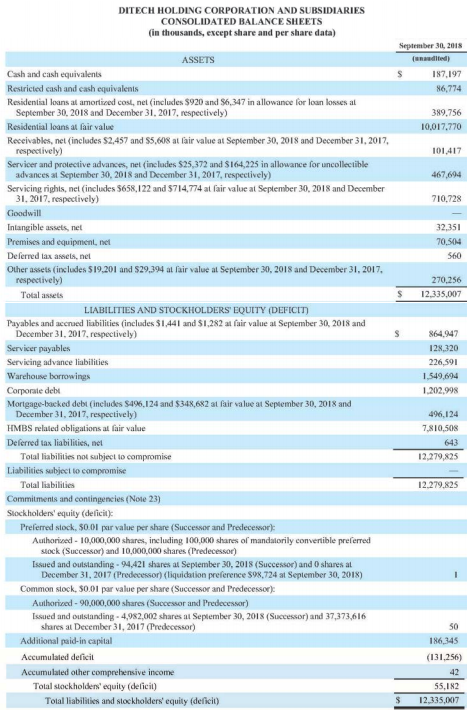

While there’s plenty of talk about a dearth of liquidity, the Debtors conveniently offer little by way of real up-to-date detail in their bankruptcy papers — a curious development to say the least. We’re left with a balance sheet snapshot through September 20, 2018. But even that is enough to see how where the Debtors missed. This is the projected balance sheet used in the first bankruptcy:

Source: Walter Investment Management Disclosure Statement

And this is the September 30, 2018 balance sheet:

Extrapolating out for the full fiscal year, you can see that, among other things, the cash, equivalents and residential loans are below projections and that payables dramatically exceed plan. Whoops!

Now, let’s be clear: the first filing was a fully consensual deal wrapped up in a bow and presented, in a mere matter of months, to the bankruptcy judge. This is not Paragon Offshore, where there was a vehement confirmation objection. There was no evidence on the record to suggest that the business plan and, by extension, the plan of reorganization, were infeasible. And yet it only took four months for that to be the case.

Which begs another question: how in the world did so many smart people get this so wrong?

*The equity recoveries were later adjusted to reflect the fact that the convertible noteholders voted to accept the plan, giving that class 50% of the new common stock. Ah, the beauty of crossholders (see Lion Point and Deer Park above).

**The consenting noteholders in the Walter transaction were, according to public filings, Carlson Capital LP, TAO Fund LLC, Credit Suisse Asset Management LLC, Marathon Asset Management LP, Nuveen, Symphony Asset Management LLC, Eaton Vance Management.

Jurisdiction: S.D. of New York (Judge Garrity)

Capital Structure: See above.

Company Professionals:

Legal: Weil Gotshal & Manges LLP (Ray Schrock, Sunny Singh, Ryan Preston Dahl, Alexander Welch)

Financial Advisor: AlixPartners LLP (David Johnston, Clayton Gring, James Nelson)

Investment Banker: Houlihan Lokey Capital Inc. (Jeffrey Lewis)

Claims Agent: Epiq Bankruptcy Solutions LLC (*click on company name above for free docket access)

Other Parties in Interest:

Prepetition Term Agent: Credit Suisse AG

Legal: Davis Polk & Wardwell LLP (Brian Resnick, Michelle McGreal)

Counsel to the Ad Hoc Group of Term Lenders

Legal: Kirkland & Ellis LLP (Patrick Nash, Gregory Pesce, John Luze)

Financial Advisor: FTI Consulting Inc.

9.0% Second Lien Senior Subordinated PIK Toggle Notes due 2024 Trustee: Wilmington Savings Fund Society, FSB

Second Lien Ad Hoc Group

Legal: Milbank Tweed Hadley & McCloy LLP (Gregory Bray, Melainie Mansfield)

DIP Agent & Lender: Barclays Bank PLC and Barclays Capital Inc.

Legal: Skadden Arps Slate Meagher & Flom LLP (Sarah Ward, Mark McDermott, Melissa Tiarks)

Nomura Corporate Funding Americas, LLC

Legal: Alston & Bird LLP (Karen Gelernt and Ronald Klein) and Jones Day LLP (Ben Rosenblum)

Fannie Mae

Legal: O’Melveny & Myers LLP (Stephen Warren, Jennifer Taylor and Darren Patrick)

Freddie Mac

Legal: McKool Smith PC (Paul D. Moak)