New Chapter 11 Bankruptcy Filing - Avadim Health Inc.

North Carolina-based Avadim Health Inc. and four affiliates (together, the “debtors”) filed chapter 11 bankruptcy cases in the District of Delaware over the Memorial Day holiday. The “vertically integrated healthcare and wellness company” intends to “expeditiously complete a third-party sale of substantially all of the Company’s assets” to their pre-petition secured lenders (Hayfin Services LLP), who have agreed not only to serve as stalking horse purchaser but DIP lenders.

Historically, the debtors have sold topical products like pre-saturated towelettes, foaming, spray and other products B2B to acute care hospitals, nursing homes, and long-term care facilities. In 2016, nine years after their founding, the debtors expanded to B2C, unleashing their products in over 47k pharmacy locations and later adding its own website and an Amazon Inc. ($AMZN) presence to the mix. Between ‘17 and ‘19, the debtors’ annual net revenues popped from $10.8mm to $45.8mm.

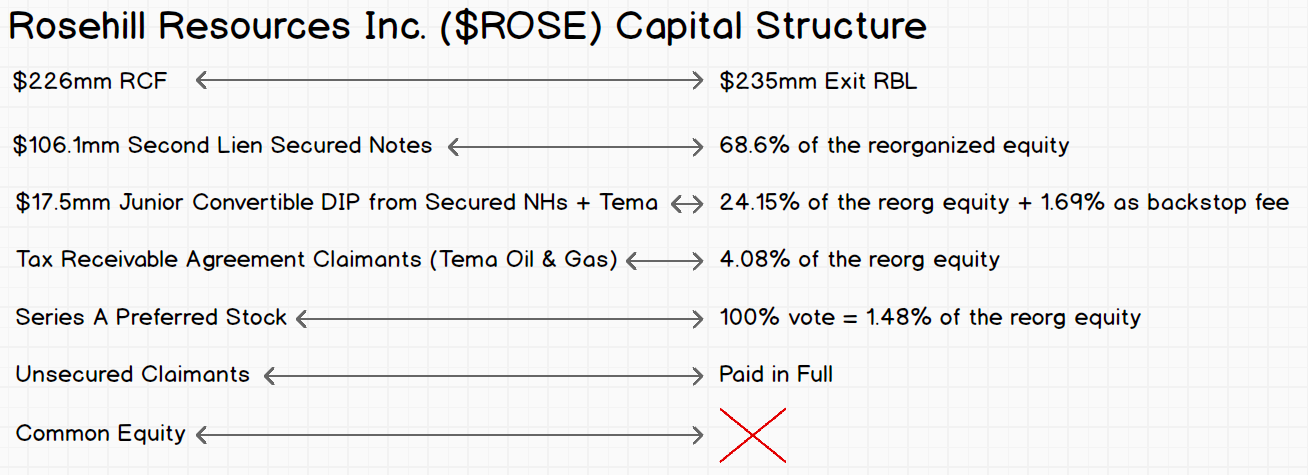

On the liability side of the ledger, the debtors historically used debt, private placements of equity, convertible notes and revenues to fund ops. The capital structure includes:

$79.6mm term loan;

$22mm senior secured notes;

$6.4mm 6% unsecured convertible notes; and

$2.01mm 1% unsecured PPP loan due 4/22.

The company also owes $4.8mm pursuant to a settlement agreement tied to a patent dispute.

Remember those rising revenues? Yeah, well, that’s all fine and good unless it’s entirely offset by significant selling and marketing expenses and excess inventory build-up because not as many institutions want your product than you modeled out. This bit is brutal:

The Company’s sales related expenses resulted in limited free cash flow to fund other operating expenses, debt service, and investment in new products. In particular, the Company ramped up significant media/marketing expenditures and built up inventory in anticipation of its previously planned early 2020 IPO; however, that IPO never materialized.

Oh, wait, it gets worse:

Notwithstanding spending tens of millions of dollars over the past decade to build the Company’s brand, the Company has been unsuccessful in reaching profitability.

Ok, sorry, folks, but when we think of “brand” we think of LVMH, the parent company of luxury brands like Dior, Louis Vuitton, and Tiffany. In other words, a company with a market cap over 320b Euro which, earlier this month, made Bernard Arnault the richest person in the world (yes, over Jeff Bezos and Elon Musk). We DON’T think of “Theraworx Protect” (the debtors’ immune health line), Theraworx Protect U-Pak (the urinary health line) or Combat One (for soldier and first responder readiness). And we DEFINITELY don’t think of a company that lost $49.5mm $34.8mm and $53.6mm in ‘18, ‘19 and ‘20 respectively.

Apparently neither does the market. The IPO failed. Thereafter, the company initiated a strategic alternatives review that came up empty (with marketing taking place from March ‘20 through October ‘20 … poor timing). This is when the army of restructuring pros got involved, including independent directors on a “Restructuring Committee,” a CRO and some bankers for good measure. All roads, however, led back to the pre-petition secured lenders owed more than $102mm in principal amounts under the term loan and the secured notes. Apparently nobody else wanted to hop aboard a ship that (a) “[o]ver the past few years … [has] been perpetually distressed, constantly facing liquidity crunches and incurring defaults under the [term loan]” and (b) had to enter into “seven amendments to their [term loan] since June 2019, increasing the principal amount available to the Debtors, expanding interest obligations owed to the lenders, and extending maturities.”

So, uh, why would anyone else want to get in on this?!?

As noted above, they don’t. The pre-petition lenders, on the other hand, are in a solid position to make a grab for valuable tax attributes and net operating losses!

MIDAVA HOLDINGS 3, INC. is the new entity formed by the pre-petition lenders to serve as stalking horse. The proposed DIP is $7.156mm at L+12%.

The debtors are represented by Chapman and Cutler LLP (Larry Halperin, Joon Hong) & Pachulski Stang Ziehl & Jones LLP (Laura Davis Jones, David Bertenthal, Timothy Cairns) as legal counsel, Carl Marks Advisors (Keith Daniels) as financial advisor and CRO, SSG Capital Advisors LLC as banker and Omni Agent Solutions as claims agent. Hayfin is represented by Weil Gotshal & Manges LLP (David Griffiths, Bryan Podzius, Rachael Foust) & Richards Layton & Finger PA (Paul Heath, Zachary Shapiro, Cavid Queroli).

The first day hearing is scheduled for later this morning at 11am ET.

Date: May 31, 2021

Jurisdiction: D. of Delaware (Judge Goldblatt)

Capital Structure: see above

Company Professionals:

Legal: Chapman and Cutler LLP (Larry Halperin, Joon Hong) & Pachulski Stang Ziehl & Jones LLP (Laura Davis Jones, David Bertenthal, Timothy Cairns)

Board of Directors: Dewey Andrew, Linda McGoldrick, Charles Owen III, Steven Panagos, Karan Rai, James Rosati, Stephen Woody

Financial Advisor/CRO: Carl Marks Advisors (Keith Daniels)

Investment Banker: SSG Capital Advisors LLC

Claims Agent: Omni Agent Solutions (Click here for free docket access)

Other Parties in Interest:

Term Loan Agent: Hayfin Services LLP

Legal: Weil Gotshal & Manges LLP (David Griffiths, Bryan Podzius, Rachael Foust) & Richards Layton & Finger PA (Paul Heath, Zachary Shapiro, Cavid Queroli)