🔥Amazon is a Beast🔥

The "Amazon Effect" Takes More Victims

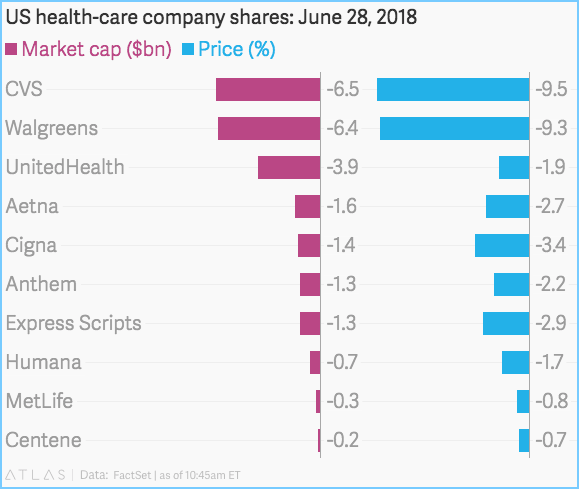

Scott Galloway likes to say that mere announcements from Amazon Inc. ($AMZN) can result in billions of dollars of wiped-out market capitalization. Upon this week’s announcement that Amazon has purchased Boston-based online pharmacy startup Pillpack for $1 billion — beating out Walmart ($WMT) in the process — his statement proved correct. Check this out:

We like to make fun of the Amazon narrative because we’re of the view that it’s overplayed — particularly in restructuring circles — and reflects a failure to understand broader macro trends (like the direct-to-consumer invasion noted below). Still, the market reaction to this purchase reflects the undeniable power of the “Amazon Effect” and we’d be remiss not to acknowledge as much. This purchase will likely be a turning point for pharmacies for sure; perhaps also, farther down the line, for benefits managers and pharmaceutical manufacturers. It also may provide Amazon with meaningful cross-pollination opportunities with its payments business — a subject that nobody seems to be talking about (more on this below).

Putting aside the losers for now, there are a variety of winners. First, obviously, are Pillpack’s founders, TJ Parker and Elliot Cohen. They stand to make a ton of money. Also its investors — Accel Partners, Atlas Venture, CRV, Founder Collective, Menlo Ventures, Sherpa Ventures and Techstars — at an 8x return, at least. Oh, and Nas apparently. And then there is Amazon itself. Pillpack isn’t a massive revenue generator ($100mm in ‘17) and it isn’t a big company (1k employees) but it packs a big punch: licenses to ship drugs in 50 sates. With this purchase, Amazon just hurdled over a significant regulatory quagmire.

So what is Pillpack? Per Wired (by way of Ben Thompson):

PillPack is trying to solve the problem of drug adherence by simplifying your medicine cabinet. Medication arrives in the mail presorted into clear plastic packets, each marked in a large font with vital information: day, time, pills inside, dosages. These are ordered chronologically in a roll that slots into the dispenser. Let’s say you need to take four different pills in the morning and two others in the afternoon every day: Those pills would be sorted into two tear-off packets: one marked 8am, followed immediately by the 2pm packet.

Put another way, Pillpack specializes in the convenience of getting you your medications directly with a design and user-experience focus to boot. The latter helps ensure that you’re taking the proper levels of medication at the right time.

Still, there are some limitations. Per The Wall Street Journal:

Amazon will be limited in what it can do, especially to start. PillPack’s specialty—packaging a month’s supply of pills for chronic-disease patients—is a small part of the overall market. It has said it has tens of thousands of customers versus Amazon’s hundreds of millions.

Current limitations notwithstanding, Thompson notes how much Pillpack’s service aligns with Amazon:

Amazon, particularly for Prime customers, is seeking to be the retailer of habit. That is, just as a chronic condition patient may need to order drugs every month, Amazon wants to be the source of monthly purchases of household supplies, and anything else one might want to buy along the way.

Like all aggregators, Amazon wins by providing a superior user experience, particularly when it comes to delivering the efficient frontier of price and selection. To that end, moving into pharmaceuticals via a company predicated on delivering a superior user experience makes total sense.

Thompson notes further:

The benefit Amazon will provide to PillPack, on the other hand, is primarily about dramatically decreasing the customer acquisition costs for a solution that is far better for consumers; to put it another way, Amazon will make a whole lot more people aware of a much more customer-friendly solution. Frankly, I have a hard time seeing why that is problematic.

To be sure, Amazon will benefit beyond its unique ability to supercharge PillPack’s customer acquisition numbers: just as Walgreen and CVS’s pharmacies draw customers to their traditional retail stores, PillPack’s focus on regular ordering fits in well with Amazon’s desire to be at the center of its customers day-to-day lives. This works in two directions: first, that Amazon now has a direct connection to a an ongoing transaction, and second, that would-be Amazon customers are dissuaded from visiting a retail pharmacy and, inevitably, buying something else along the way. This was a point I made in Amazon’s New Customer:

This, though, is why groceries is a strategic hole: not only is it the largest retail category, it is the most persistent opportunity for other retailers to gain access to Prime members and remind them there are alternatives.

A similar argument could be made for prescription drugs: their acquisition is one of the most consistent and predictable ways by which potential customers exist outside of the Amazon ecosystem. It makes a lot of sense for Amazon to reduce the inclination to ever go elsewhere.

It seems that Amazon is doing that lately for virtually everything. Consistently, further expansion beyond just chronic-disease patients seems inevitable. Margin exists elsewhere in the medical chain too and, well, Jeff Bezos once famously said “Your margin is my opportunity.” David Frankel of Founder Collective writes:

The story of the last five years has been that of bricks and mortar retailers frantically trying to play catch-up with Amazon. By acquiring PillPack, Amazon is now firmly attacking another quarter trillion dollars of TAM. Bezos is a tenacious competitor and has just added the most compelling consumer pharmacy to enter the game since CVS was founded in 1963.

TJ Parker understands the pharma business in his bones, has impeccable product sensibilities, and now has the backing of the most successful retail entrepreneur in history.

Expect some real healthcare reform ahead.

No wonder those stocks all sh*t the bed. That all sounds downright horrifying for those on the receiving end.

*****

Recall weeks back when we noted this slide in Mary Meeker’s “Internet Trends” presentation:

Healthcare spending continues to rise which, no doubt, includes the cost of medication — a hot button issue of price that even Donald Trump and Hillary Clinton have agreed on. This purchase dovetails nicely with Amazon’s overall health ambitions. Per the New York Times:

But Mr. Buck and others said Amazon might have a new opportunity. A growing number of Americans are without health insurance or have such high deductibles that they may be better off bargain shopping on their own. He estimated that 25 million Americans fell into that category.

Until now, he said, PillPack has not aggressively competed on price. With Amazon in charge, “how about they start posting prices that are really, really aggressive?” Mr. Buck said.

As Pillpack increases its scale, Amazon will be able to exert more leverage in the space. This could have the affect of compressing (certain) pharmaceutical prices. To get there, Amazon will undoubtedly seize the opportunity to subsume Pillpack/pharma into Amazon Prime, providing Members discounts on medicine much like it provides Whole Foods shoppers discounts on bananas.

There is other opportunity to expand the user base as well. People are looking to save money on healthcare as much as possible. With cash back rewards, Amazon can offer additional discounts if consumers were to carry and use the Amazon Prime Rewards Visa Signature Card — which already offers 5% back on Amazon.com and WholeFoods purchases (plus money back elsewhere too). Pillpack too? We could envision a scenario where people scrap their current plastic to ensure that they’re getting discounts off of one of the most rapidly rising expenditures out there. Said another way, as more and more consumer staples like food and medicine are offered by Amazon, Amazon will be able to entice Pillpack customers with further card-related discounts. And grow a significant amount of revenue by way of its card offering. No doubt this is part of the plan. And don’t forget the data that they would compile to boot.

Per Forbes shortly after Amazon launched its Amazon Prime Rewards Visa Signature Card,

Given that Amazon credit card holders spend the highest on its platform, the company is looking at ways to expand its credit card consumer base. CIRP estimates that approximately 15% of Amazon’s U.S. customers have any one of Amazon’s credit cards, representing approximately 21 million customers. However, growth of its card base has not kept pace with its growing Prime membership. In June 2016, it was estimated that Amazon has around 63 million Prime members. Assuming that only Prime members have an Amazon credit card, it would mean that only a third of its Prime customers have one of its credit cards. According to a survey by Morgan Stanley, Amazon Prime members spend about 4.6 times more money on its platform than non-prime members. Its credit card holders spend even greater amounts than what Prime members spend. By enticing its prime customers to own its credit cards, Amazon will be encouraging them to spend more on its platform. Its latest card is aimed at attracting Prime customers by offering deals not only on Amazon.com but on other shopping destinations as well. This can lead to higher spending by existing Prime customers and help convert the fence sitters into Prime memberships.

And those numbers are dated. Amazon Prime now has 100mm members. Imagine if they could all get discounts on their meds. 💰💥💰💥

All of which begs the question: who gets hurt and who benefits (other than Visa ($V)) from this potential secondary effect? 🤔